Candlesticks are a huge topic of conversation among traders… and for good reason!

But while some candlesticks can tell you a lot about what the market is trying to do…

…others may seem completely irrelevant to future movements.

They can be confusing sometimes, right?

Well, that’s why I’m covering a candlestick pattern which can be a seriously potent trading tool:

The Inverted Hammer!

Today, I’ll help you understand how to use it in the right situations at just the right time.

In this article, you’ll cover:

- What exactly the inverted hammer is

- Some ways I like to trade the inverted hammer

- Practical examples of how to trade the inverted hammer

- Limitations on the inverted hammer

Are you ready?

Then let’s dive in!

What is the Inverted Hammer? (Bearish Signal)

The inverted hammer candlestick pattern is a powerful tool used by traders to identify potential trend continuations – especially downtrends.

Now wait, I know what you’re thinking!

“Isn’t the inverted hammer considered bullish?”

Well, the textbooks might say so – but let me explain why I believe it’s actually a much better bearish indicator.

Take a look at a diagram to see what it looks like…

Example of an inverted hammer:

It’s a candlestick with a small body near the bottom, a long upper shadow reaching upward, and hardly any lower shadow.

Finding an inverted hammer at the end of a downtrend is crucial, but it’s also a big deal at the top of ranges – where resistance has been seen before…

It can suggest that the bulls made an attempt to control the market but failed to maintain it throughout the candle.

The color of the candlestick, whether green or red, also reflects the price movement during the trading session.

A green-bodied inverted hammer means the closing price was higher than the opening price.

A red-bodied inverted hammer shows the opposite.

While green suggests some bullish momentum, I still consider it a bearish candlestick.

…with red candles suggesting a stronger continuation signal.

Think of them as little stories the market is trying to tell us.

What does it tell you?

The buyers unsuccessfully tried to take control of the downtrend.

They came flooding into the market session, only to be met with stronger selling pressure.

Let’s delve deeper into how to trade them!

How to Trade the Inverted Hammer

This can be approached in two main ways, with both providing some extra confidence I need to make the trade!

Using the Inverted Hammer as a Bearish Signal

This involves recognizing the inverted hammer as an early signal that a downward trend could continue…

…or that buyers are weakening at the top of a range.

When this pattern forms at the bottom of a downtrend, it suggests that selling pressure is still coming in even as the bulls try to unsuccessfully lift the price.

Seeking additional confirmation signals is crucial here, though.

For instance, traders may wait for a trend line to be respected…

Or observe the continuation of market structure with a new lower low and lower high forming.

Using the inverted hammer as a bearish signal means identifying the pattern and verifying it through entry triggers – to be as sure as you can!

Using the Inverted Hammer as an Entry Trigger

This method offers traders a precise way to open trades – looking at the bearish momentum shown by the pattern.

When the inverted hammer is shown, you can often enter short positions at areas of value in order to profit from possible trend continuations or range reversals.

The inverted hammer is often used as an entry candle for trades at significant support zones or range highs where the price fails to break resistance.

Essentially, traders can maximize profits and tighten stop losses by waiting for an inverted hammer as the entry trigger.

You can handle risk by placing stop-loss orders above the wick of the inverted hammer or above the support zone that has been broken.

However, it’s important to recognize market conditions, fundamental factors, and unforeseen events can all impact how well the inverted hammer works as an entry trigger…

…so don’t put all your eggs in one basket.

Now that you understand some ways to use the inverted hammer, let’s examine some real trading examples to reinforce the concepts!

Trading Examples

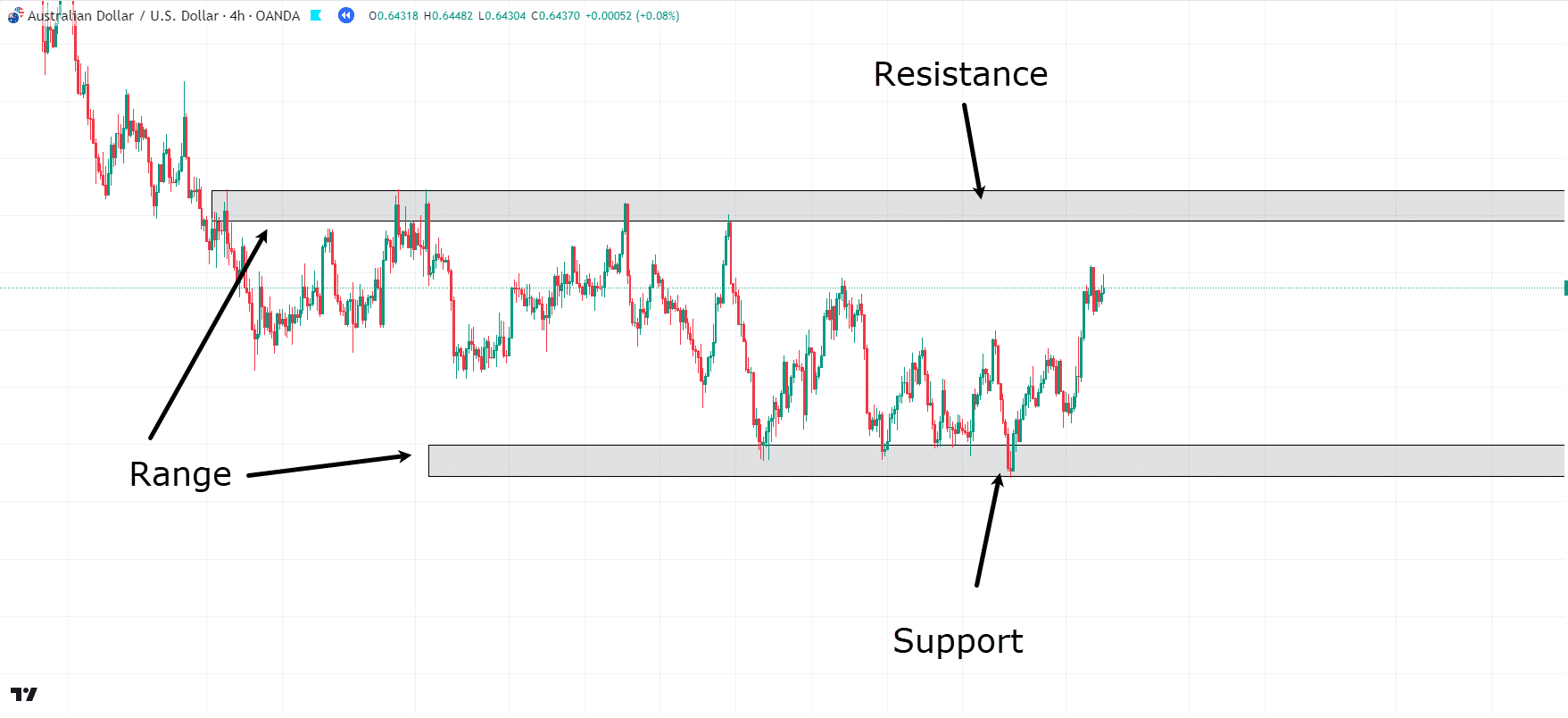

Range Example

Take a look at this chart…

AUD/USD 4-Hour Chart Range:

Price has clearly begun forming a range, where price has met a resistance level multiple times and also begun forming support at the bottom.

It’s safe to say that resistance and support are both areas of value.

Let’s take a look at what occurs next, then…

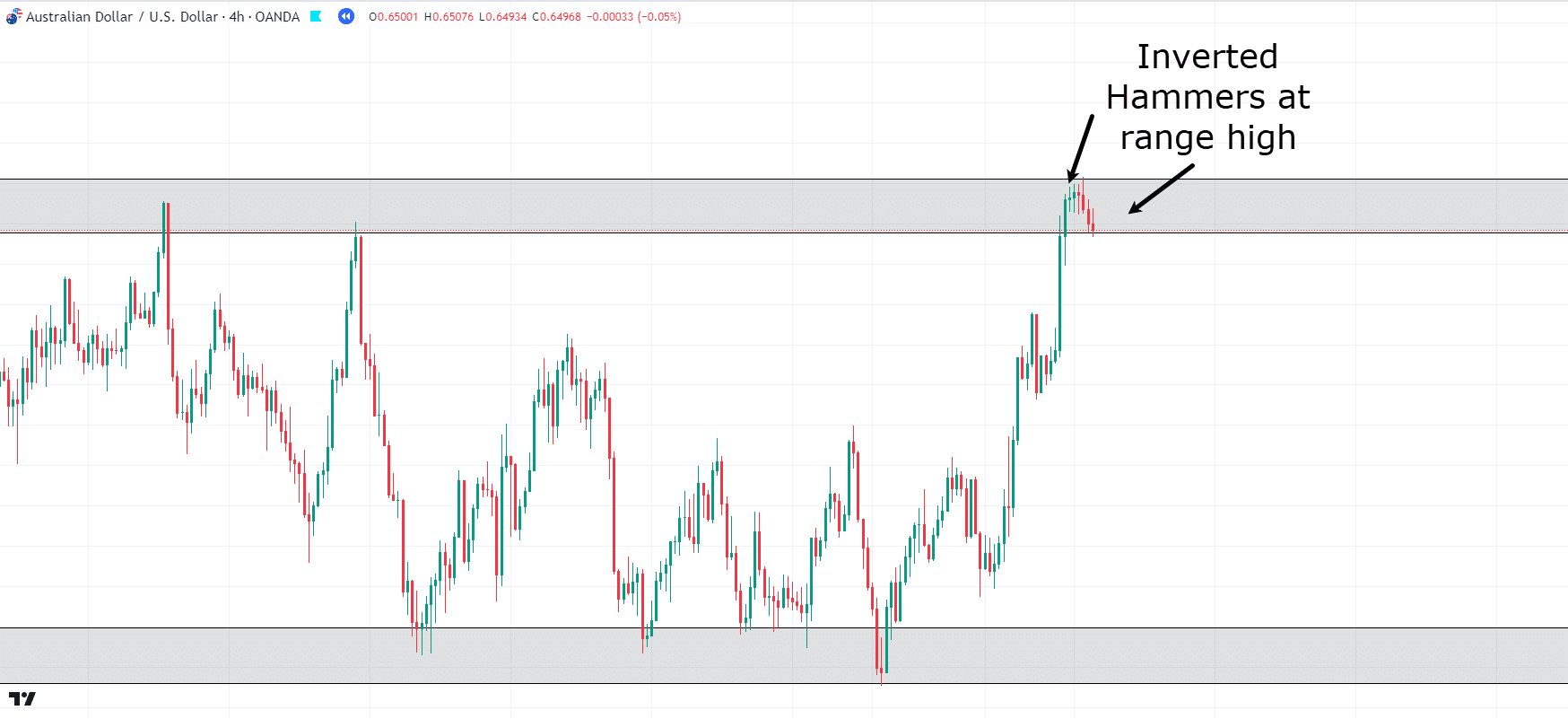

AUD/USD 4-Hour Chart Inverted Hammer:

As the price comes into the area of value, you can see it begins to stall…

Not only that, but Inverted Hammers begin to form in the zone – can you see?

In other words, price has reached an area where it has been rejected several times in the past.

As buyers attempt to push through the resistance, they encounter strong selling pressure, leading to the formation of inverted hammers.

There’s a potential trade opportunity here, let’s take a look…

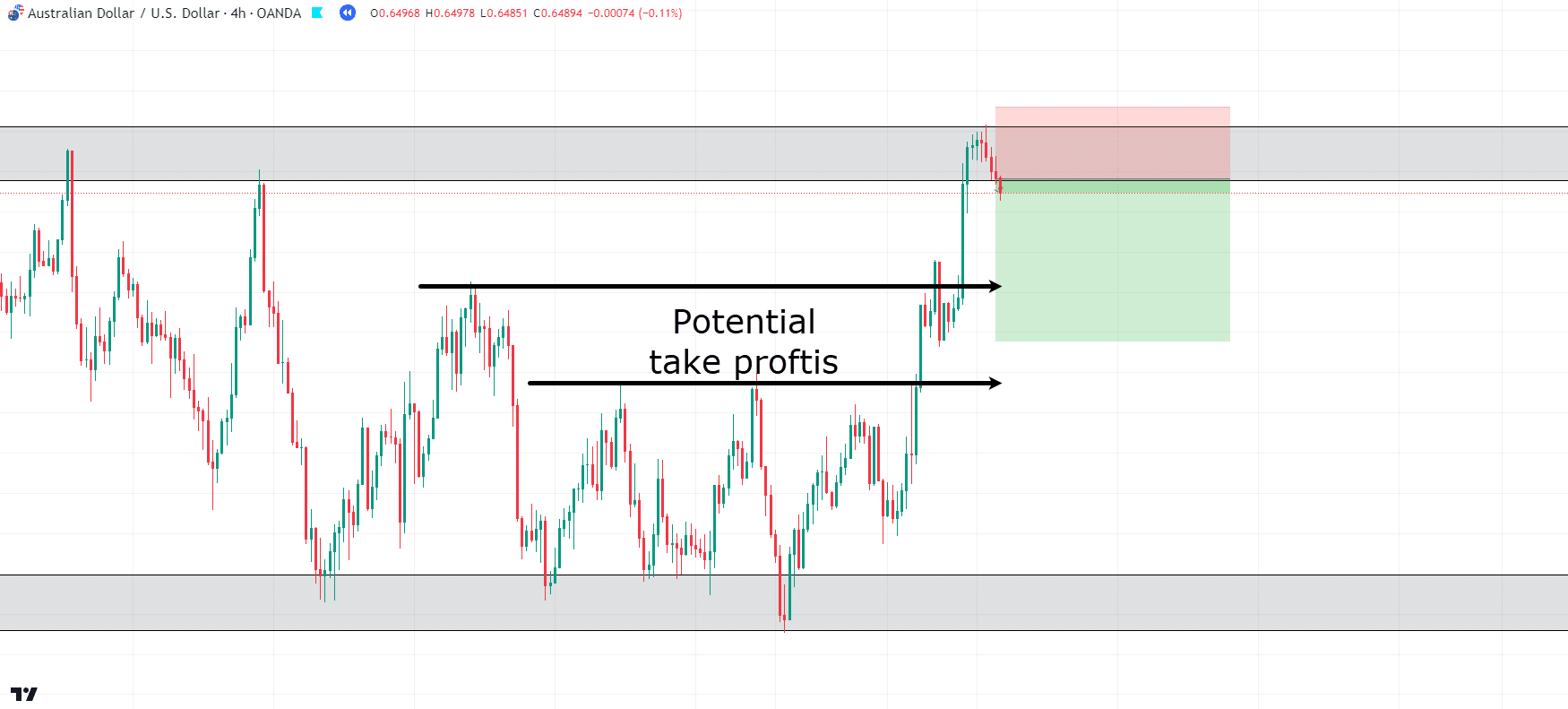

AUD/USD 4-Hour Chart Inverted Hammer:

As price rejects the resistance, let’s consider placing our stop above the zone.

The distance above the zone really depends on your risk tolerance!

For a higher potential reward, you might place it close to the wick of the inverted hammer…

…for a safer trade, give it some breathing room above the zone.

Potential take profits could be set at any of the previous highs, which may act as support and resistance flip zones.

If you’re aiming for more reward, you could target the range low as well…

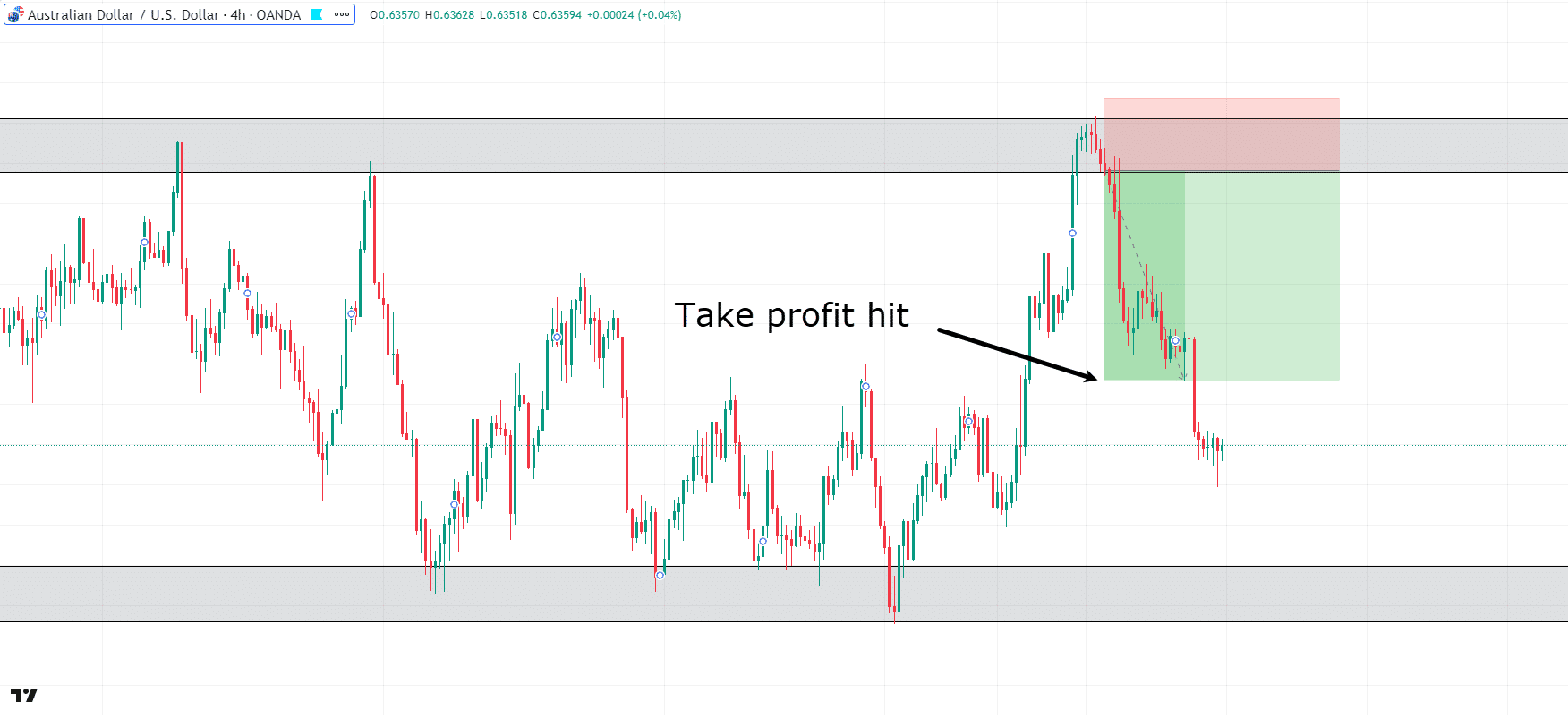

AUD/USD 4-Hour Chart Take Profit:

As seen in the chart, the price fell from the entry area and quickly approached the different take profit targets.

Even though this trade did not hit the range low, it is important to understand how important it is to find key candle structures at key value areas on the chart.

Now, let’s explore another example, this time focusing on the breach of support levels…

Break and Retest

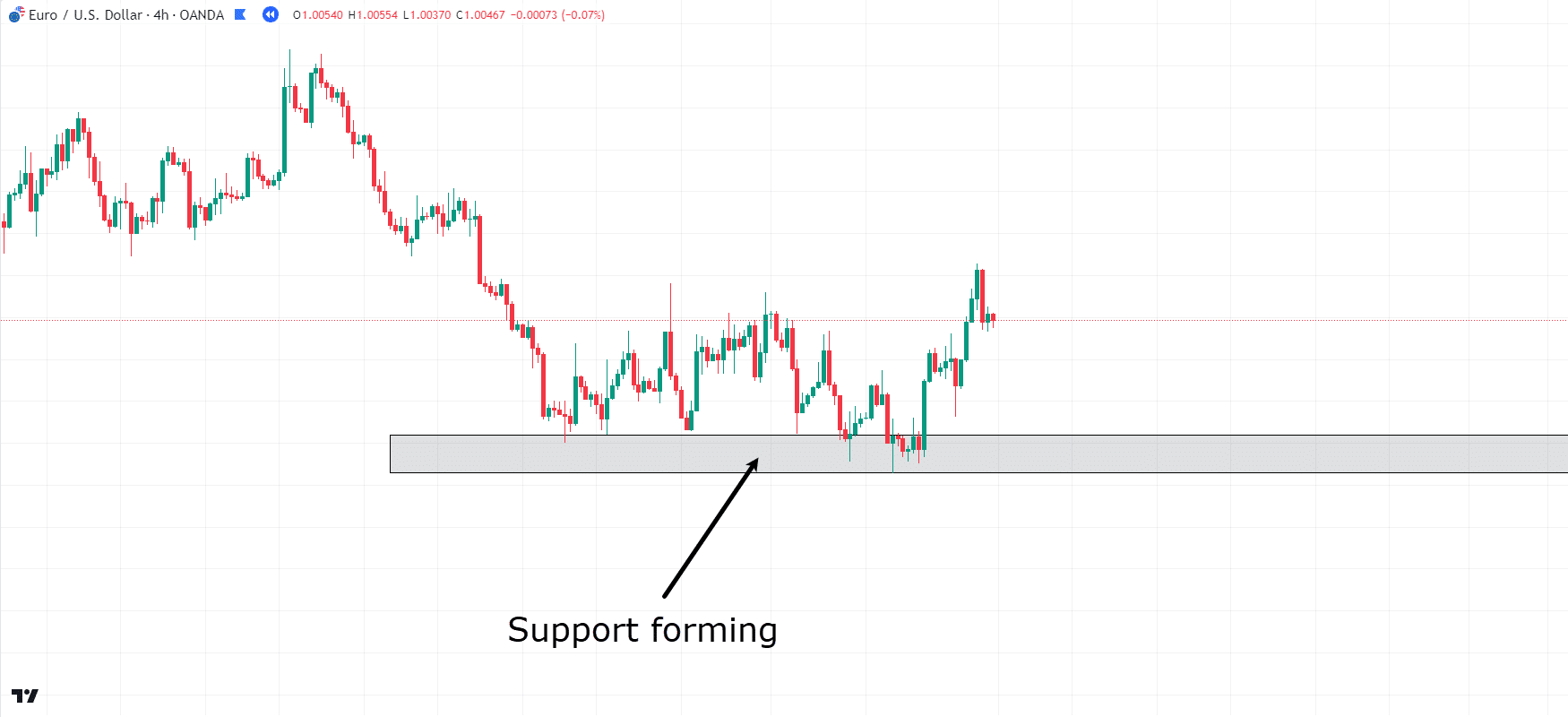

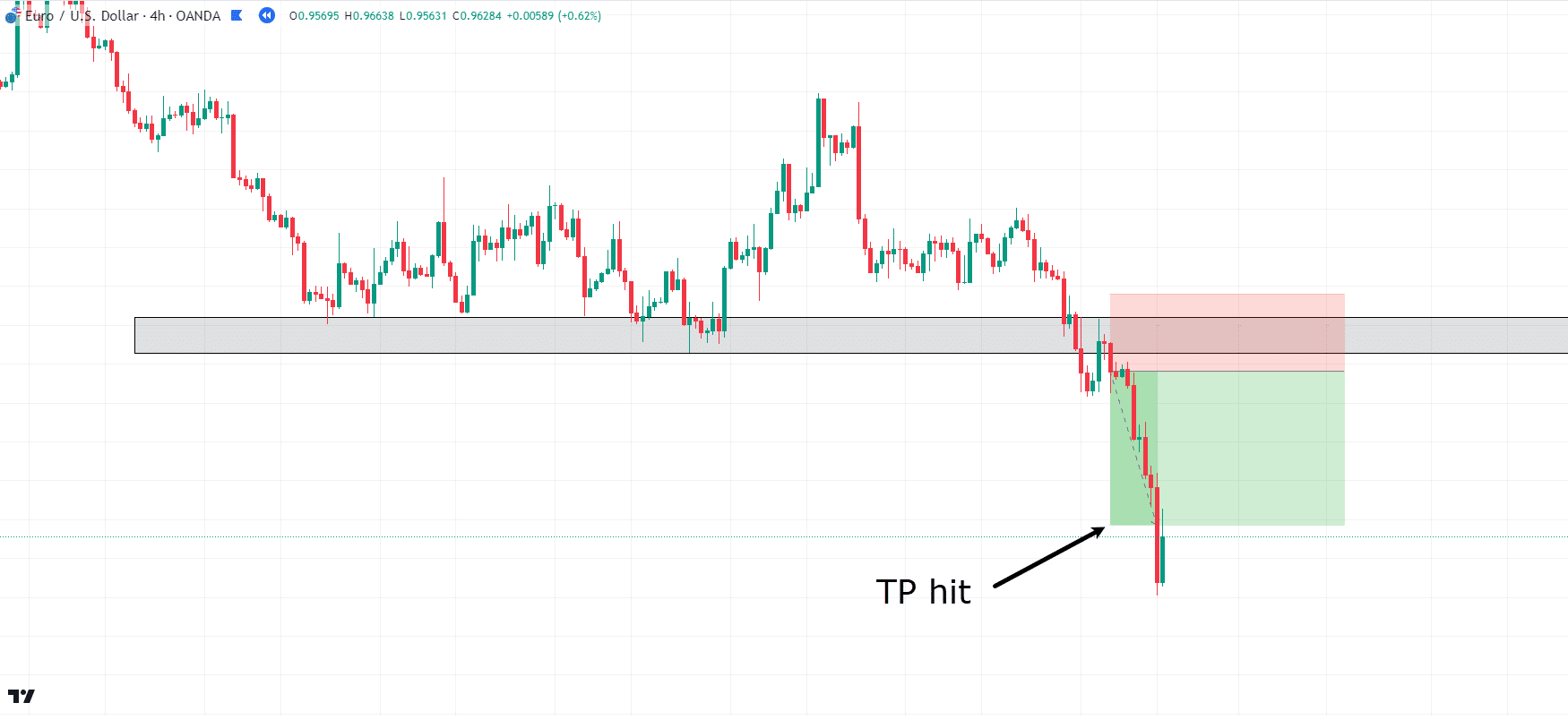

EUR/USD 4-Hour Chart Support:

In this EUR/USD chart, you can observe that the price has started to establish a support level.

Despite several tests of this level, the price consistently returns to this zone relatively swiftly…

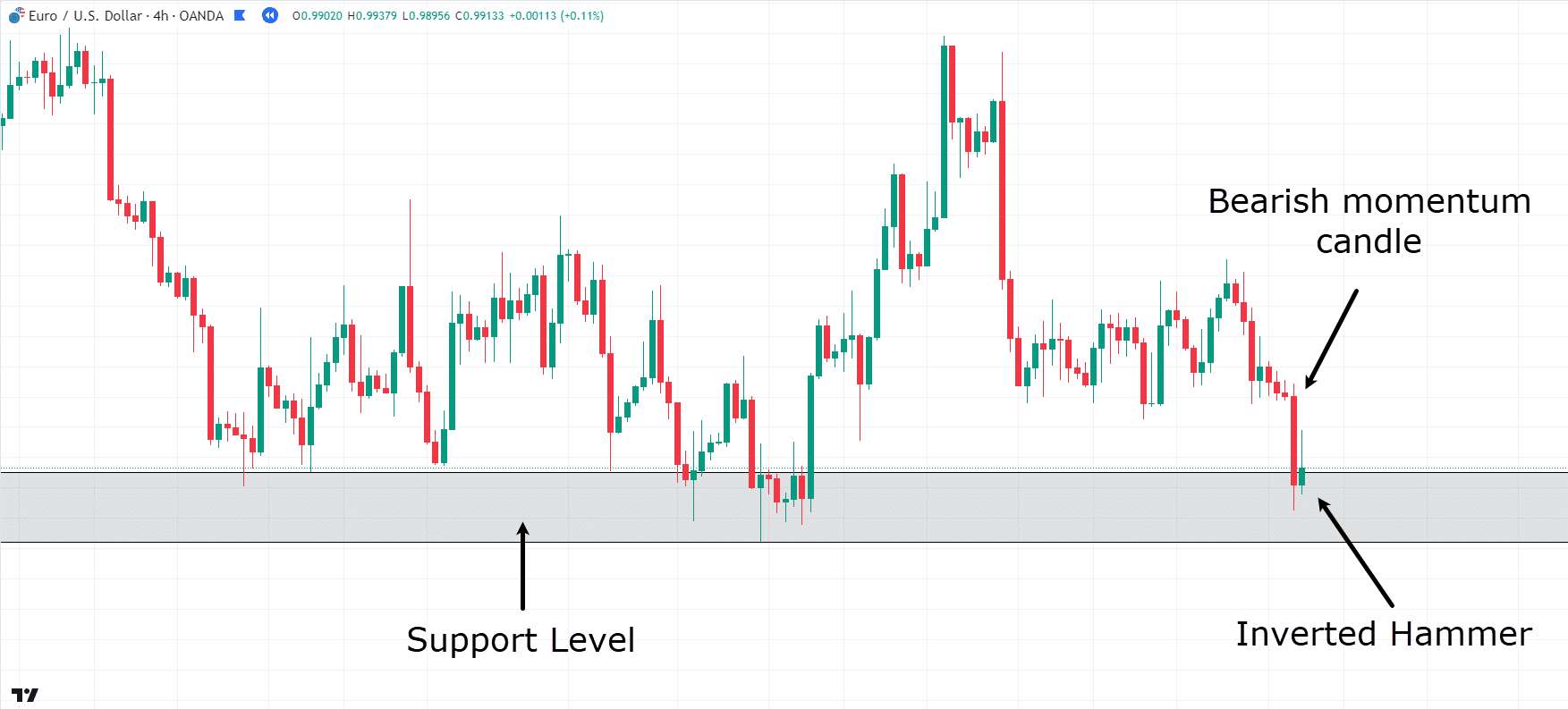

EUR/USD 4-Hour Chart Inverted Hammer:

As the price comes back to the zone again, something interesting occurs!

A strong bearish momentum candle swiftly enters the zone, followed by an Inverted Hammer….

When you compare this with the previous test, you might say,

“Well, there was a bearish momentum candle there too, though…”

…and you’d be right!

However, the candle after that bearish candle was a hammer candle followed by multiple smaller hammers.

Can you see how the narrative differs this time?

The story unfolds with a bearish momentum candle showing little rejection as it enters the support zone….

On the following candle, bulls attempt to push price out of the support zone and generate bullish momentum…

…but they meet more selling pressure, driving the price back down near the candle’s open price!

Actually, the broader market context suggests that price repeatedly returns to this zone without any significant bullish follow-through on the rebounds.

Based on this, it seems likely that the price will go down.

However, before entering a trade, it’s a good idea to wait for further confirmation…

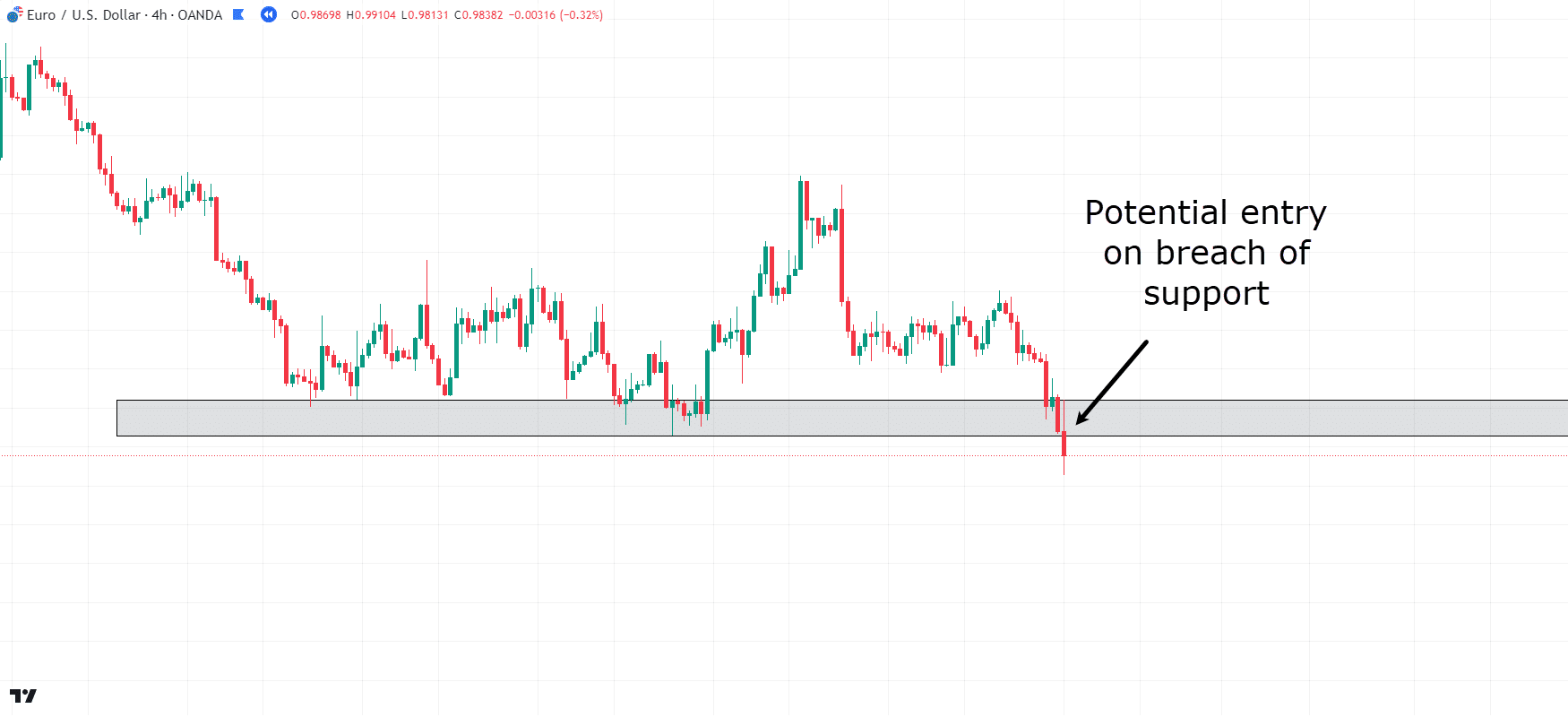

EUR/USD 4-Hour Chart Support Break:

Now that price has definitively broken the support level!

Following the inverted hammer, another bearish candle plunged deep into the zone before the subsequent candle breached and rejected the zone, too.

At this opportunity, some traders might be tempted to enter a short trade, attempting to beat the market and secure a premium price…

However, for the sake of argument, let’s exercise patience and wait for price to move away from the zone before retesting it…

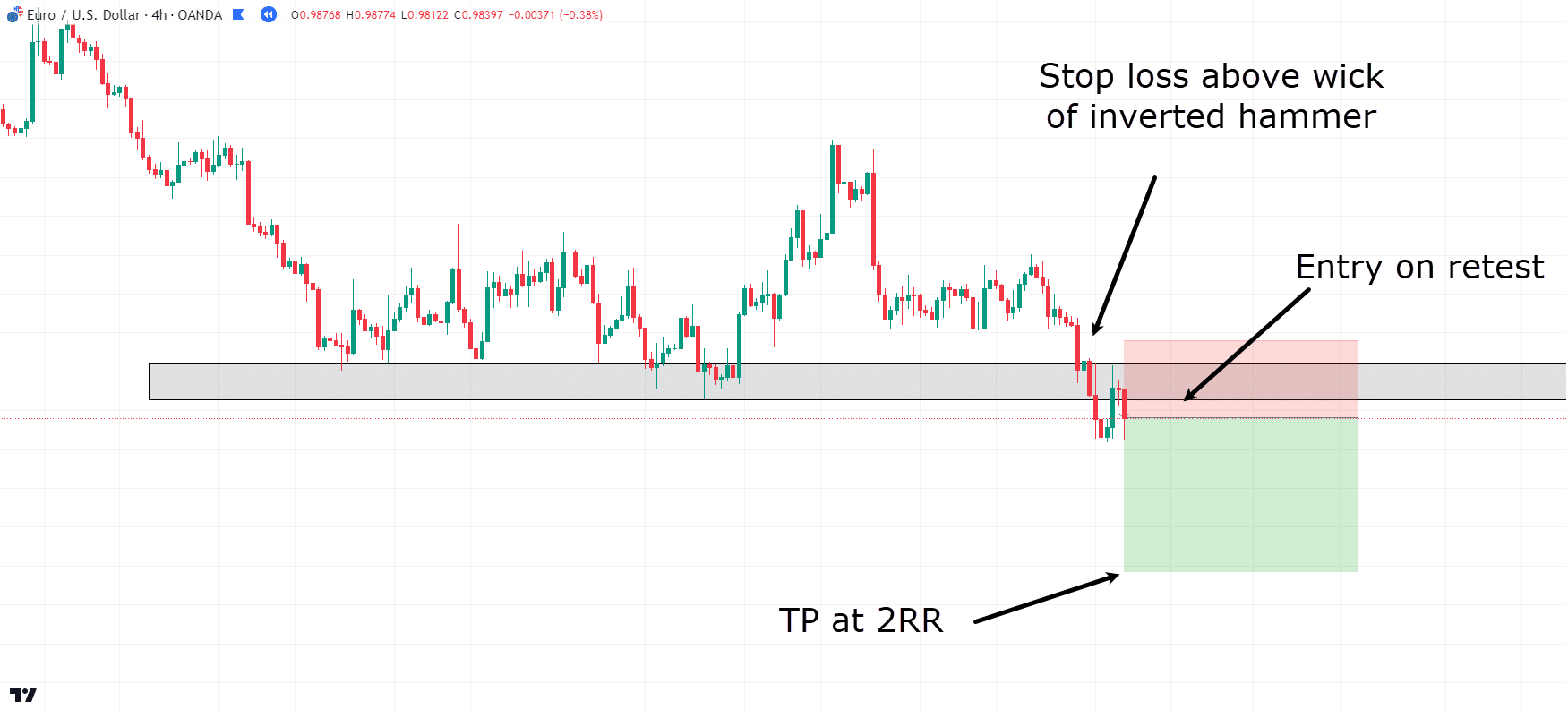

EUR/USD 4-Hour Chart Entry:

After a few more candles, you can observe that price makes several attempts to reclaim the zone.

So, what are the factors for considering a trade here?

- Price has revisited a support level that appears to be weakening.

- Entry into the zone occurred through a bearish momentum candle followed by the inverted hammer.

- The sequence of candlesticks suggests that buyers attempted to enter the market but failed to generate any significant momentum.

- Support has been breached and subsequently rejected, now acting as resistance on the other side.

These factors provide substantial evidence that the price may continue lower, wouldn’t you agree?

For this trade, the stop loss can be placed above the wick of the original inverted hammer. Targets for this example will be set at a 2RR…

EUR/USD 4-Hour Chart Take Profit:

Well, look at that!

Just as expected, the price fell as the buyers were unable to sustain any buying momentum…

See how when you analyze the market as a whole, and piece together all the little bits of evidence the market gives you, you can make better-informed trading decisions?

Let’s look at one last example to contrast exactly this point…

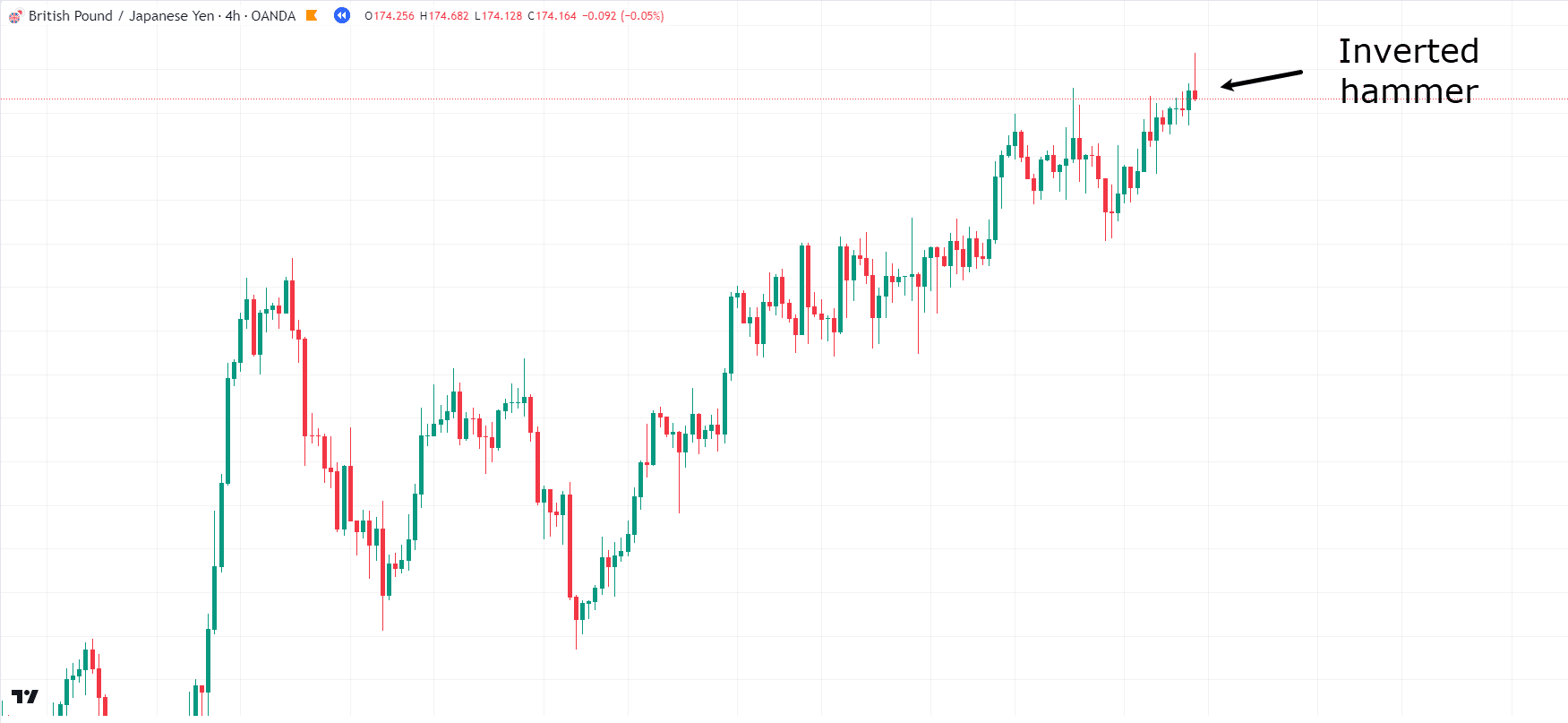

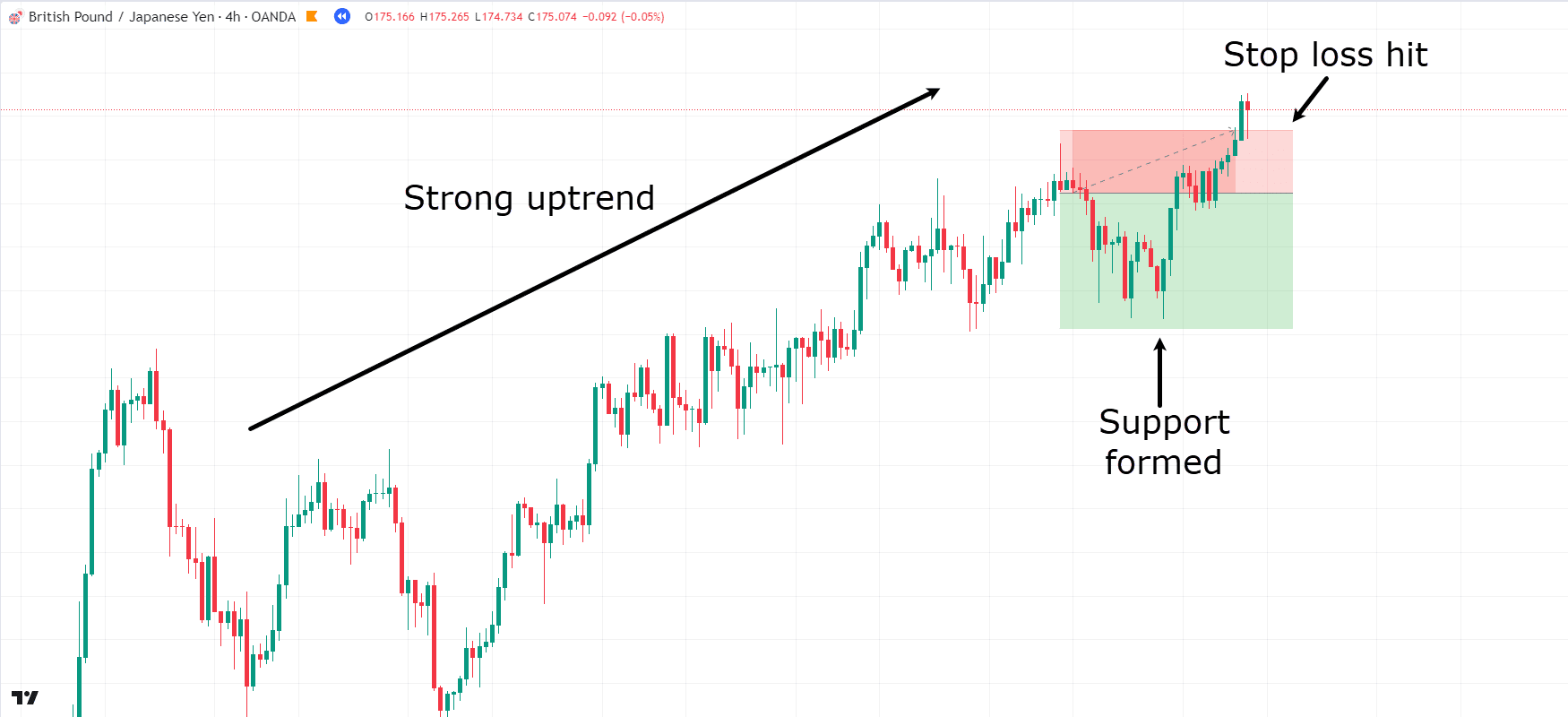

GBP/JPY 4-Hour Chart:

As you can see, price has printed multiple inverted hammers in this little cluster of candles…

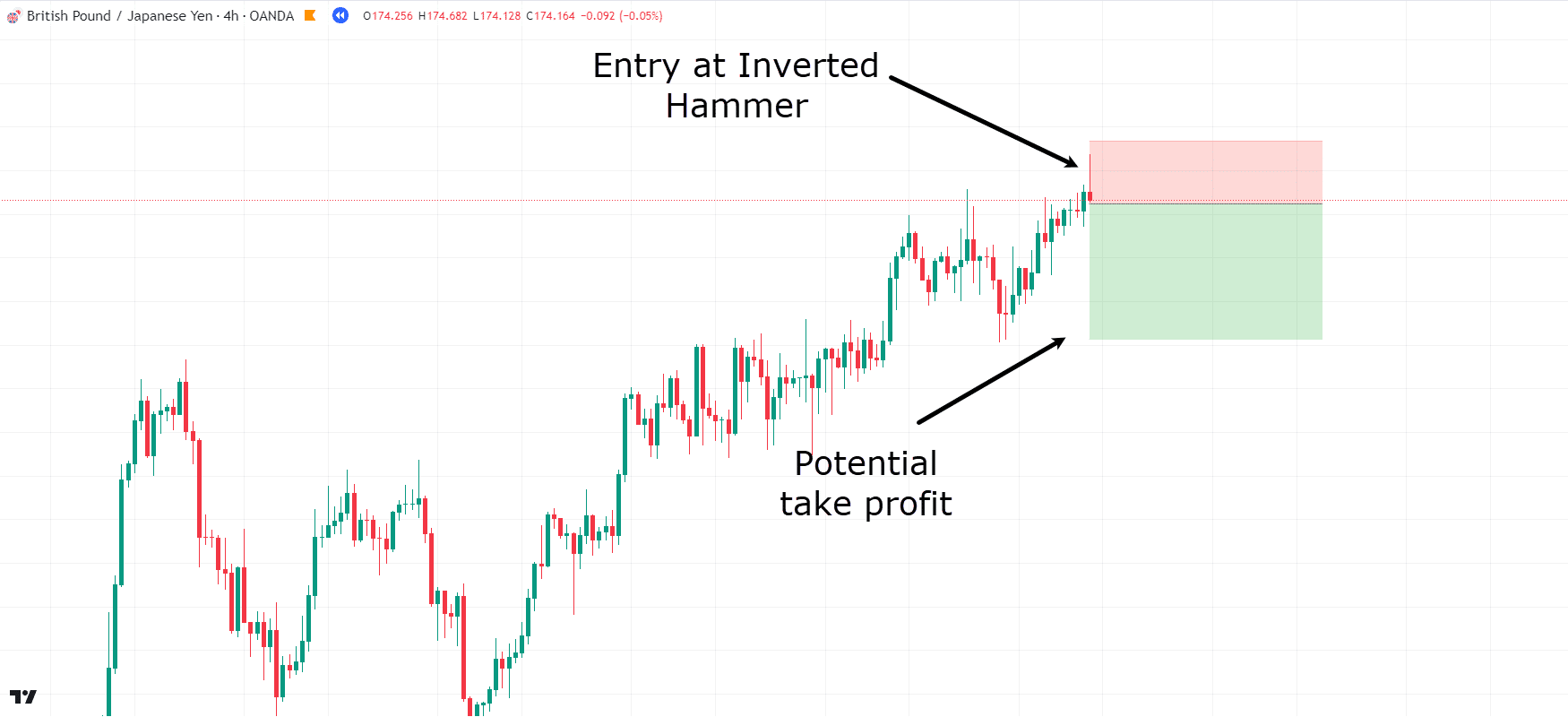

GBP/JPY 4-Hour Chart Entry:

Let’s say for argument’s sake, you took this trade because you saw the Inverted Hammer occurring.

Entry at the candle and potential take profits at 2RR…

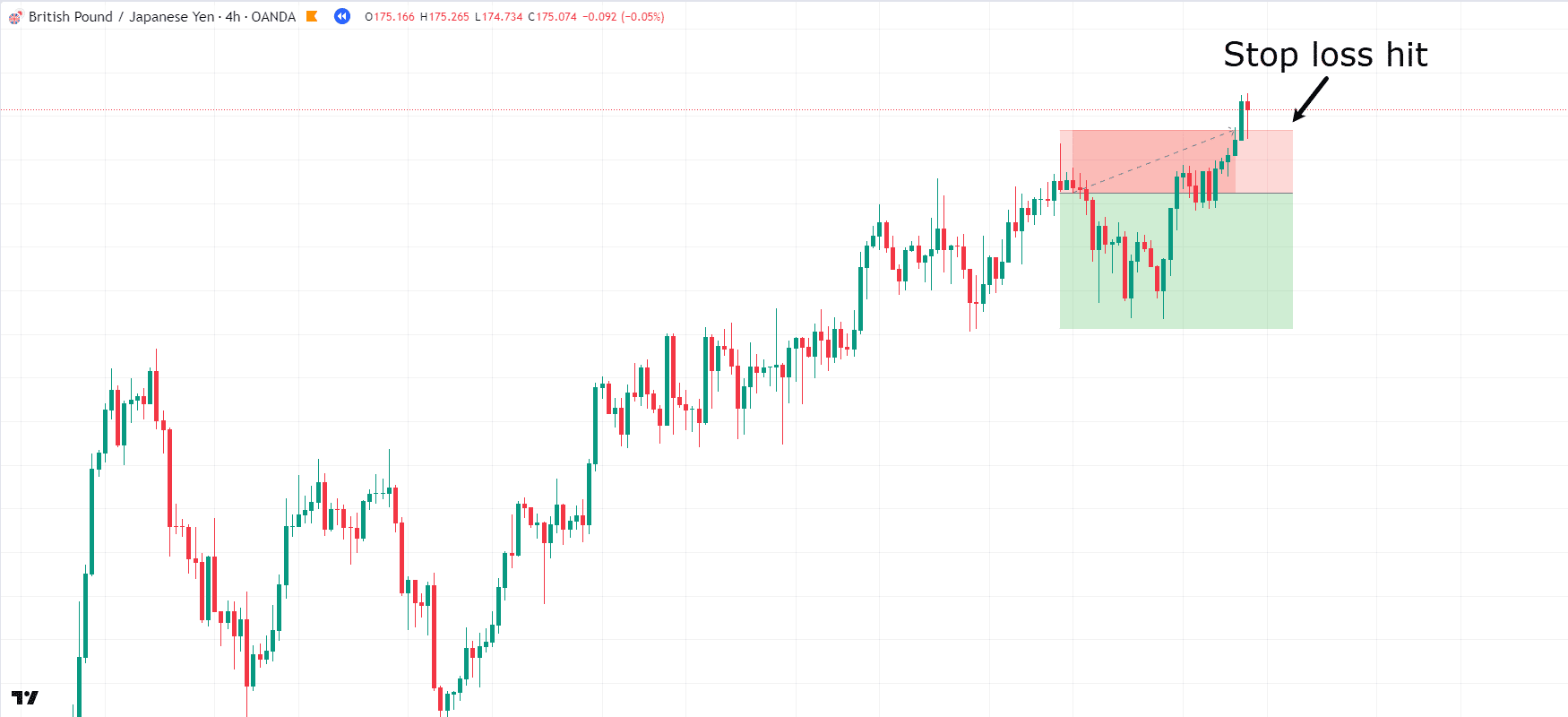

GBP/JPY 4-Hour Chart Stop Loss:

Oh no!

…Why did this happen?

The inverted Hammer pattern formed and price did go in your favour!

But let’s take a step back for a second…

GBP/JPY 4-Hour Chart Explanation:

When you analyze this scenario, a few things begin to pop out.

Price is actually in a strong uptrend with little to no sign of that momentum slowing…

…unlike previous examples, there are no real key areas of value on which this trade was based!

Although the price initially moved in favor of the trade, it eventually came down to a chart area and began treating it as support.

These bullish candlesticks at the support level occurred multiple times, indicating that the price was struggling to go lower.

While this could have been an opportunity to close the trade early, the trade itself lacked any solid market analysis.

Instead, it was based solely on a candlestick pattern forming randomly on the chart, rather than incorporating multiple arguments for a short trade.

As such, when trading the Inverted Hammer, it’s important to consider the market outlook as a whole, rather than solely focusing on the candlestick pattern itself.

This plugs into some limitations of the Inverted Hammer!

Limitations of the Inverted Hammer

You must be aware of the constraints of this pattern and exercise caution when incorporating it into your trading strategies!

Cannot be used in Isolation

One of the primary limitations of the inverted hammer is that it cannot be relied upon as a standalone trading signal.

While the pattern does provide valuable insight into potential bearish continuation, it is essential to boost its analysis with additional technical indicators and confirmation signals.

Relying solely on the inverted hammer without considering other factors such as market context, trend strength, and volume can increase the risk of false signals…

…and lead to poor trading outcomes!

You should always use the inverted hammer as part of an overall trading strategy – incorporating plenty of information to validate your trade opportunities.

Must be used in the right area of the market

Another limitation of the inverted hammer is relying on its context within the broader market trend.

When the pattern appears during a downtrend, it may mean that the trend is likely to continue in a bearish direction.

However, when it appears during other market conditions, it is not as important.

When figuring out what the inverted hammer means as a trading signal, you need to think about where it is and how the market is moving around it.

Potential for short-lived bearish movement

You should remember that any bearish continuation indicated by the inverted hammer may be short-lived.

Indications that bulls have begun trying to step into the market can sometimes give you the heads up that the move lower may not continue for long!

Factors such as market volatility, fundamental developments, or unexpected news events can all have an influence.

As such, you should take care, closely monitoring price action that follows an inverted hammer – properly assessing the strength of any movement.

Conclusion

In conclusion, the inverted hammer is a valuable tool for predicting continuation movements in the market and can serve as a great entry trigger for your trades.

When used in the correct context of the market and with other technical analysis, the inverted hammer provides traders with an edge to anticipate market outcomes.

To summarize, in this article, you’ve:

- Learned what the inverted hammer is

- Discussed the bearish nature of the Inverted hammer

- Explored the different ways to trade the inverted hammer

- Reviewed practical examples using charts

- Identified the limitations when using the inverted hammer

Congratulations on uncovering another tool for successful trading!

By using the Inverted Hammer to complement your other technical analysis you are well on your way to profitability!

Now – I’m eager to hear your thoughts on the inverted hammer…

Do you currently use this candlestick pattern in your trading?

Can you see why I view it as a bearish candlestick pattern rather than a bullish candlestick pattern?

How much success have you had with it?

Share your thoughts and experiences in the comments below!