Wait, what? Another candlestick article?!

But of course!

Although they don’t have all the answers all the time, candlesticks are a crucial source of information when dealing with markets.

Truth be told, it’s not obvious at first glance what they’re trying to say, right?

Well, it’s time to dig down into the details and really get into what’s going on…

That’s why I’ve written this article on understanding Candlesticks in Technical Analysis!

In this article, you’ll cover:

- What exactly a candlestick is

- Why candlesticks are important

- How momentum and indecision are reflected in candlesticks

- The importance of using candlesticks in the correct context

- Tips and tricks for successful candlestick usage

- Common mistakes and limitations to watch out for

Are you ready?

Then let’s go!

What is a Candlestick?

At its core, a candlestick is a type of price chart used in technical analysis that displays the high, low, open, and close prices of an asset for a specific period.

Let’s take a look at a Candlestick and analyse it…

Anatomy of Candlestick:

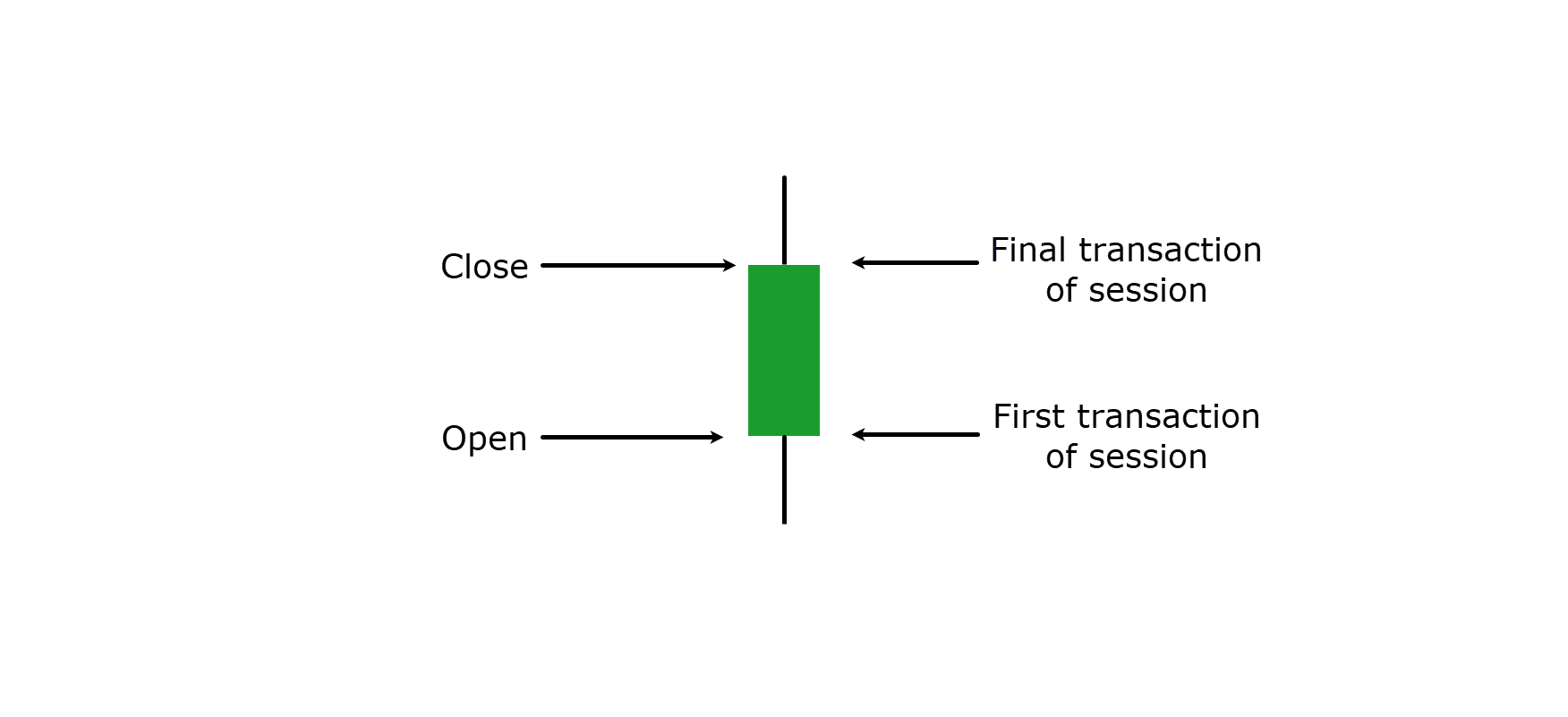

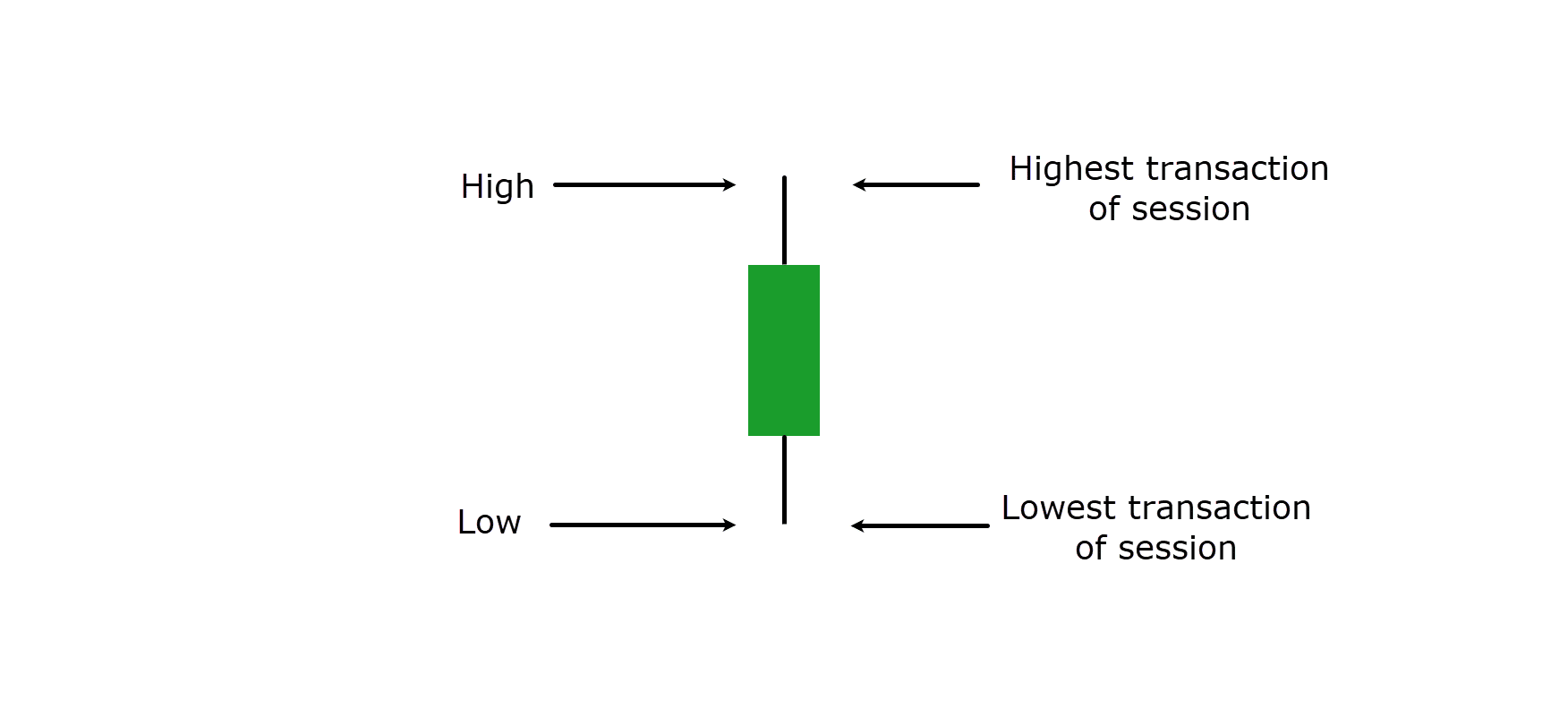

Candlesticks are created with a body and wicks (or shadows).

The body represents the range between the open and close prices…

The wicks show the highest and lowest prices reached during the trading session…

By examining the shape and color of the candlestick, traders can gauge market sentiment and potential future movements.

Body: Open and Closes

As touched on above, each candlestick has a body, formed by the open and close prices of the trading session.

The length and position of the body within the candlestick provide crucial information about market momentum and investor sentiment…

Candlestick Body:

As you can see, the open price marks the first transaction price at the beginning of the trading session, while the close price is the final transaction price at the end of the session.

Depending on the chosen timeframe—be it 4 hours, 1 day, or 1 hour—each candlestick represents the price action within that specific period.

The color of the body also plays a significant role.

If that particular example was a daily candlestick, it would mean the price closed higher than it opened over that entire day.

This is because a green (or white) candlestick signals bullish sentiment and suggests buyers held control during the session.

Conversely, a red (or black) candlestick shows that the close price is lower than the open price, signaling a bearish sentiment and suggesting that sellers dominated the session.

Wicks: High and Low

In addition to the body, candlesticks feature wicks, which extend above and below the body…

Candlestick Wicks:

The upper wick shows the highest price reached during the session, while the lower wick shows the lowest price.

It’s the wick that can provide valuable insight into the price extremes and volatility within the session.

For now, understand that long wicks can suggest strong resistance or support levels, as well as potential reversals, whereas short wicks indicate relatively stable trading within the session’s open and close range.

Let’s look at how these bodies and wicks can combine…

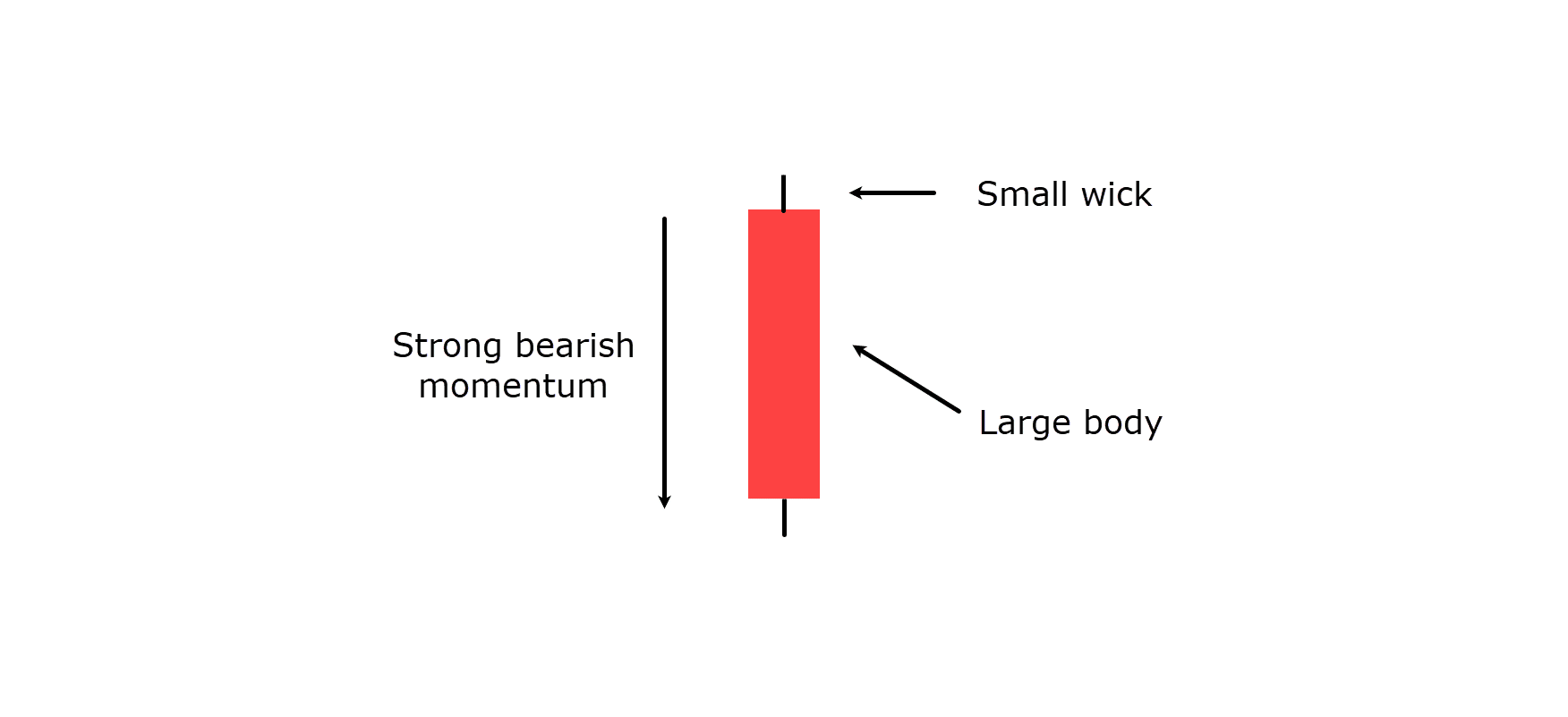

Momentum Candlesticks

Momentum candlesticks are characterized by their long bodies and minimal wicks, indicating strong buying or selling pressure throughout the session…

Bearish Momentum Candle Example:

As shown in the diagram above, a long red candlestick suggests strong bearish momentum, with sellers pushing prices lower while facing little opposition.

Conversely, a long green candlestick would indicate strong bullish momentum, with buyers driving prices up decisively.

Recognizing these momentum candlesticks can help you identify and ride market trends, so look out for them!

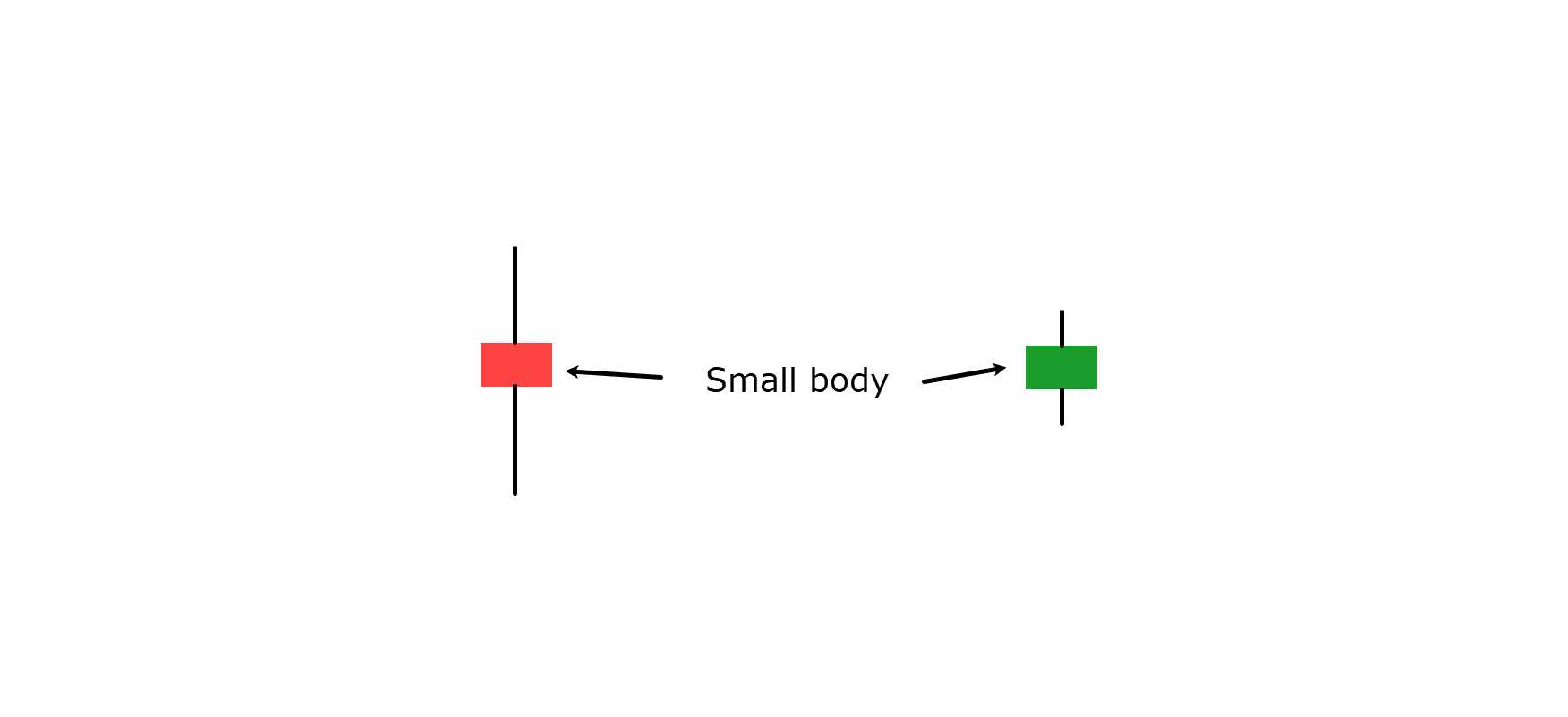

Indecision Candlesticks

Indecision candlesticks, such as doji or spinning tops, are formed when the open and close prices are very close or equal, resulting in a small body and long wicks…

Indecision Candles:

These candlesticks represent a stalemate between buyers and sellers, with neither side able to gain a definitive advantage.

The appearance of indecision candlesticks often precedes market reversals or periods of consolidation, signaling traders to exercise caution and wait for clearer signals before making decisions…

Why They Are Important

Candlesticks offer a universal view of market dynamics that other charting techniques can’t match.

A key importance lies in offering a quick analysis of market data during trading sessions.

A Holistic Way of Viewing the Market

As each candlestick displays the open, high, low, and close prices, they enable you to view the full range of market activity within the specified timeframe.

These details allow you to quickly assess market sentiment, identify trends, and make more informed trading decisions with a simple glance at the chart.

The Reason Candlesticks Exist

Candlesticks exist because they break down complex data into something much easier to understand.

Unlike line charts, which only show closing prices over time, candlesticks reveal how buyers and sellers worked against each other.

This interaction is critical for understanding market psychology and predicting future movements!

Let’s take a look at two identical charts, one candlestick, and the other line…

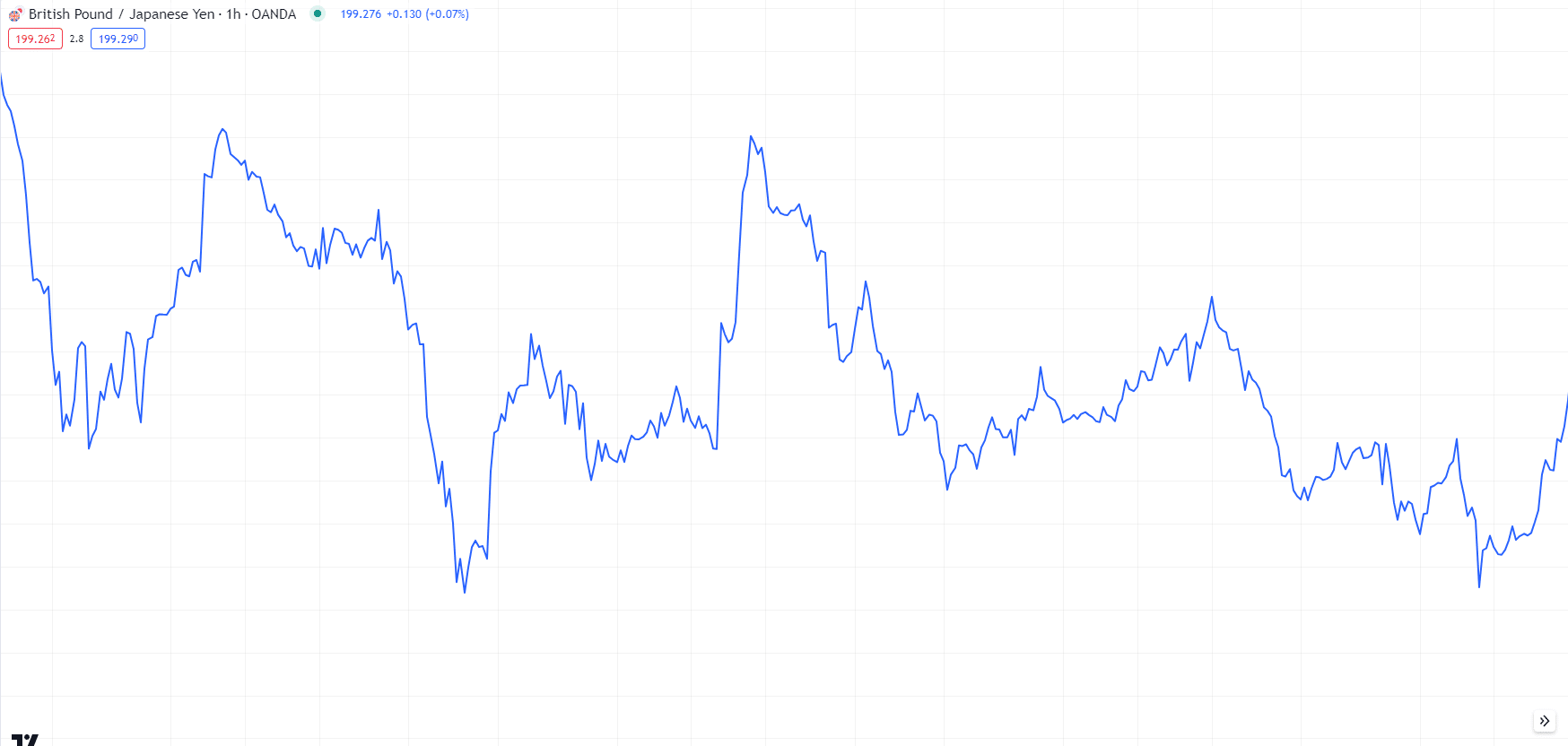

GBPJPY 1-Hour Timeframe Line Chart:

See how this line chart does give us a general idea of where the price has been and where it could be going?

However, you might struggle to see how these price swings occurred or why…

That’s because line charts can’t display information such as price rejection; where prices test certain levels but fail to hold them.

Let’s look at the same chart but with candlesticks…

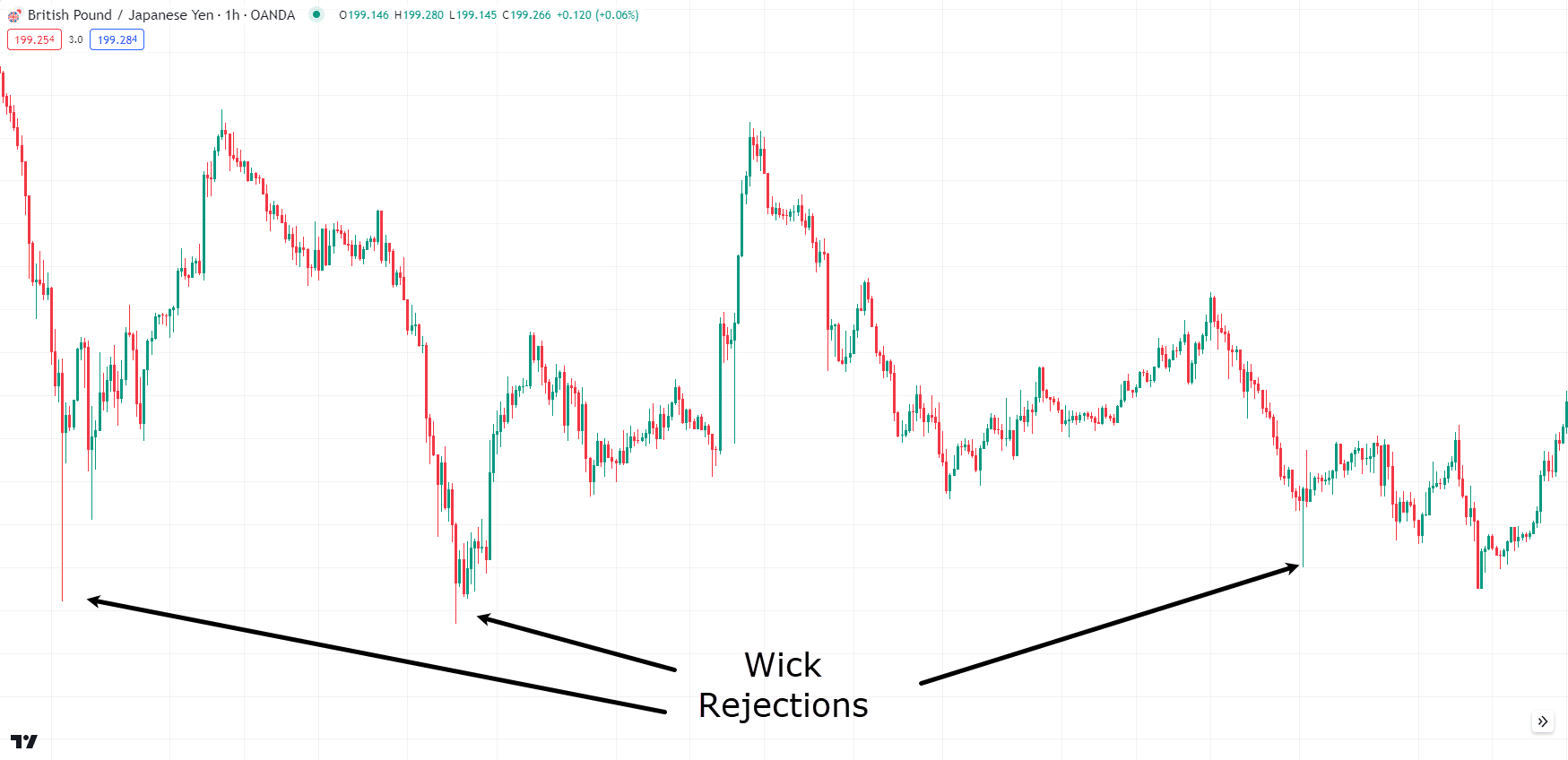

GBPJPY 1-Hour Timeframe Candlestick Chart:

See how the price originally wicked lower than what the line chart represented?

This is crucial information that was unavailable in the line chart, due to the closing price being much higher.

It’s a great example of selling pressure being met with stronger buying pressure, and, thanks to your candlestick chart, you can see there is a strong likelihood of price bouncing again as support in this area in the future!

This kind of detailed information is essential for identifying potential reversal points and understanding market sentiment.

Limitations of Other Charting Techniques

Other charting techniques, such as bar charts or point-and-figure charts, also have limitations in the way they present data.

While bar charts do show open, high, low, and close prices, they don’t offer the same level of clarity and intuitive insights provided by candlesticks.

Point-and-figure charts can focus on price movements and ignore time, but neglect things such as the speed and duration of price changes.

Candlesticks provide the best of all worlds in an easy representation.

Piecing Together the Market Story

OK, I know I often talk about the story of the market!

You may ask, “What story? It’s simply some candles at certain prices on a chart, isn’t it?”

The reason I get excited is because when you spend a lot of time watching charts, you begin to start piecing together each chart’s own little story…

…all through piecing together multiple candlesticks.

When the candlesticks start to act the same way, it shows you a small indication of what is occurring in the market…

…just like it’s talking to you!

Candlesticks show both how the session is progressing, as well as the continuity and flow of market trends over time.

This makes it easier to spot patterns, such as bullish or bearish engulfing patterns, doji formations, and morning or evening stars, which are vital for predicting future market directions.

By using candlesticks, you can connect the dots between sessions, gaining a clearer understanding of overall market behavior – and the story that the market is telling you!

How Are Candlesticks Used?

I touched on why candlesticks are used but let’s delve deeper into how you can read the candlesticks’ story to give you an advantage in the market.

Rejection: Bulls or Bears Winning

One key aspect of candlestick analysis is understanding rejection, which occurs when the price tests a certain level but fails to sustain it.

This is often visible through the candlestick wicks.

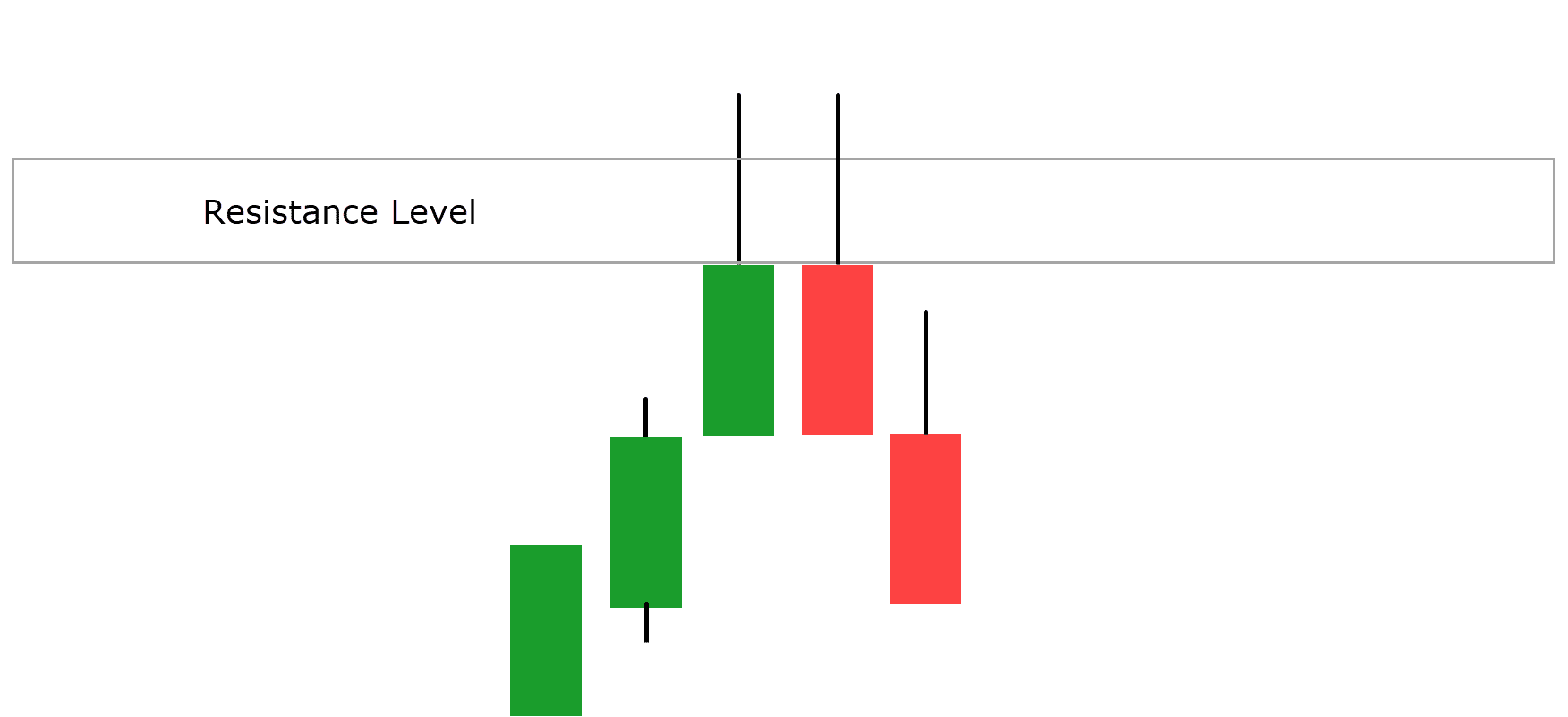

For instance, a long upper wick indicates that buyers pushed the price up during the session, but sellers ultimately overpowered them, driving the price back down before the close…

Selling Pressure Diagram:

It suggests potential bearish sentiment or resistance at higher levels.

This works the same at a support level where a long lower wick suggests sellers drove the price down, but buyers regained control, pushing the price back up.

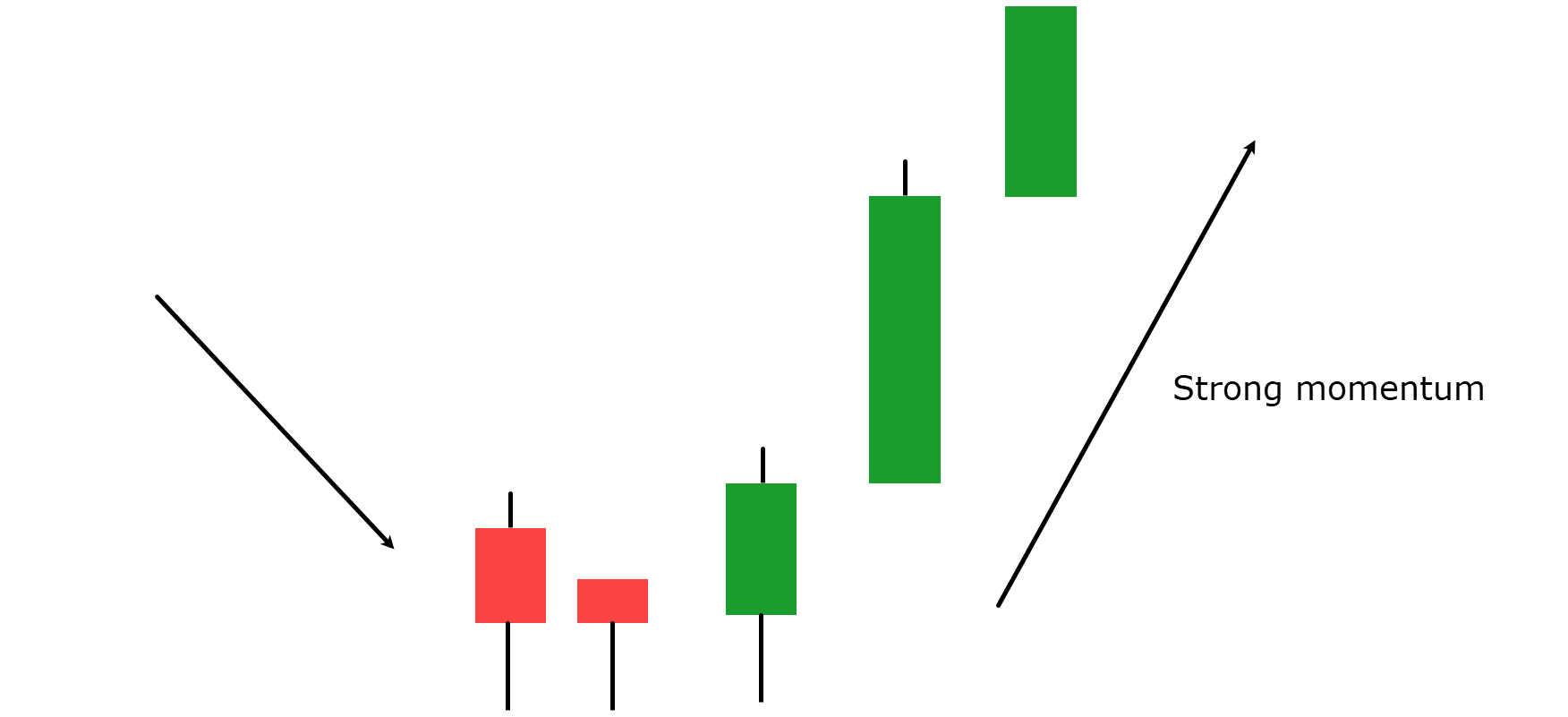

Momentum: Clear Visibility in Candles

Candlesticks also make it easy to see momentum within the market.

A series of long green (bullish) candles with minimal wicks means strong upward momentum, suggesting buyers are in control…

Bullish Momentum Candles:

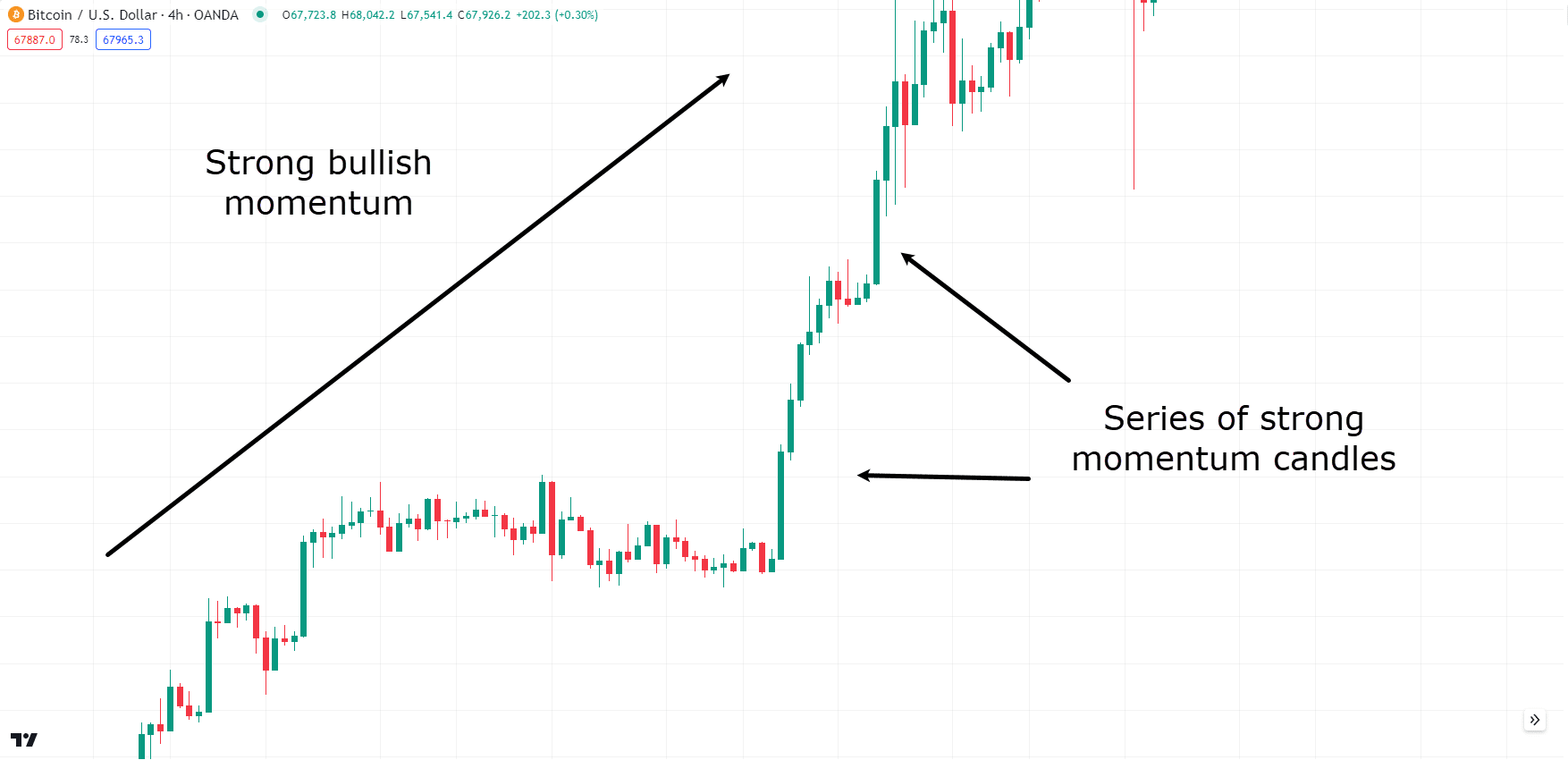

See how the green candles completely outweighed the red candles at the bottom of the trend?

This visual representation of momentum helps traders identify and follow prevailing trends and predict market flow.

Patterns: Names and Meanings

Over time, traders have identified specific candlestick patterns that provide insights into potential future market movements.

They are often a combination of the above rejection candles and momentum candles, and when used with other market analyses, they can become a powerful tool.

The pattern names often reflect what the candles look like, offering a quick and easy way to visualise and understand what the candlesticks are trying to represent.

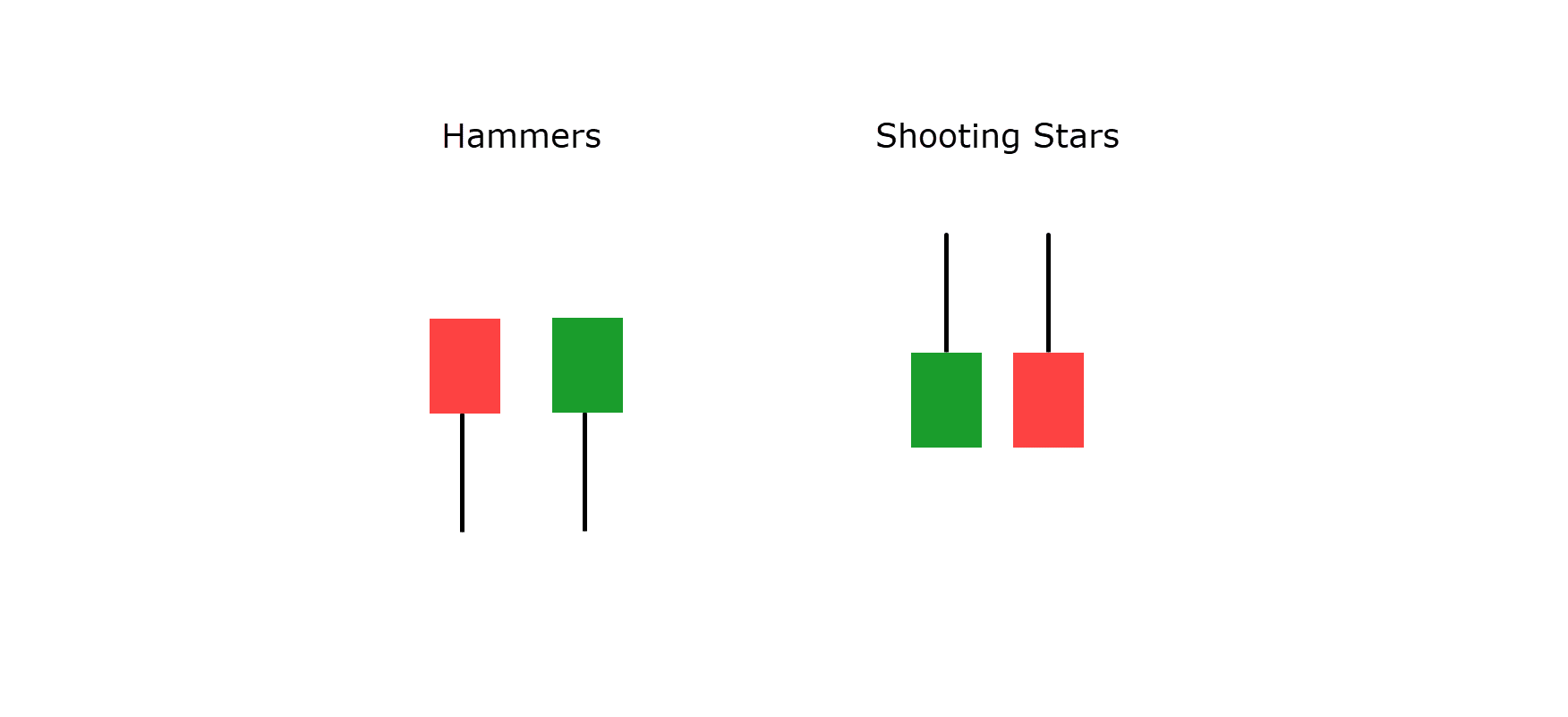

Some patterns you may have heard of are Hammers and Shooting Stars – often used for detecting rejection in the market at support and resistances…

Hammer and Shooting Star Examples:

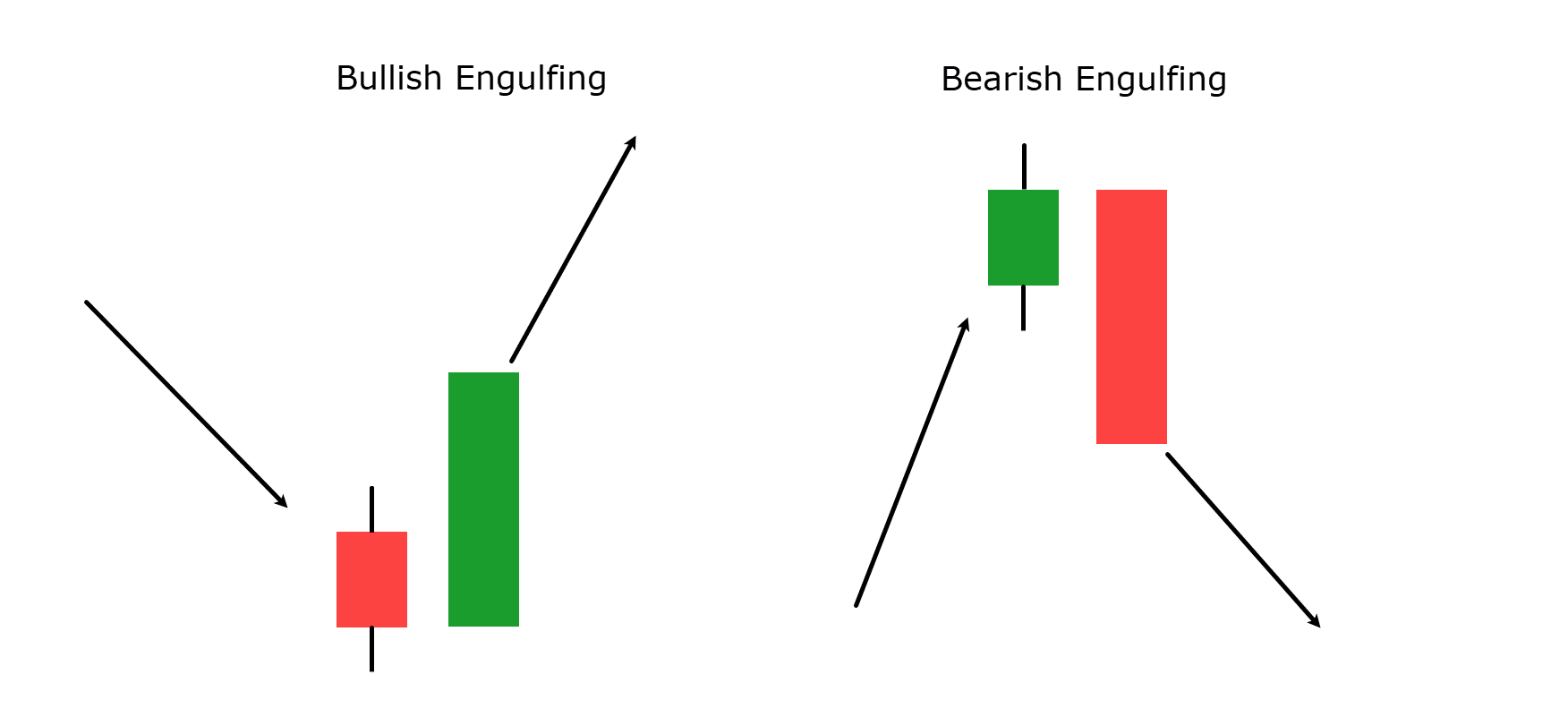

There are also bearish and bullish engulfing patterns.

These often highlight the momentum in a certain direction that completely engulfs one or more of the previous candles, showing that momentum has drastically shifted…

Bullish and Bearish Engulfing Patterns:

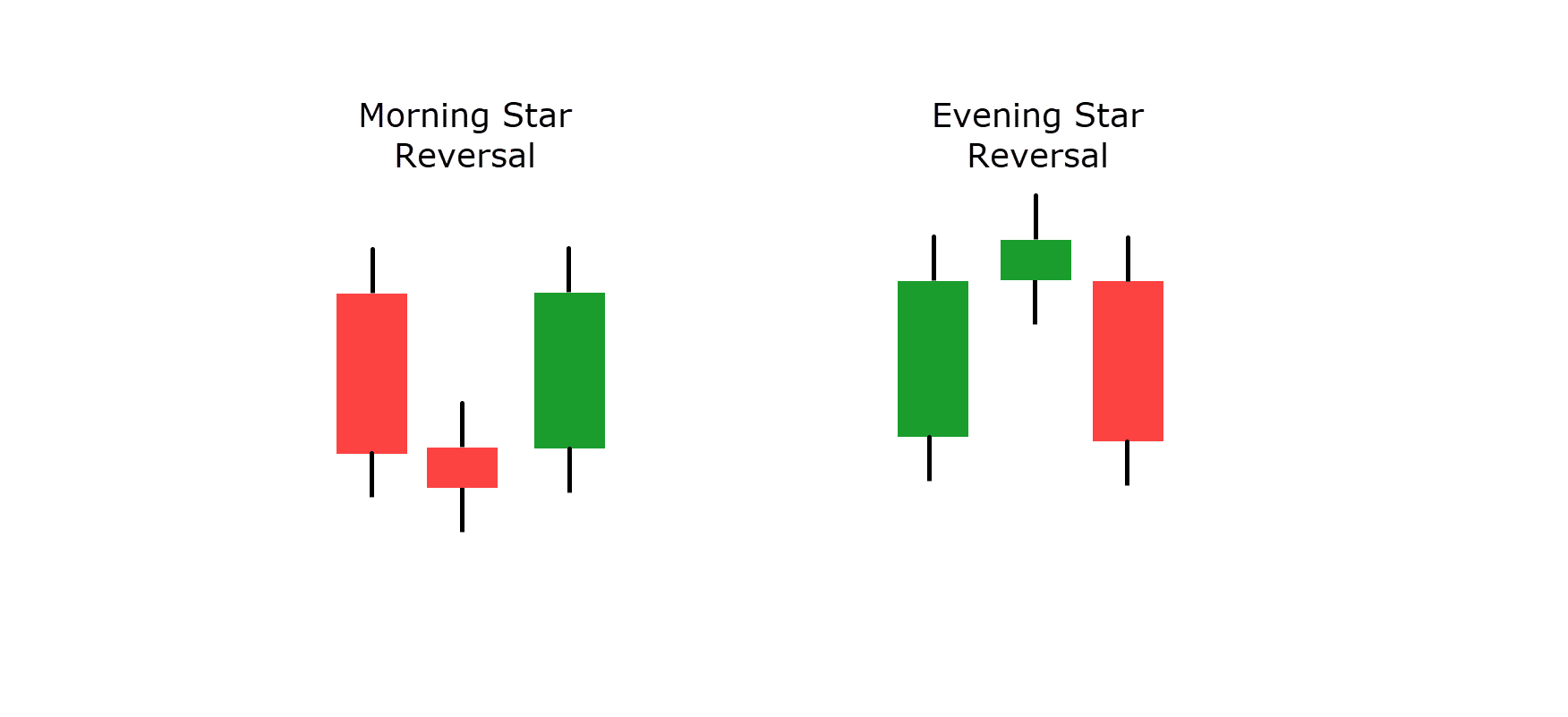

Morning and Evening star reversal patterns are often found at key turning points in the market.

They are a mix of rejection or indecision candles and often followed by engulfing like candles that signal strong momentum in the new direction…

Morning and Evening Star Reversal Patterns:

Many other combinations of candlesticks make up valuable patterns, and I encourage seeking them out on your charts to help understand the stories they are telling you!

What Are Some Tips and Tricks to Successfully Use Candlesticks?

Candlesticks are a powerful tool in technical analysis, but their effectiveness is greatly enhanced when used with certain strategies and best practices.

Here are some tips and tricks to maximize the value of candlesticks in your trading:

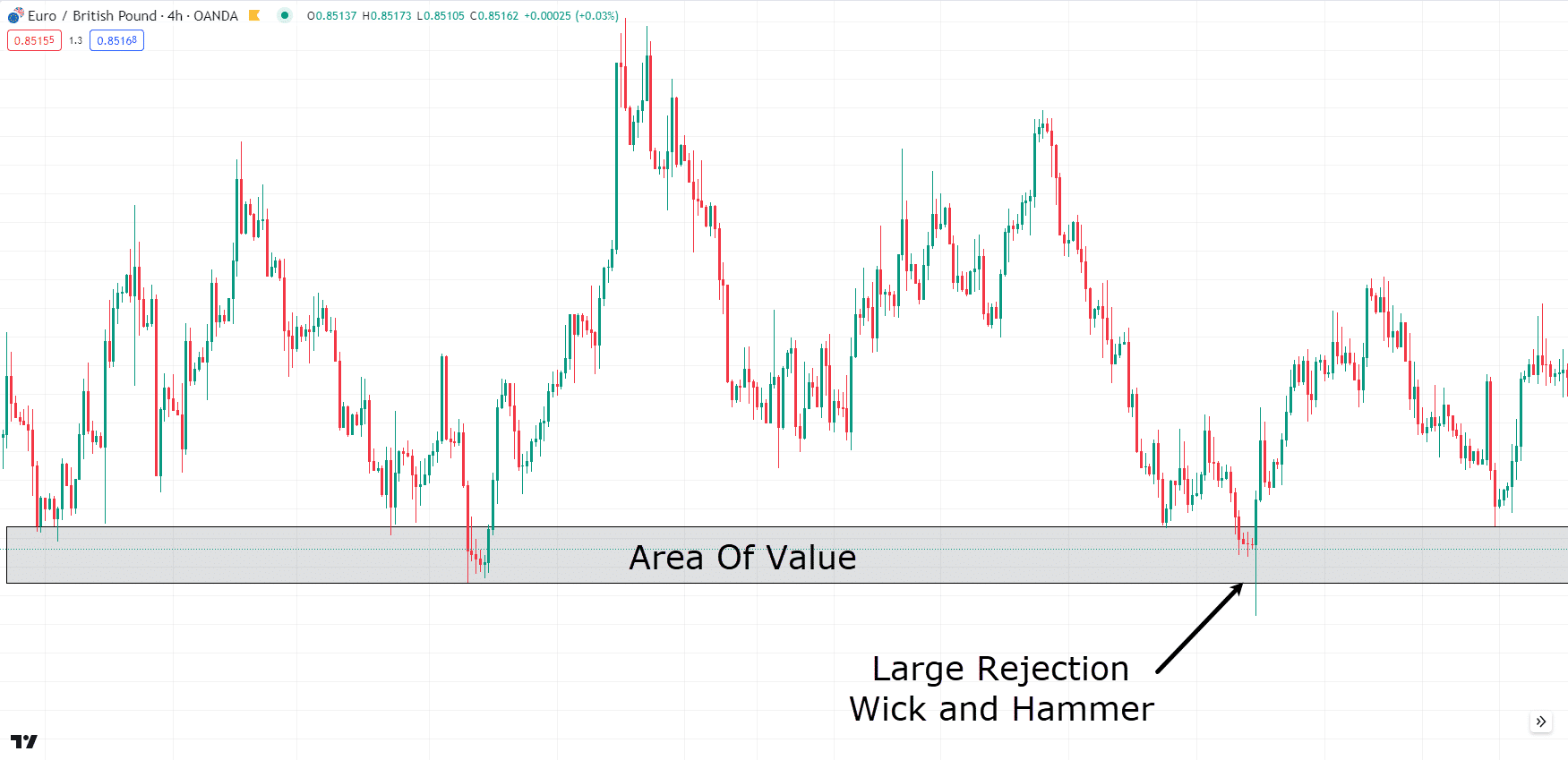

Key Areas of Value

Using candlestick patterns with key areas of value—such as support and resistance levels, trendlines, and moving averages—is vital to success.

Key areas of value are significant price levels where the market has historically shown strong reactions, either reversing direction or accelerating momentum…

EUR/GBP Hammer Candlestick At Area Of Value:

For example, identifying a bullish candlestick pattern like a hammer at a major support level can provide a stronger signal for a potential reversal.

Similarly, spotting a bearish engulfing pattern at a resistance level might indicate an upcoming downward move.

By focusing on these areas, you can improve the accuracy and reliability of your candlestick analysis.

Group of Candlesticks Together

Analyzing a group of candlesticks together, rather than in isolation, can provide a deeper insight into market sentiment and strengthen your technical analysis.

For instance, a series of bullish candlesticks forming higher highs and higher lows within an uptrend can confirm ongoing bullish momentum…

BTC/USD Strong Bullish Momentum:

When candlesticks act in a very similar way, or there are a series of candlesticks all showing the same sort of rejection or momentum, it can be a great early indicator that price might either react to a level or continue with its strong momentum.

Wick Rejection

Wick rejection is a common but significant phenomenon, especially in key areas of value.

Wick rejection occurs when the price moves to a certain level but then retreats, leaving a long wick and a shorter body on the candlestick.

It indicates that buying or selling pressure has come in at that level, causing a reversal.

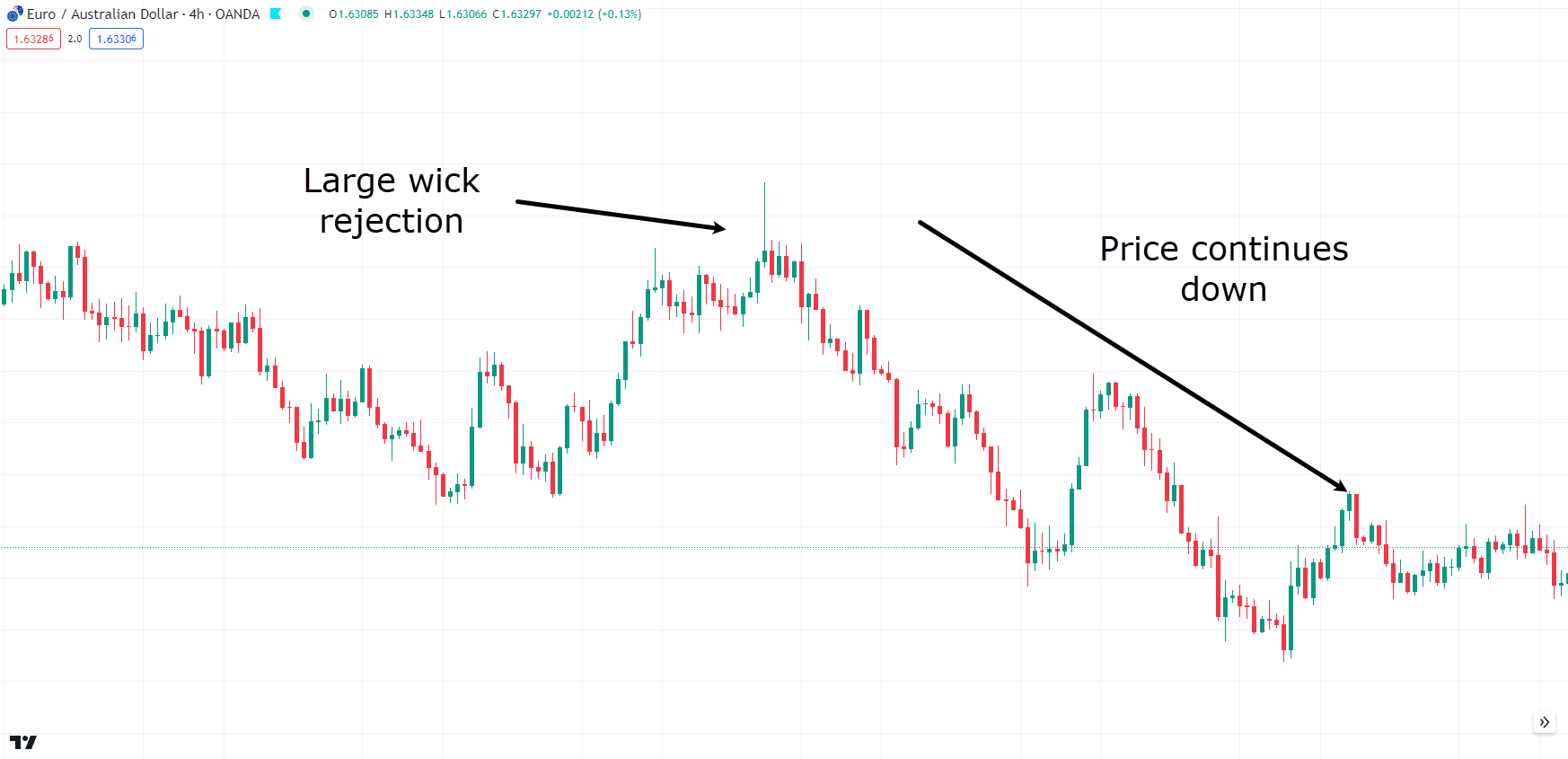

For example, a long upper wick on a candlestick that forms at a resistance level suggests that despite an attempt by buyers to push the price higher, sellers have taken control, driving the price back down…

EUR/AUD Wick Rejection:

This can be a signal to sell or avoid buying.

By paying close attention to wick rejections, especially in conjunction with other technical signals and key areas of value, you can gain insights into potential reversals and continuations in the market.

Remember, the longer the wick, the bigger the rejection!

Integrating Candlestick Analysis with Overall Strategy

This means not relying solely on candlestick patterns but using them as one piece of the puzzle in your trading strategy.

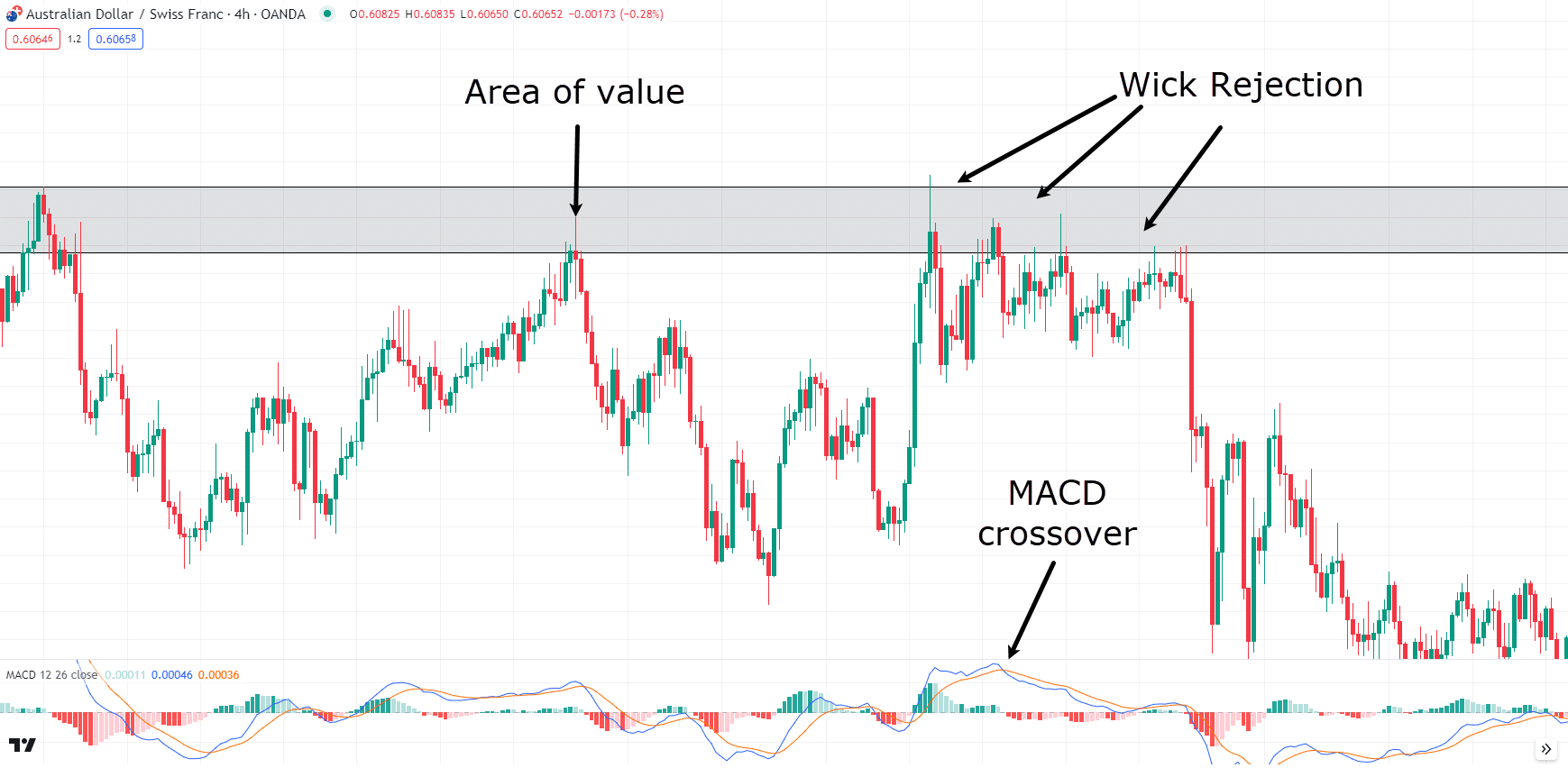

Combining candlestick insights with trend analysis, volume data, and other technical indicators forms a well-rounded view of market conditions.

Things like using candlestick analysis with other technical indicators such as RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), or Bollinger Bands can offer extra confirmation and reduce the risk of false signals…

AUD/CHF Example Multiple Technical Indicators:

This universal approach can help you make more informed trading decisions.

Importantly, you should also practice patience and discipline.

Wait for clear candlestick patterns to form at key areas of value, and use them in combination with other signals to confirm your analysis.

Avoid making hasty decisions based on single candlesticks or ambiguous patterns, as these can often lead to false signals.

What Are Some Common Mistakes and Limitations of Candlesticks?

While candlesticks are a valuable tool in technical analysis, they are not without their limitations.

Using Them in the Wrong Areas of the Chart

One of the most common mistakes I see is using candlestick patterns in the wrong areas of the chart.

Candlestick patterns are most effective when they appear at key areas of value, such as support and resistance levels, trendlines, or significant moving averages.

For example, there’s no point in trying to make sense of a hammer in the middle of a range and taking action based on it.

Price is often attracted to key areas of value, and although a candle might be bullish or bearish for that session, it does not always mean there will be follow-through!

Not Taking in the Overall Context of the Market

Another mistake is failing to consider the overall context of the market.

Candlesticks provide valuable information about price action within a specific timeframe, but they in no way offer a complete picture just on their own.

Ignoring the larger market context, such as the prevailing trend, market sentiment, and fundamental factors, can lead to misguided decisions.

It’s important to consider the higher timeframes when analyzing candlesticks and ask yourself whether this pattern on the lower timeframe really has much weight – all while considering the much larger context of the market!

(candlesticks on higher timeframes have much more weight and meaning than those on a lower timeframe.)

Remember to consider any news events occurring and use that to better understand why certain candlesticks may have more volume or momentum before considering whether or not it’s a worthwhile entry trigger!

Subjectivity

Interpreting candlestick patterns can be pretty subjective.

Different traders may see different patterns or even interpret the same pattern in their own ways, leading to inconsistency in analysis and decision-making.

It’s important to analyse the assets you trade and start to come up with your own meaning and understanding of the variety of candlestick patterns.

Ask yourself what rejection looks like, or how big an engulfing pattern has to be for you to consider it a worthwhile pattern.

It’s often an individual conclusion with no right or wrong answer.

Conclusion

In conclusion, candlesticks are a valuable tool for predicting market movements and can serve as a great indicator for trades.

When used in the correct context of the market and with other technical analysis tools, candlesticks can provide you with an edge in anticipating market outcomes.

To summarize, in this article, you’ve:

- Learned what a candlestick is

- Discussed the importance of candlesticks in technical analysis

- Explored how to analyze candlesticks and the stories they tell

- Reviewed common candlestick patterns and their meanings

- Identified tips and tricks for successful candlestick usage

- Highlighted common mistakes and limitations of using candlesticks

Congratulations on uncovering another essential tool for successful trading!

By using candlesticks to complement your other technical analysis, you are well on your way to becoming a more informed and effective trader.

Now – I’m eager to hear your thoughts on candlestick analysis…

Do you currently use candlestick patterns in your trading?

Can you see why they are a critical component of technical analysis?

How much success have you had with them?

Share your thoughts and experiences in the comments below!