How do some traders seem to recognize legitimate price movements versus fakeouts?

Can they really see into the future?

Is some kind of blood sacrifice required?

Don’t worry—no black magic necessary!

Experienced traders often use techniques like volume analysis to help make informed decisions.

It’s no secret, then, that learning about it can greatly boost your trading success!

At first, Volume may seem like a pointless addition to the chart…

However!

…if used correctly, it can help give you the extra confirmation you need to take trades with confidence.

I wrote this guide to explain exactly what volume analysis is as simply as possible.

With a bit of focus, I’m sure you’ll see how it can be extremely helpful for your trading!

In this article, you’ll dive into key aspects such as:

- What is Volume Analysis?

- How to add Volume to your Tradingview chart

- The difference between green and red bars

- Some differences for volume in Forex vs. Stocks

- How volume is typically used with some practical examples

- The limitations of volume analysis

Ready to enhance your trading strategy?

Let’s begin!

What is Volume Analysis?

So, what is Volume analysis?

Basically, volume analysis is a trading method that looks at the number of shares traded over a certain time.

The data you get from it can assist you in working out the strength of price movements.

By looking at how much of an asset is being traded, traders can learn about market sentiment.

Volume analysis helps confirm trends, identify potential reversals, and validate breakouts by revealing buying or selling pressure.

For instance, a price rise on high volume indicates strong buying interest, which suggests the trend is likely to continue.

On the other hand, a price increase on low volume… may not be as reliable!

Volume can be used on all assets; however, there are some differences, which I’ll highlight later on in this article.

Where to Find It

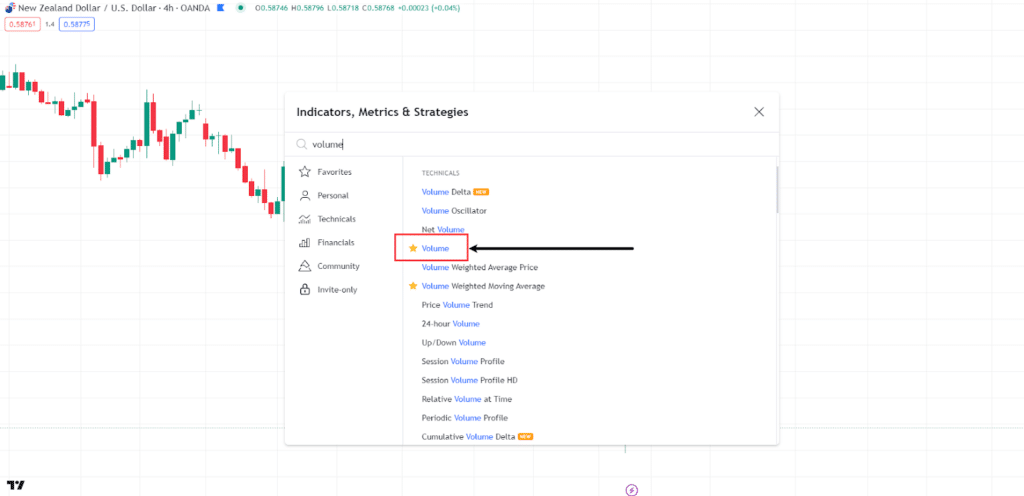

Let’s look at where you can find the most common Volume indicator on Trading View.

- Navigate to your Trading View screen and select any chart.

- At the top of the chart, you will see the Indicators tab…

Click on the Indicators tab and it will bring you to a window where you can search for different indicators.

3. Search for Volume Indicator…

In the search window, type “Volume” and select the Volume Indicator as shown in the example.

4. View the Volume data on your chart

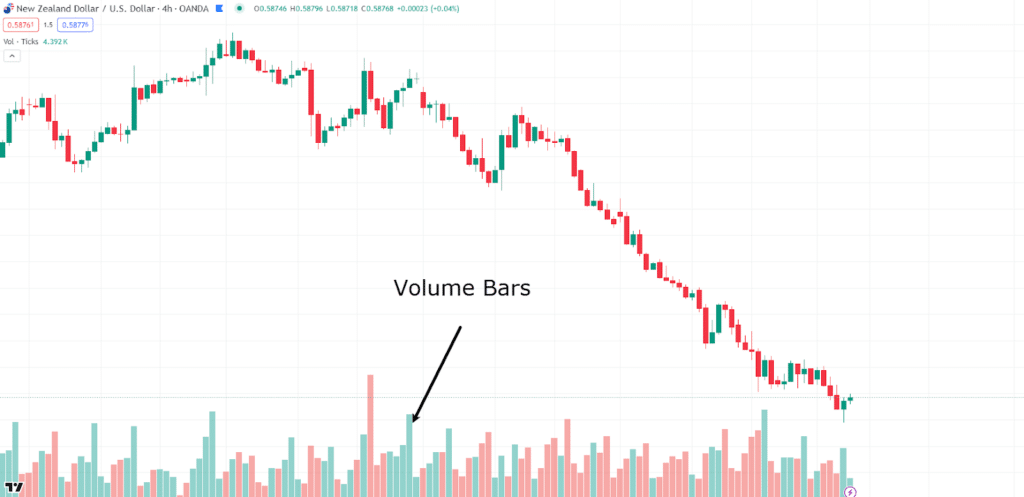

Once selected, the window will close, and your chart will display the Volume Indicator at the bottom, similar to the example below…

Volume data can be found on virtually all trading platforms and financial websites, the location just depends on what you’re using.

So, volume is displayed in long bars at the bottom of the chart – see the red and green bars?

The height of each bar represents the volume traded during that period.

For this example, it represents the volume traded for each 4-hour candle period on the NZD/USD 4-hour chart.

Now that you know where to find it, let’s look at what it’s trying to tell you!

What Volume Represents

Volume shows the number of shares or contracts traded during a certain time frame.

High volume means increased trading activity and interest in the asset, often with major price movements.

Low volume suggests a lack of interest and can signal weak price movements or consolidation periods.

The main goal of volume analysis is to show the strength or weakness of price movements and help you make better decisions.

It is often used as confirmation rather than the entry trigger itself.

Remember that many factors can affect volume, and I’ll explain more about this later in this article.

So, you might be asking, why are some of the bars red and some green?

Let’s take a look.

Green Bars vs. Red Bars

Often, traders mistake the red and green colors as indicators of the volume itself.

However, they simply show whether the price moved up or down during that period.

If the price increases from the previous candlestick, the volume bar will be green.

If the price decreases from the previous candlestick, it will be red.

These colors often have too much influence on traders’ decisions when, actually, it’s the height and difference in volume bars that are more important!

Before looking at the details on how to use volume for charting, there is one major piece of information you need to know.

It’s important to remember that there is a difference between volume for Forex vs. Stocks

And in fact, volume has always been considered much more valuable for stocks…

Here is why.

Difference in Volume for Forex vs. Stocks

Volume analysis differs between the forex and stock markets because of the way they are structured.

Stocks trade on centralized exchanges like the NYSE or NASDAQ, where volume data is transparent and easily accessible.

In contrast, the forex market is decentralized, with volume data being broker-dependent.

It means the volume data in forex markets might not be completely reliable when thinking about the market as a whole.

Despite this, volume analysis remains valuable in forex trading, as most large forex brokers report similar volume data, reflecting overall market sentiment.

One point, though, is that analyzing volume on lower timeframes in forex can present new challenges.

While it can give insights into intraday trading activity and help identify potential trading opportunities, it’s important to note the influence of trading sessions in overlapping time zones.

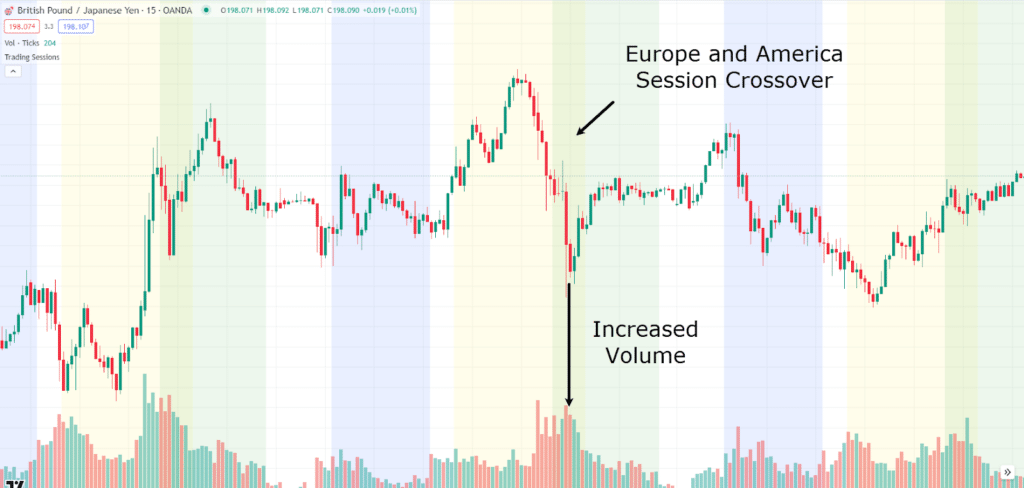

Take a look at this chart below…

GBP/JPY 15 Minute Chart Trading Sessions:

The blue zone indicates the Asia session, while yellow represents Europe, and green signifies America.

You can see where the Europe and America sessions overlap, resulting in increased volume, which isn’t necessarily valuable during analysis.

So with the basics in place, let’s put volume analysis into practice, helping you use it for trading confirmation and decisions!

How is Volume Typically Used?

You now know why volume is used and where to find it in Tradingview.

But how can you use it when looking at a chart?

Never Used in Isolation – Use with a Strategy as Confirmation

It is best to use volume analysis along with other technical indicators and chart patterns rather than by itself.

It should serve as a confirmation tool for your trading signals and strategies.

For instance, when a technical indicator suggests a potential trade, volume analysis can confirm the strength of that signal by showing the level of market participation.

A high volume combined with a signal could mean strong market interest, making a successful trade more likely.

The Average Volume Across an Area of Interest

A mistake I often see traders make is looking at the volume of each session individually rather than taking a holistic approach.

I prefer to look at the average volume over a specific period to understand the typical trading activity for a security.

A sudden spike in volume above the average can signal an upcoming significant move.

For example, if a stock’s average volume is fairly flat but then, for some reason, a few volume bars begin to show increased volume at an area of value, you might start paying closer attention and build up a case for entering the stock.

Trend Continuation Confirmation

Volume analysis can confirm trend continuation.

In an uptrend, increasing volume as the price rises indicates strong buying interest, suggesting the trend is likely to continue.

As you may see on price charts, too, when price is in an uptrend, it often has small, minor pullbacks.

If the moves upward have strong volume, while the small retracements have lower volume, it may mean that the pullbacks are weak and the uptrend is strong enough to continue.

Candlestick Volume Confirmation

So if you’ve followed me for some time, you know I love my candlestick patterns!

Well, volume can add an extra layer to them.

For example, a bullish engulfing pattern that occurs on high volume suggests a strong reversal signal, as it indicates significant buying interest.

Volume confirmation of candlestick patterns would add extra strength to your analysis, helping you make more accurate predictions about future price movements.

Breakout Confirmation

Breakouts are no exception when looking at volume, either.

Breakouts are critical points where the price moves above or below resistance or support levels.

High volume during a breakout can confirm the breakout is real, as it shows strong market participation and increases the likelihood of a sustained price movement.

However, if the price breaks out of a range on low volume, it suggests weak market interest and a higher risk of it becoming a false breakout.

By analyzing volume during breakouts, traders can work out which breakouts are genuine or false, which improves the effectiveness of their trading strategies.

Now that you know how to use Volume, let’s look at some real-life examples!

Trading Examples

Let’s take a look at some actual trading examples to give you a better understanding of how you can use volume to make better trading decisions.

Check out this chart…

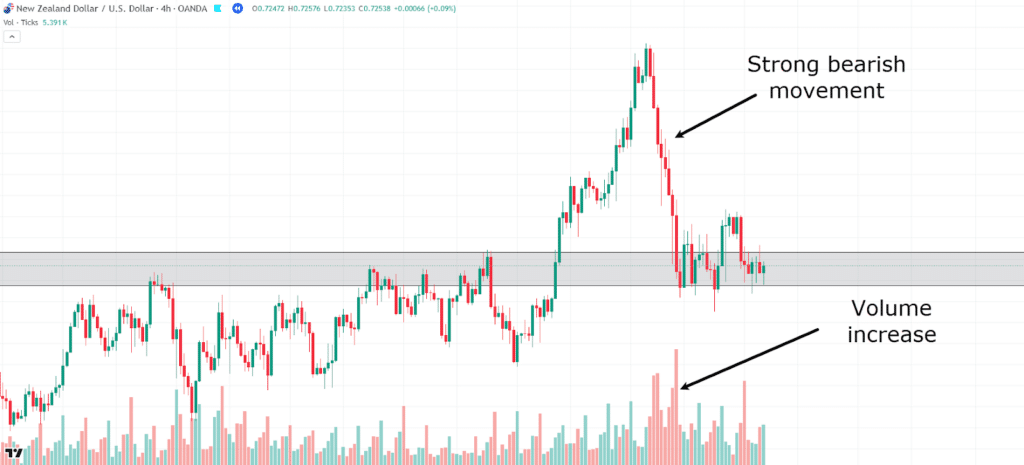

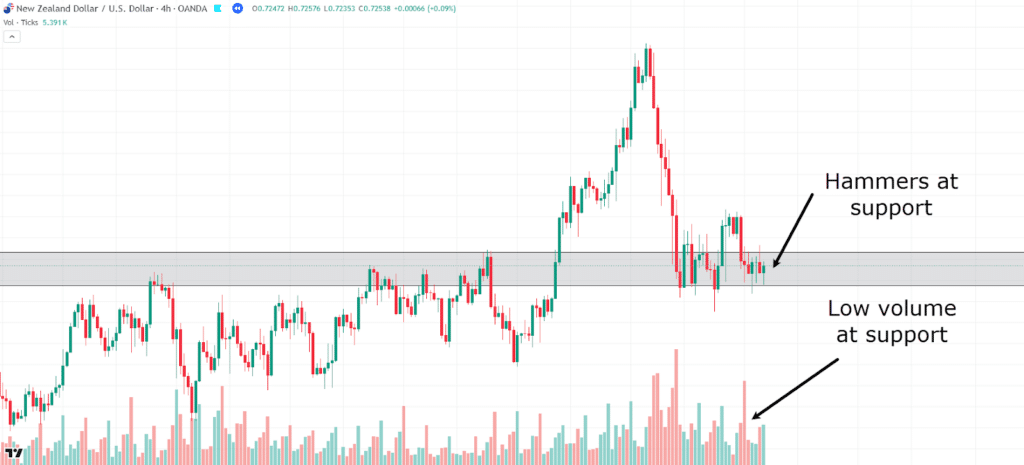

NZD/USD 4-Hour Chart:

Here, you can see an area of value where price previously acted as resistance and is now support.

Price broke through the resistance level, forming a much higher high, eventually peaking and reversing back down to the resistance level, which now looks to be acting as support.

Notice the volume increase on the move down…

NZD/USD 4-Hour Chart Low Volume:

You might be thinking, “Great! Price is at a support level, let’s take the buy!”

However, can you see something interesting occurring at the area of value?

Price is rejecting the zone, but it’s at low volume…

…and the only volume increase during this period was from the large bearish candle after the small bounce.

This might mean that there is not a lot of volume with the bulls trying to hold this support level…

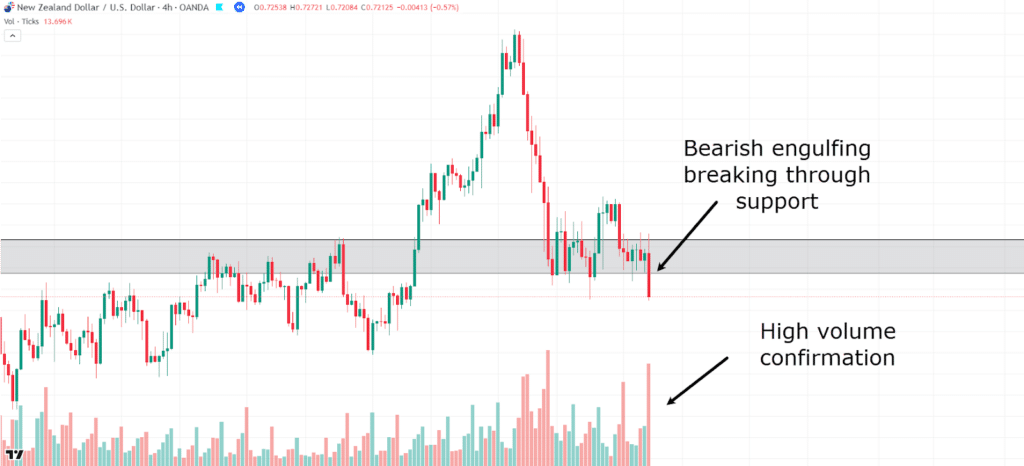

NZD/USD 4-Hour Chart Increase Volume:

The price eventually breaks the support level as expected, and look at what happened with the volume during the break!

Volume increased as support fell!

This shows how volume increases can reveal which moves have some real momentum behind them, compared to the rest of the candlesticks.

Let’s take a look at what happens next…

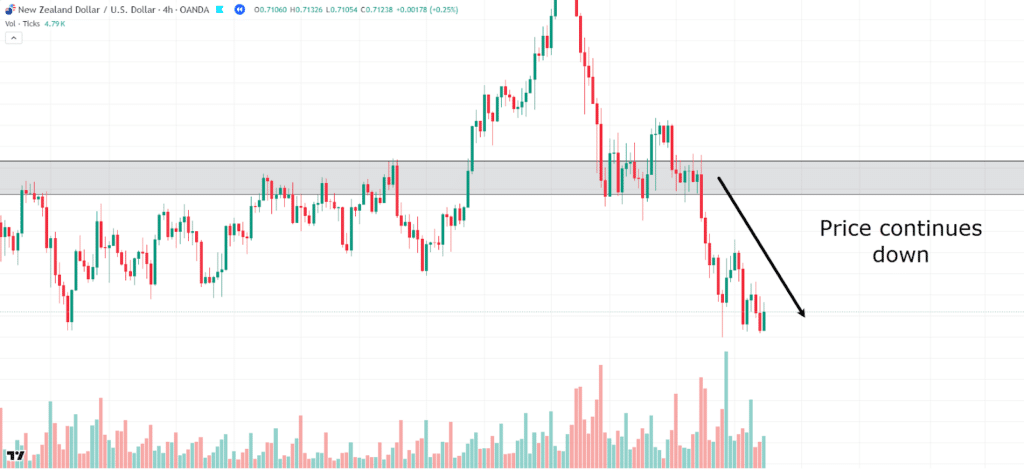

NZD/USD 4-Hour Chart Price Continuation:

Price continues its strong momentum to the downside, giving a decent opportunity to take a short trade.

Before going on, the important thing to note here is how to identify whether the support is likely to hold or not, as it could prevent you from taking a long trade at support.

Let’s look at another example – this time with a stock…

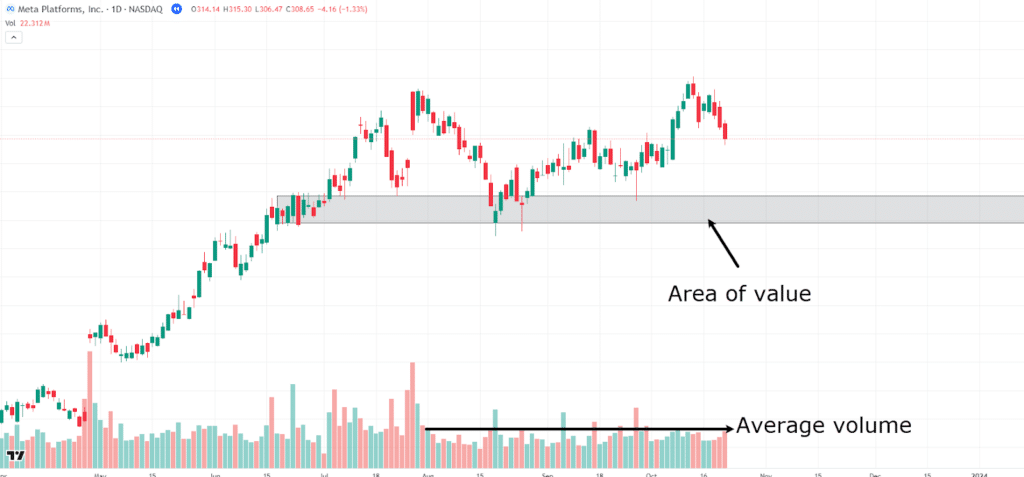

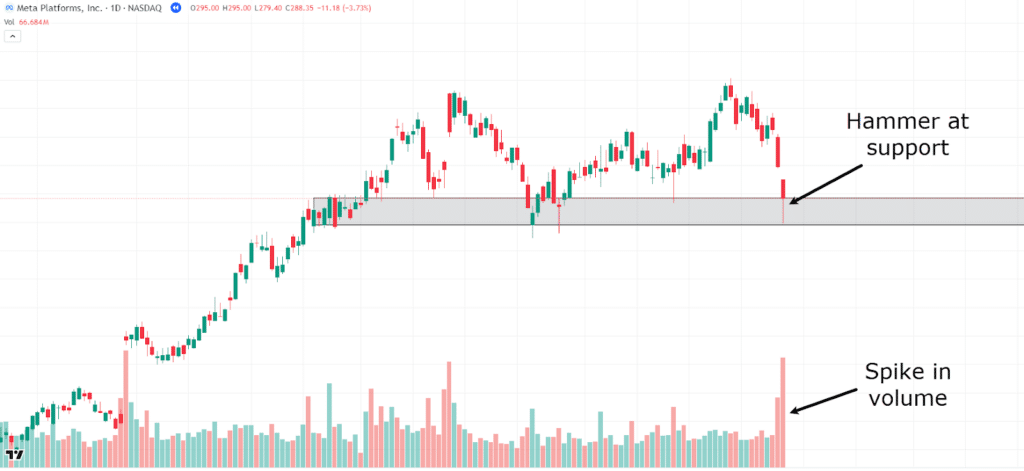

META Daily Chart:

Here you can see the stock Meta has been in an uptrend.

While the price has now formed a bit of consolidation, volume has also evened out and is remaining relatively low.

An area of value has formed with a support level…

META Daily Chart Support Level:

Price comes back to the support level again, and some key notes to identify are the candlestick pattern and the volume…

See how the hammer has formed at support, which is a bullish candlestick pattern?

Even though it’s a red volume bar and a red candlestick, as discussed earlier, the color of the volume is not so important.

What this setup is telling you, is that bears tried to bring the price under the support level but failed to do so, and this time on high volume.

This means there is enough volume on the buying side to hold this support level.

Can you see how this differs from the previous example, where support volume was weak?…

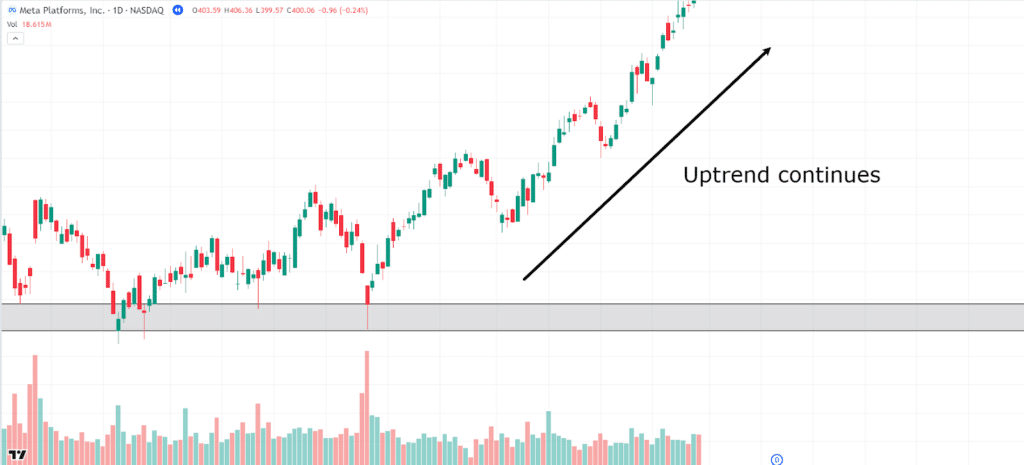

META Daily Chart Uptrend Continuation:

From that point on, the price moves back into its uptrend.

In this way, the volume and candlestick pattern gave you the information you needed to CONFIRM the buy entry, rather than making it the sole reason to buy.

The price came to an area of value, and there was a bullish candlestick on high volume.

If you already owned Meta stock, this could be a great way of knowing whether or not it was worth holding it or exiting your position.

Or, if you were looking to enter a new position, you would have a great consolidation period, with strong entry signals using the technical analysis of support and candlestick patterns, combined with the confirmation from volume.

So with all that said, let’s take a crucial look at how volume can sometimes be misleading…

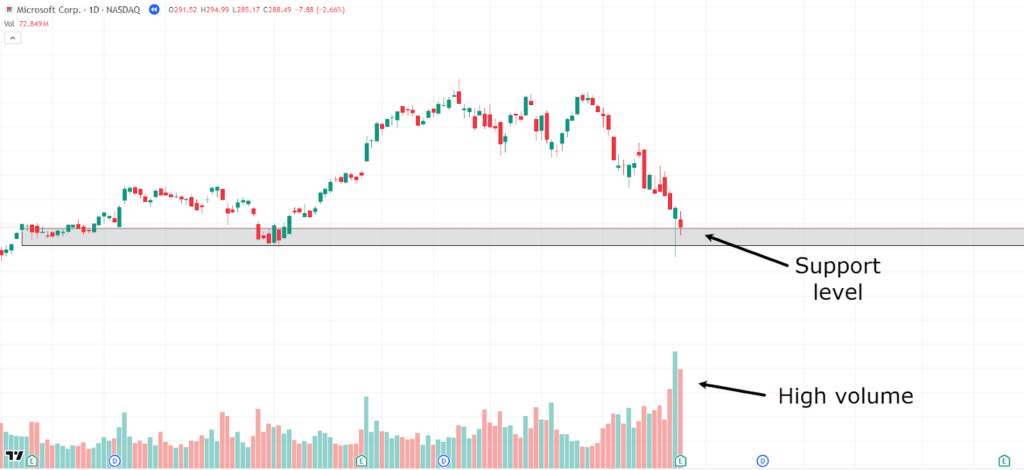

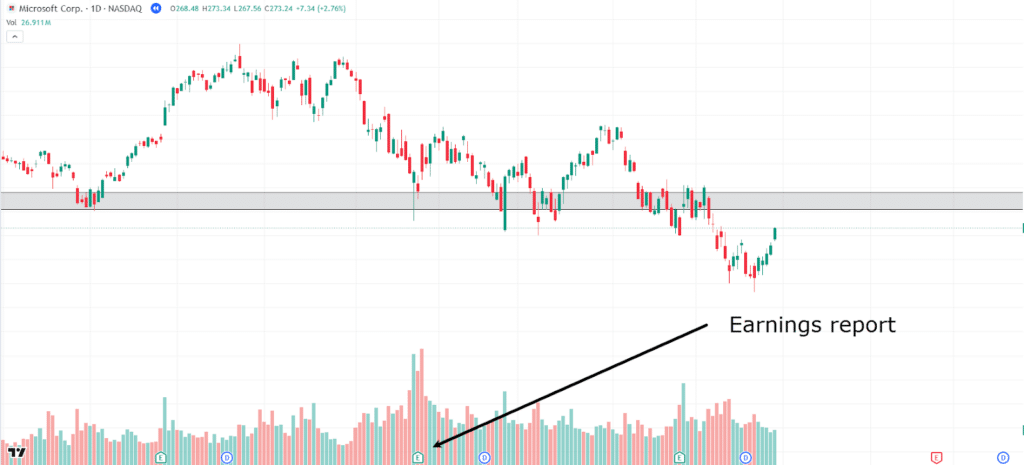

Microsoft Daily Chart:

Here is a similar example to the previous one, where the stock Microsoft has formed a support level after a decent uptrend.

The price has come back to the support level, and something interesting is occurring.

A hammer candlestick has formed at support, along with an increase in volume…

Similarly to the last time, there’s reason to believe this level will hold!

Let’s take a look at what happens…

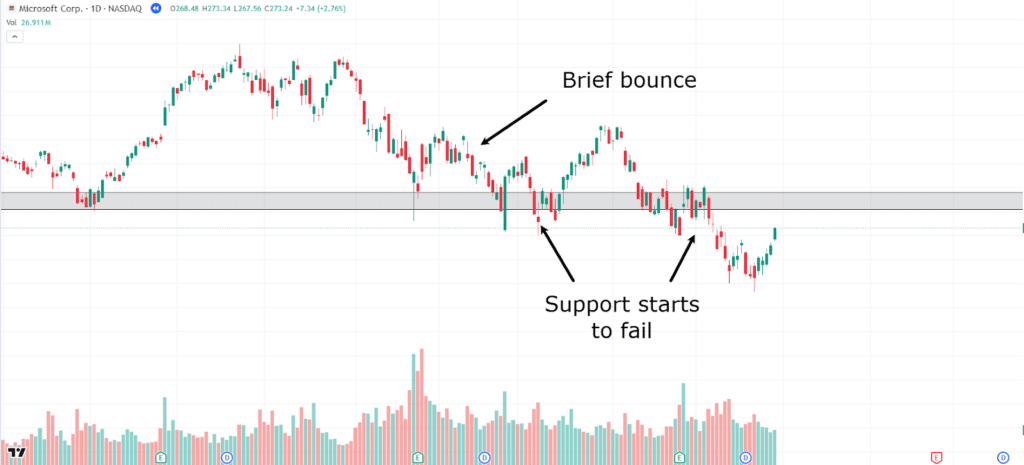

Microsoft Daily Chart Support Breaks:

Although the price initially bounced, which is still helpful information, it ultimately grinded its way below the level.

On the chart, I’ve highlighted the areas where support begins to fail.

So you might be asking:

“OK, why did this happen, Rayner?”

It’s a good question, and the honest answer is…

…sometimes volume doesn’t give the whole picture!

This support tried to hold, and you can see multiple bounces from it after the volume spike, but eventually, as the price came back to the support level time and time again, the buyers were exhausted.

Remember, the benefit of this analysis is that it still gives you plenty of time to exit your position.

Ultimately, the price did not continue in an uptrend, but it held the support long enough for you to reevaluate whether or not the level would hold the second, third, and even fourth time.

There is one other thing you might need to consider when looking at stocks.

Take a look at the following chart…

Microsoft Daily Chart Earnings Report:

Clearly, dividends and earnings are key factors in price movements for stocks…

…but they also influence volume!

Just by looking at the chart, it’s hard to say whether or not this earnings report was negative or positive, but it could have played a role in whether or not the price continued in an uptrend.

It’s a great example of volume analysis limitations, but let’s take a look at some more.

Limitations

Only Useful as Confirmation – Not a Signal in Itself

Volume data can certainly help confirm trends, breakouts, and other signals generated by other technical analysis.

However, relying solely on volume can be misleading, as it might not provide clear entry or exit points without the context of other indicators like moving averages, trend lines or support and resistance.

For example, a price move with high volume suggests strength, while the same move with low volume might be a false signal.

Can Become Confusing

Volume analysis can be confusing, especially in markets with high volatility or low liquidity.

Sudden spikes or drops in volume can be misinterpreted, leading to wrong conclusions about market direction.

Additionally, algorithmic and high-frequency trading (HFT) has changed traditional volume patterns, making it harder to understand volume data accurately.

HFT can cause large volume spikes that don’t necessarily reflect meaningful market sentiment, complicating the analysis further, so keep an eye out.

Lack of a Comprehensive Market View

When considering Forex trading, for example, volume data often represents only a portion of the total market activity.

This can make volume accuracy inconsistent and hard to rely on.

Additionally, news events can greatly affect volume.

High-impact news can cause volume spikes that are more of a knee-jerk reaction than a true market confirmation.

While volume is useful for confirming breakouts and trend continuations, it’s important to be cautious during news events, as these can disrupt normal volume patterns.

Conclusion

Clearly, volume analysis can be a valuable tool to better understand market dynamics and confirm your trading signals.

By including volume data with your trading strategy, you can gain crucial insights into the strength of price movements and market sentiment.

When used alongside other tools, volume analysis can give you an edge in predicting market trends and validating breakouts or reversals.

To summarize, in this article, you’ve:

- Learned what volume analysis is and where to find volume data

- Discussed what volume represents

- Explored the differences in volume for Forex vs. Stocks

- Understood the three major ways volume is used in markets

- Reviewed chart examples of volume confirmation for trend continuation and breakouts.

- Identified the limitations of volume analysis, including its dependency on context and potential for confusion.

By mastering volume analysis and integrating it with your other technical analysis tools, you are well on your way to becoming a more informed and effective trader.

Now, I’m very eager to hear your thoughts on volume analysis!

Do you currently use volume analysis in your trading?

Can you see why it is a critical component of technical analysis?

How much success have you had with it?

Share your thoughts and experiences in the comments below!