A trailing stop loss is simple.

Ride the trend and capture monster profits…

Looks easy but, what else is going on here?

Well – the truth is, it’s a trading technique that can have huge effects on your trading psychology.

Imagine you’re in profit…

But the market pushes its way back to your trailing stop loss…

It’s still a profit…

…but what about the thought creeping into your mind?

“Damn, if I hadn’t had a trailing stop loss and taken my profits at resistance, my profits would’ve been much bigger!”

Sounds familiar, right?

It’s why in today’s trading guide, I’ll not only share with you the disadvantages of trailing stop loss but also give you the full context behind it and techniques on what you can do instead.

Specifically, you’ll learn…

- The different kinds of trailing stop loss and the best indicators to use for them

- Why trailing stop loss isn’t as pretty as you think when you trade it in real-time

- Powerful trailing stop loss techniques and strategies to better optimize and pick the best trailing stop loss for you

- A complete trailing stop loss strategy for short-term and long-term trends

Safe to say that after this training guide, you’ll never see trailing stop loss the same way!

Are you ready?

Then let’s get started.

Disadvantages of Trailing Stop Loss: What is it and How it Works

Let me ask you:

If you google “trailing stop loss” what do you find?

That’s right!

Moving averages…

However, did you know that there are different ways in which you can trail your stop loss?

Specifically, they are:

- Trend-based indicator trailing stop loss

- Oscillator-based trailing stop loss

- Candlestick trailing stop loss

Interested to learn more?

Let me share them with you in detail…

Trend-based indicator trailing stop loss

You can probably guess the meaning, right?

These indicators work best in trending markets.

Indicators such as a moving average…

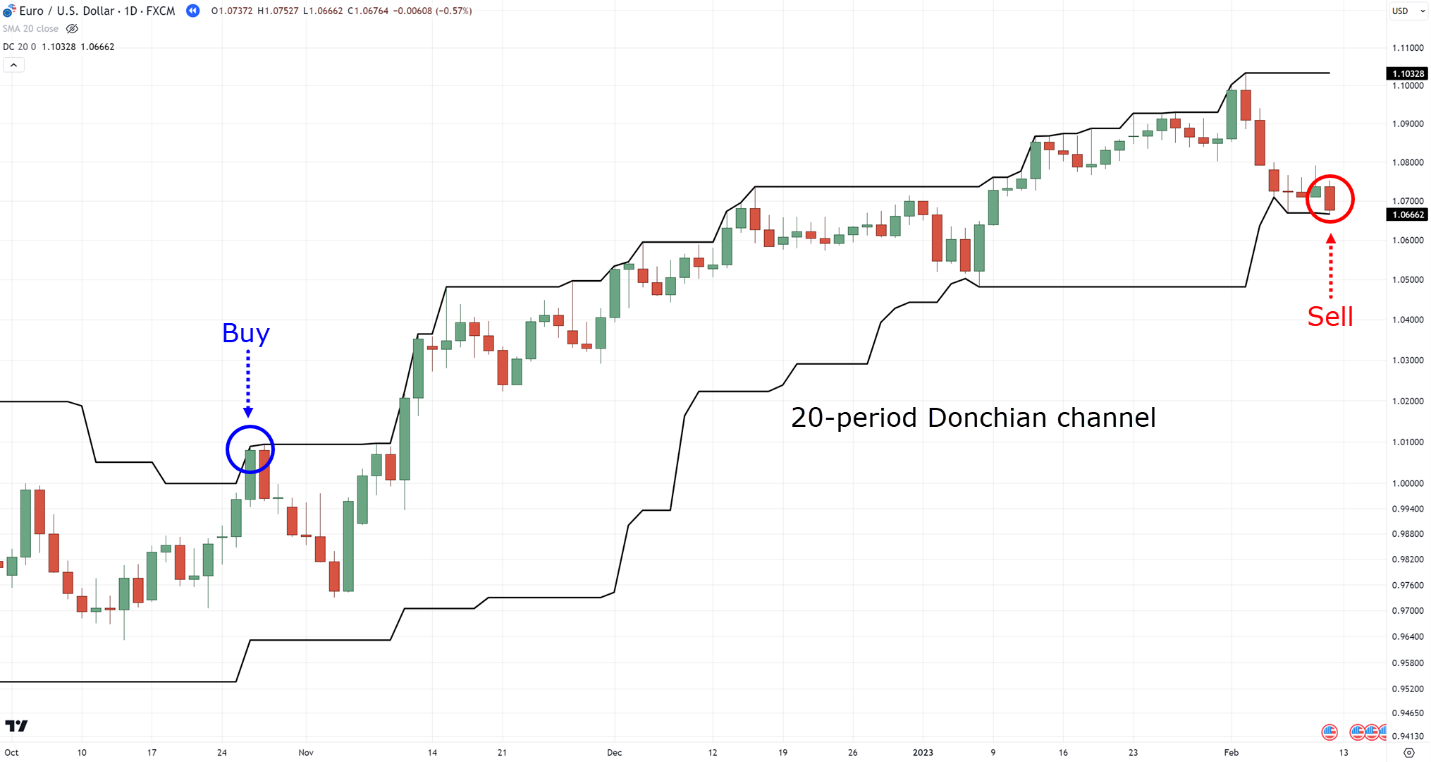

And the Donchian channel…

…both work quite effectively!

However, they’re not the holy grail… as these indicators will falter on range markets, so watch out!

Oscillator-based trailing stop loss

This type of trailing stop loss method can work best when trying to catch the short-term momentum of the markets.

One example is the RSI indicator, wherein you only exit if the price closes above the overbought level…

And then wait for the price to close below the overbought level again as an exit trigger…

It can be counter-intuitive, as we are often taught to buy at oversold and sell at over-bought levels, right?

But in reality, the market can keep its momentum by staying at those levels for quite some time…

…opening opportunities for trailing your stop loss.

Candlestick trailing stop loss

Across all trailing stop losses out there, this one is the most aggressive.

It must also be well-practiced in order to apply properly.

But, how to go about it?

Once you are in the trade…

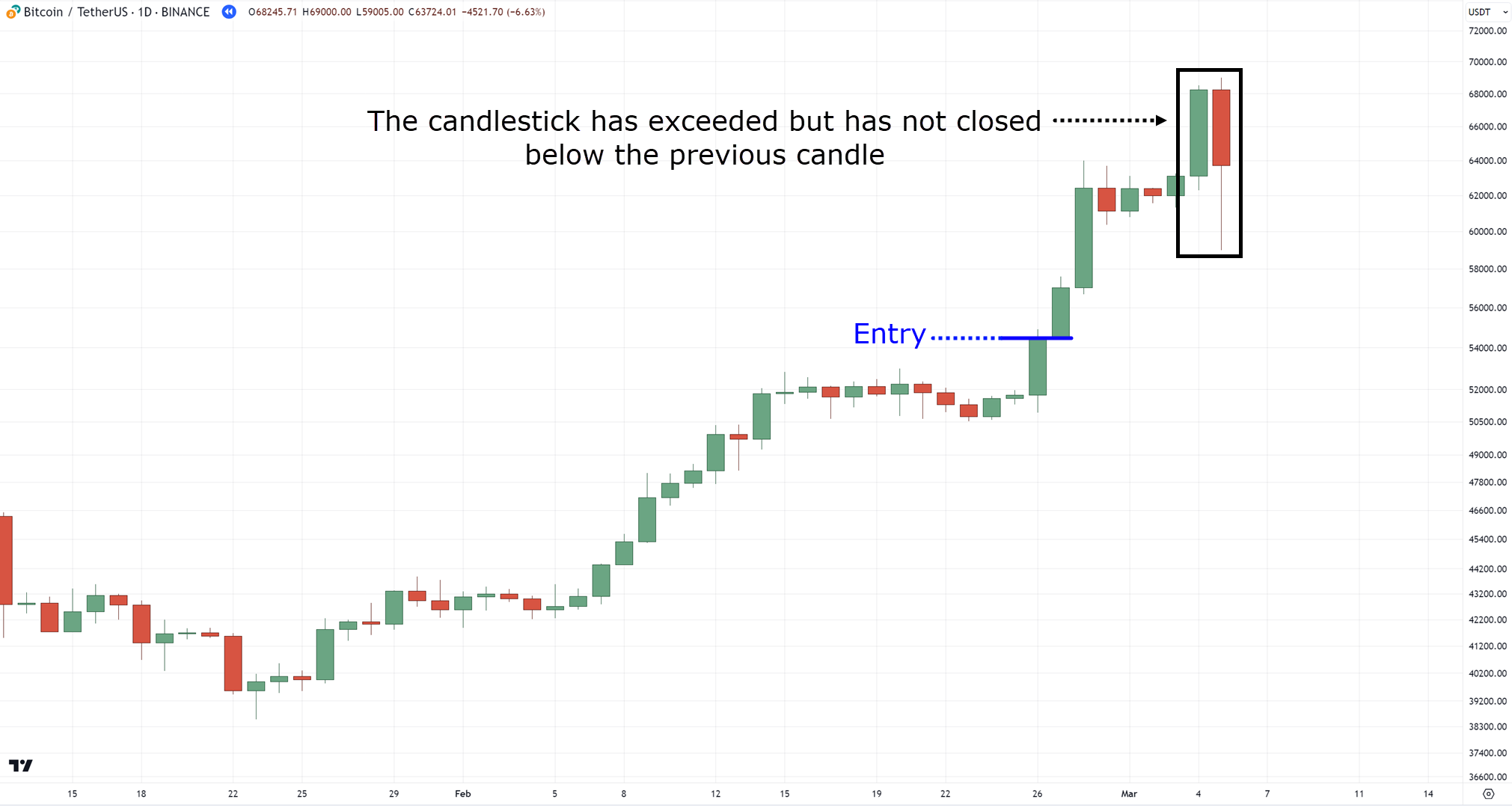

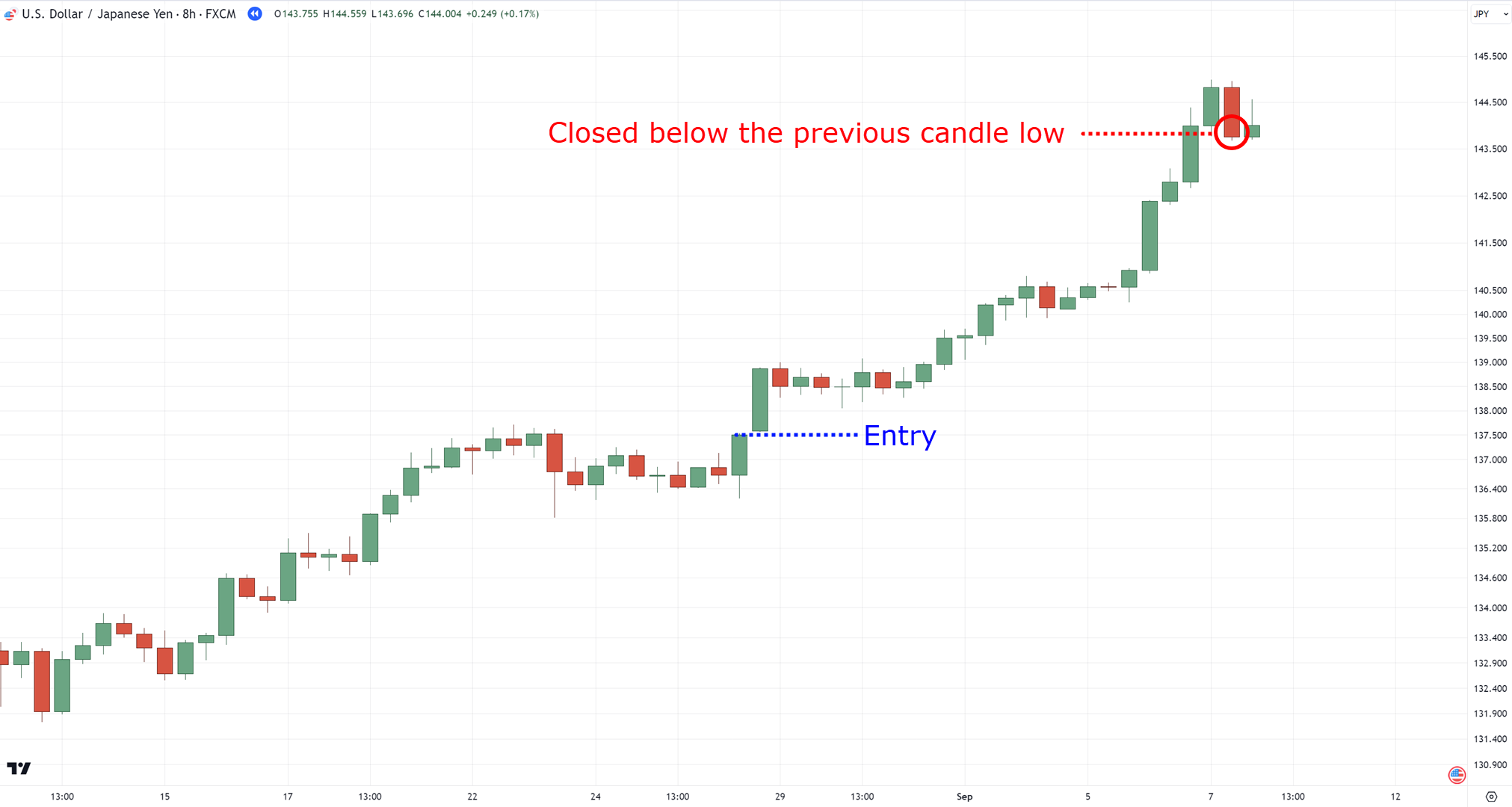

…you wait for the candlestick to close beyond the previous candlestick…

That’s right, if the candlestick’s wicks have exceeded the previous candle, you still stay in the trade…

…but if it closes beyond the previous candle’s highs and lows, then you exit the trade…

Again, this method can be the simplest to understand as it doesn’t require any magic indicators or periods.

It’s pure candlestick!

However, it does need some time to get used to.

So now that you’re equipped with some knowledge…

How can you use it in live trading?

After all, seeing concepts in textbooks is always different from reality, right?

So, let me share the disadvantages with you in the next section…

What Are The Disadvantages Of Trailing Stop Loss?

The truth is that all the disadvantages you’ll hear from this section are pretty much the cost of doing business.

However, have you ever heard the saying:

“There is no holy grail in the markets”…?

It’s why I’m going to share with you the pros and cons of each concept shown so far, to help you decide which one to choose.

Because that’s what it takes to be a consistent trader.

Let’s get started…

Disadvantages of a trend-based indicator trailing stop loss

There are two main disadvantages here.

First, you’ll often have poor risk to reward trades as the trend does not push far…

Second, there is the psychological impact of this type of trailing stop loss.

Imagine being in serious profit, only for the market to wipe most of it away…

Ouch!

It’s par for the course when choosing this method, but it may not be for everyone.

Disadvantages of an oscillator-based indicator trailing stop loss

When it comes to indicators, a major disadvantage is false signals.

There will be times when you see the price break and reverses from overbought levels…

….only for the price to reverse again – back to the trend!…

Pretty darn frustrating!

But one way to reduce this is to increase your RSI-period value to 14-period or above.

Again, this reduces it, but doesn’t eliminate the problem entirely.

Disadvantages of a candlestick-based trailing stop loss

Despite it being the most aggressive trailing stop loss there is, false signals present a major disadvantage.

They mean there will be times when you’ll exit the trade due to just a small blip…

Of course, you would’ve made more profit if you stayed in the trade, but that is how it goes!

Now you might be thinking:

“Which one is the best one for me?”

“I still can’t pick what kind of trailing stop loss I should use.”

Don’t worry, as I have all the answers for you in the next section!

How To Overcome The Disadvantages Of Trailing Stop Loss

Think of the concepts I shared with you as job applicants you have to choose from….

So, now you want to ask yourself…

“What are the criteria I should consider when it comes to picking the best one?”

“Which one’s the best fit for me and my trading plan?”

In short…

Step 1: Know your trading methodology

What are the different trading methods?

Well, there’s the classic trend following…

Momentum trading, where you only plan to ride and capture the short momentum strength in the markets…

And Mean Reversion trading, which is more or less the opposite of momentum trading where you profit in the market’s weakness…

Of course, there are other trading methods out there!

But when it comes to trailing stop loss, these are often the ones that you need.

So, which trailing stop loss is most relevant for each?

Step 2: Use a relevant trailing stop loss method for your trading methodology

For trend following, you’ll want to decide what types of trend you want to capture.

Do you want to capture short-term, medium-term, or long-term trends?

If you want to capture short-term trends, then you’ll want to use a “tight” trailing stop loss – such as the 20 to 30-period Donchian channel trailing stop loss…

For medium-term trends, you’d want to use a 50 to 100-period Donchian channel trailing stop loss…

Finally, for long-term trends, a 100 to 200-period Donchian channel is relevant…

Now that’s a very long trade!

Bear in mind that these are cherry-picked charts extracted from the harsh reality of real world of trading…

There will be plenty of times when you will see your profits evaporate (a major disadvantage of trailing stop loss)!

But you can’t deny how simple the concept is, right?

However, it’s never about choosing the best period out there – it’s all about selecting the most relevant indicator and period that suits your trading style.

Moving on, we have momentum trading.

For this, you have two ways to trail your stop loss.

The first is by using a candlestick stop.

This means that once you enter the trade…

…you will not exit the trade until it closes beyond its previous candlestick…

Now, make sure to read that again.

Even if the candlestick’s wick exceeds the previous candle, you’re still in the trade.

You’ll want to wait for a close and then exit at the next bar…

Systematic and simple, right?

As previously stated, though, its major disadvantage is that it might be a false signal.

But if you’re a momentum trader who wishes to capture short-term moves in the markets, then the disadvantage becomes a normal cost of doing business!

The second way to go about this is by using an indicator trailing stop.

You can do so by picking an oscillator and momentum-based indicator such as the MACD, RSI, or stochastic.

Let’s take the RSI indicator as an example…

If you enter a breakout trade, then you’ll want to wait for the RSI to close above RSI 70…

(Because again, we are adopting a momentum trading approach.)

…but only exit when it closes back below RSI 70…

Can you see how using an indicator-based trailing stop loss makes it more objective and systematic?

Well, how about mean reversion trading?

It’s actually even more simple – as you can use the same tools I shared with you previously.

The only difference is that you’re entering on a pullback instead of a breakout.

Specifically, if you’ve entered a pullback trade…

…you’ll want to wait for the price to close above 50, only exiting when the price closes below 50 again…

Same concept as a while ago, right?

Except this time, again, you’re entering on a pullback.

Now, I’ve shared a lot of techniques and concepts in a short amount of time.

I think if you want to learn in depth about the trading methodologies I’ve shared with you, you should check out these links:

Trend Following Trading Strategy Guide

The Essential Guide to Momentum Trading

High Probability Trading: The Definitive Guide to Trading Pullbacks and Breakouts

With that said, let me shell out some truths about trailing stop loss in the next section…

Disadvantages Of Trailing Stop Loss: Should you use a trailing stop loss?

Honestly, Trailing stop loss is not for everyone.

But how can you tell?

You need to consider the following…

You’re used to and are willing to delay your gratification

It’s true.

Having a trailing stop loss can allow you to capture monster trends.

But more often than not, you’ll encounter failed trades almost half of the time.

So, let me ask you…

Are you willing to endure plenty of losing and breakeven trades before finding a monster trend?

Or are you more comfortable taking a fixed target profit to reduce the uncertainty in your mind?

I’m sure my question highlights how everything has its pros and cons.

But with this guide, I hope you can see there are options out there!

With that said, let’s do a quick recap of what you’ve learned today.

Conclusion

Everything that I’ve shared today is not for you to completely avoid stop losses but for you to gain a better understanding of their concept.

The variety of trailing stop losses means they are not all created the same – each has its own quirks.

So, here’s what you’ve learned today:

- Various types of trailing stop loss exist, including trend-based, oscillator-based, and candlestick indicators.

- Each type has drawbacks such as forfeiting profits, false signals, and inappropriate usage during certain market conditions.

- Matching the trailing stop loss method to your trading strategy helps mitigate its disadvantages.

- Trailing stop loss may not suit everyone, so always weigh its pros and cons against your trading style.

Now it’s over to you!

Do you agree to the disadvantages of a trailing stop loss I shared with you?

Also, d you often change your trailing stop loss depending on the market condition?

Or perhaps you only use one, to be as consistent as possible?

I look forward to your response in the comments below!