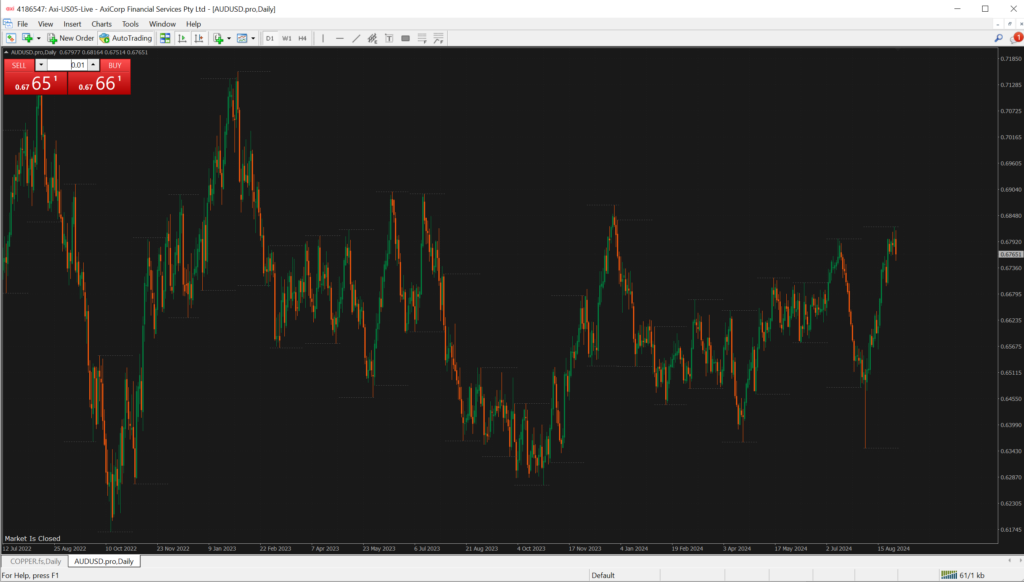

When you first opened your trading platform, it probably looked something like this…

You think to yourself:

“What the heck am I supposed to do with this??”

So, you conquer your first hurdle by learning technical analysis and learn how to navigate around your platform.

Now, you face your next hurdle…

How many units should you buy?

And then you start thinking:

“Ah, I usually buy 100 shares in the stock market so I’ll just buy 10 just to be safe”

The next thing you know?

Your account hits zero in an instant.

Why?

Because none that you know…

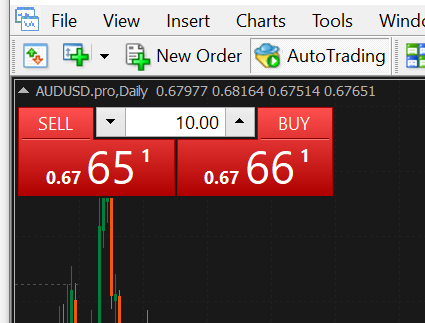

Buying 10 lots means that you’re entering with 1,000,000 units!

This may not have happened to you but I know a ton of traders who experienced a similar case.

And this is why the most important think to learn first in trading is to learn how to apply risk management in forex first.

Above anything else!

This is why in today’s guide you’ll learn how to apply risk management in forex.

Specifically, you’ll learn…

- A precise risk management method that allows you to be flexible with your risk on the forex market

- Accessible position sizing calculators that you can use anytime without registering or downloading anything

- A secret to knowing when and how you should change your risk management parameters

This guide will be quick and snappy.

But the goal is to ensure you immediately apply the learnings after you’re done.

Sounds good?

Then let’s get started…

How to apply risk management in forex: Percentage risk management method

Now, before I share with you some formulas here I want you to know a couple of things first.

In the world of forex we always use the term “lots” similar to what I shared with you.

And as a quick cheatsheet, here’s what they all mean:

- 100,000 Units = 1.00 Lot

- 10,000 Units = 0.10 Lot

- 1,000 Units = 0.01 Lot

- Below 1,000 Units = 0.001 Lot

So, yes…

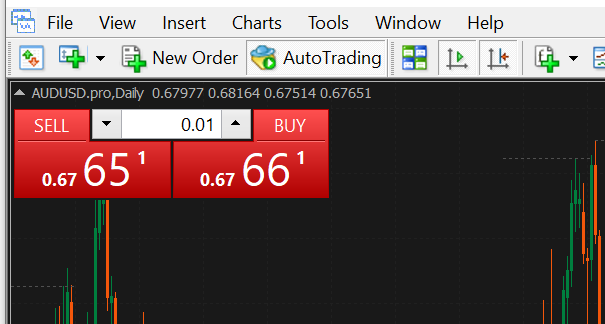

Please don’t put 1.00 on your trading platform!

But if you really want to keep it safe, place 0.01 for every trade you do, especially if you have a forex trading account below $500.

Now, as you grow your account…

You’ll start to have more flexibility over your risk management.

This is why you need to learn the percentage risk management method!

In principle, here’s how this risk management method works:

If your stop loss is hit, you position size in a way that you only lose 1% of your account balance

This position sizing method is usually best used:

- For trading the lower timeframes

- For placing precise stop loss while maintaining risk

- For any form of trading or investing that has to deal with leverage

So, for example…

You have an $8,000 account.

1% of that capital is $80.

This means that if my stop loss is hit, I want to make sure that I don’t lose more than $30 on my overall portfolio.

Again, this so-called “1%” is different from the allocation, though we’ve touched on it a little before ending the previous section.

But you might ask:

“What makes this position sizing method good?”

Well, the beauty of this position sizing method is that you can be flexible on where you place your stop loss.

You can place a tight stop loss, and still make sure that you only lose 1% when your stop loss is hit:

You can have a wide stop loss, and still make sure that you only lose 1% when your stop loss is hit:

See what I mean?

This gives you flexibility on where you want to place your stop loss as your potential loss will remain static!

So, back to the question:

How do you apply risk management in forex?

Well, using this formula…

Units to buy = Risk amount / (stop loss in pips – value per pip)

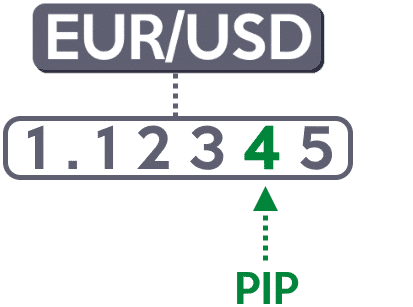

You see, we have the term “pip” in forex, which is pretty much just the 4th decimal place of a cross-currency pair!

However, we also have the term “pip value.”

Now, what is it?

Simply put, a pip value is how much you make or lose money if the price moves 1 pip if you buy 1 standard lot of units.

It’s similar to fueling your car:

Asking “How much is the fuel per 1 liter?”

Is also similar to asking “How much is the pip value per 1 standard lot?”

The question now is:

“How do we identify the value per pip?”

Unfortunately, it’s a calculation of its own…

Value per pip = (1 pip / current price) x 1 standard lot

So, if the current price of EURAUD is 1.62932 for example, the calculation would look something like this:

Value per pip = (0.0001 / 1.62932) x 100,000 units

Once you finish the calculation, the numbers will end up as $6.14

This means that if you buy 100,000 units of EURUSD, you would gain $6.14 if the price moves 1 pip in your favor.

But then again!

The pip value is just a part of our overall equation, so bear with me here, my friend!

Going back to our calculation:

Units to buy = Risk amount / (stop loss in pips – value per pip)

We now know what our value per pip is, which is $6.14

And with your $3,000 capital…

You want to risk 1% of that account on your trade on EURUSD which is $30.

Finally, for this example, you decided to place your stop loss 50 pips below the area of support:

Given all the details we have collected the formula now should look something like this:

Units to buy = $30 risk per trade / (50 pips – $6.14 pip value)

After the calculations, the lots you’d need to buy to enter the trade is 0.68 lots or 6,800 units.

This means that if you enter EURAUD with 0.68 lots, you won’t lose more than $30 when your stop loss is hit.

Makes sense?

Now, remember!

I’m sharing these formulas so that if everything goes wrong, you’ll still be independent enough to execute trades and apply risk management.

So, you are always free to refer back to this guide.

Now that you know the ins and outs of how to apply risk management in forex…

How can we automate this?

Surely you don’t want to crunch all those numbers in the forex market right?

So, let me share some tools with you in the next section…

How to apply risk management in forex: What tools should you use?

Here are some basic criteria I will lay down on what kind of risk management tools we’ll use:

- The risk management tool must be free (no registration required)

- The risk management tool must be easy to use and understand

- The risk management tool must require no installation or download

That just sounds pretty awesome, right?

That’s why I meant it when I said that you can apply everything you learned immediately as soon as you finish this trading guide.

So, what are the tools that meet these criteria?

The best position sizing tool for forex

Obviously, for forex, we won’t need the portfolio allocation method.

As you’d need leverage to start trading forex!

So, which platform to use to apply risk management in Forex?

Well, this one you should already be familiar with…

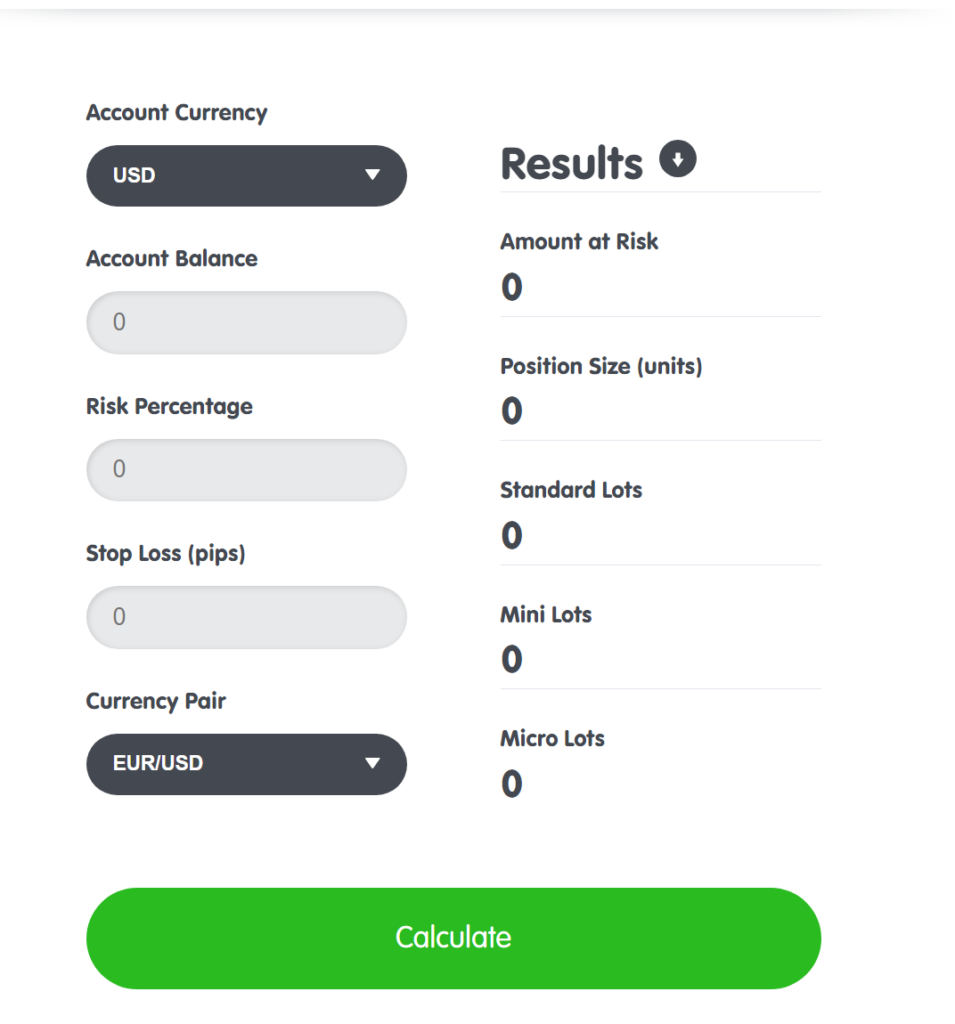

Babypips’ Position Size Calculator

Even before you use it you can already tell that this is as simple as it gets!

Because if you recall the formula I shared with you, this calculator already does it all for you.

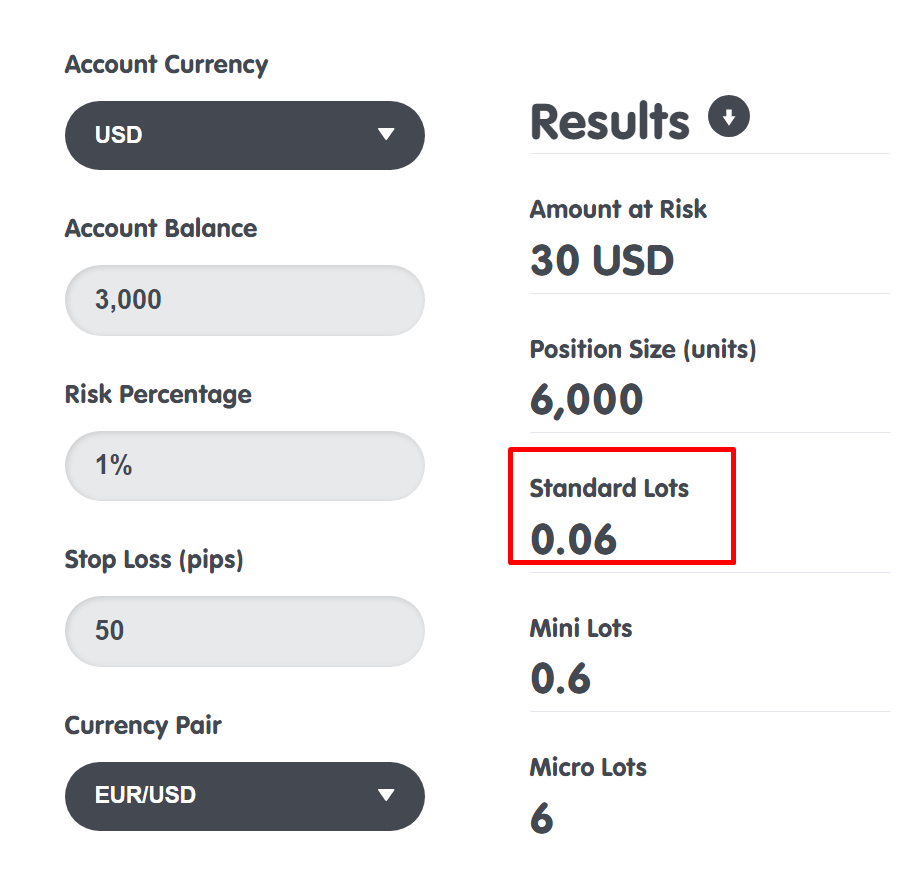

So, let’s say that you, again, have a $3,000 account and that you only want to risk 1% per trade.

And finally, you have a 50 pip stop loss.

Looking at the calculation, you would need to enter trades with 0.06 lots or 6,000 units!

Of course, there is a downside to this calculator.

Which is that it assumes that you are entering the trade right now as a market order.

But, what if you want more flexibility?

What if you want to place orders in advance and apply proper risk management?

In this case, you’d need a pip value calculator…

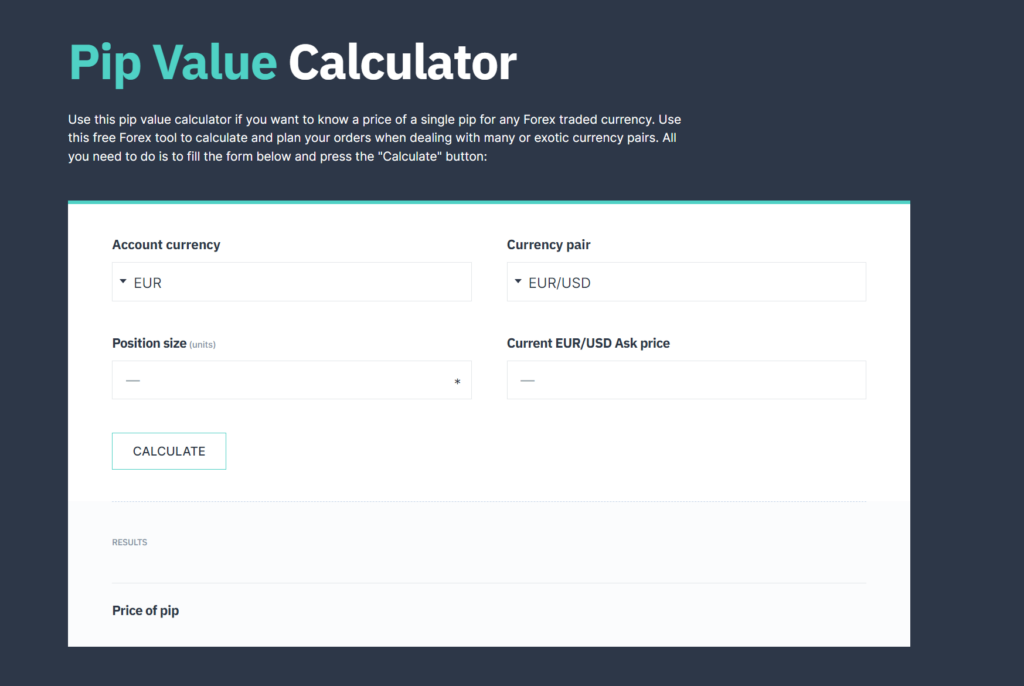

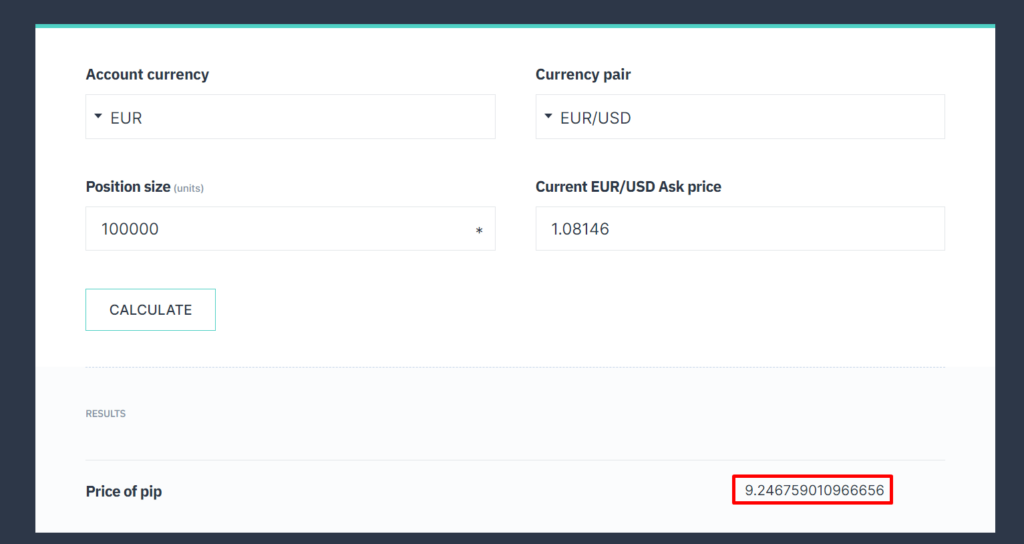

EarnForex’s Pip Value Calculator

Remember the lengthy calculation I shared with you?

Units to buy = Risk amount / (stop loss in pips – value per pip)

Value per pip = (1 pip / current price) x 1 standard lot

Quite a lot, right?

But in this case, we don’t need the value per pip calculation as we already have a platform doing it for us!

So, same thing!

Let’s say you have a $3,000 account and you’re risking 1% which is $30 and your stop loss is around 50 pips.

And that you are placing a limit order on EURUSD at the price of 1.08146.

Looking at the calculator, our pip value is $9.25 per one standard lot (yes, in this case always put 100k)

If we plug in the numbers…

Units to buy = $30 risk / (50 pips – $9.25 pip value)

Units to buy = $30 risk / 40.75

Units to buy = 0.74 units

And yes, you can create your spreadsheet to automate the rest of the formulas.

But that’s pretty much it!

P.S. The number of units to buy in this example is a different number from the previous example because I placed a different ask price

Now…

I’m sure there are a lot more calculators out there that fully automate things.

There are trading platforms that already have an integrated risk management calculator in them.

There are even indicators to install on your MetaTrader 4 to apply risk management!

But in this case…

I did my best to share with you the most accessible calculators out there as I don’t want to spend half of this guide teaching you how to register with certain brokers are install indicators on our platform.

With that all said and done, we’re not done yet.

Because in the next section, I want to do something very special for you.

More of a “bonus” on what you’ll learn in this guide.

Because if you noticed…

I always ask you to risk 1% of your account per trade or allocate 10% of your account per trade.

But when can you change those numbers?

When should you risk 0.5% per trade?

How about allocation, what do you allocate 20% of your capital per trade on a single stock?

How do you go about it?

Let me tell you in the next section…

How to apply risk management in stocks and forex: The secret to changing the parameters

The bottom line is this…

How you modify your risk depends on the market condition and what time of trading style you have.

This is why in this final section I’ll share with you how to apply risk management for intraday trading in forex.

But basically, the lower the timeframe you go, the more precise you need to be.

Especially on your risk management.

This is why for lower timeframe trading you’d want to adopt the percentage-based risk management for Forex.

Remember the formula I shared with you?

Units to buy = Risk amount / (stop loss in pips – value per pip)

Yes, I know that I shared with you tools on how to automate them as much as you can.

But I pulled them out just to refresh your memory!

In the earlier examples, I shared with you that you should risk 1% risk per trade if your stop loss is hit, right?

But this time…

If you’re trading below the 1-hour timeframe it’s highly recommended that you only risk 0.5% risk per trade (regardless of whether it’s a bull or bear market).

Why is that?

The reason is frequency.

The higher the frequency of your trades, the faster the feedback you’ll get on your results

And faster the feedback means that the bigger the risk your emotions will be involved (i.e. greed and fear).

So, to reduce your attachment to single wins and losses, you’d want to risk 0.5% risk per trade so that your mind is more focused on the numbers than the returns.

Got it?

And that’s everything for today!

The world of risk management is exciting, and what I’ve shared with you today is just the tip of the iceberg.

However, I made sure to share with you enough to get you started trading in the forex market as soon as possible.

So with that said, let’s do a quick summary of what you’ve learned today…

Conclusion

Here’s the truth:

Knowing how to apply risk management in forex must come first and not last.

This ensures that you don’t blow your hard-earned money no matter how many times you mess up!

Worse case?

Your portfolio bleeds.

Giving you enough time to stop the bleeding and learn from mistakes (instead of nuking your portfolio with one trading mistake)

So, here’s a quick recap of what you’ve learned today…

- Having a risk-based percentage position sizing is a bit more complicated to apply, but this gives you both the flexibility of placing your stop loss anywhere while also maintaining risk.

- There are free and accessible position sizing calculators ready for you to access, such as calculators from BabyPips, and EarnForex.

- If you plan to trade the lower timeframes, risk 0.5% per trade or even lower such as 0.25%

And that’s pretty much it!

A complete guide from beginner to advanced on how you can surgically control the risk parameters of your portfolio!

But this time I want to hear what you think.

What are some other risk management methods you know of?

And if you trade crypto, how do you apply risk management there?

Let me know in the comments below!