Being financially independent means having enough passive income to cover your essential or desired living expenses. A common guideline is to aim for a net worth equal to 25 times your annual expenses, often used as a baseline for achieving financial independence. However, this approach is overly simplistic because it depends on the composition and liquidity of one’s net worth.

If your net worth consists entirely of liquid, income-producing assets, 25 times your expenses should suffice. But if much of it is tied up in a primary residence or illiquid private investments, you may not be able to generate enough passive income or readily sell assets for true financial independence. Liquidity and cash flow are paramount for retirement.

For those retiring at the traditional age of 65, a net worth of 25X your annual expenses, supplemented by Social Security, is usually sufficient for a comfortable retirement. However, the 25X rule becomes more precarious for those seeking early retirement. The multiple should be a target for your liquid, income-producing assets, not your net worth. And your liquid portion of your net worth needs to generate income.

Longer time horizons, inflation, and lifestyle changes—like growing families—can quickly erode a seemingly adequate net worth.

Couldn’t Stay Fully Retired For Long On 25X Expenses

When I revisited my finances after a 2013 financial consultation, I was reminded of the limitations of the 25X rule for achieving FIRE (Financial Independence, Retire Early).

Although I retired in 2012 at age 34 with a net worth of roughly 38 times my annual expenses, I couldn’t sustain full retirement beyond 18 months. The challenge lay in the composition of my net worth—much of it tied up in my primary residence—and the rising costs of maintaining a growing household. These factors made early retirement far more complex than I had initially anticipated.

My original plan was to embrace a simpler life with my wife on my grandparents’ farm in Waianae, Oahu. The vision was idyllic: we’d source most of our food from the land and live comfortably on $80,000 a year. However, detaching ourselves from San Francisco, a city we’ve called home since 2001, proved difficult. Life pulled us in a different direction.

Our journey took an even bigger turn with the births of our children in 2017 and 2019, further anchoring us to San Francisco. The vision of a quiet life on the farm shifted to balancing the demands of raising a family in one of the most expensive cities in the world. Early retirement, it turned out, required more than a high net worth—it demanded greater cash flow and a willingness to adapt to life’s unexpected turns.

Why A Net Worth Equal To 25X Annual Expenses Is Not Enough To Retire Early

Today, our net worth is even greater than the 38X expenses we had in 2012. Yet, I don’t feel financially independent because our passive income doesn’t fully cover our current living expenses. I subscribe to the legacy retirement philosophy of leaving some wealth to my children and charities versus dying with nothing.

We had exchanged a large amount of productive investments generating passive income for a home that, although paid off, requires ongoing expenses such as property taxes, maintenance, and utilities—costs that stocks and bonds don’t have.

My goal now is to recoup the productive investments we allocated to our home over the next three years.

Rollover IRA as a Case Study on Net Worth Composition

Let’s take my rollover IRA as a simple example of why 25X annual expenses falls short as a retirement net worth target. 25X is the inverse of 4%, the safe withdrawal rate popularized in the 1990s by Bill Bengen, creator of the 4% Rule.

Imagine my IRA were my only asset, with a balance of $1,300,000. This means that my entire net worth consists of my rollover IRA, a 100% productive, income-producing asset.

Coincidentally, according to a Northwestern Mutual survey from late 2023, this amount aligns with what Americans believe they need to retire comfortably. Let’s assume I live off $40,000 a year in expenses. If we multiply $40,000 by 25, that equals $1,000,000, suggesting I could be financially independent.

However, due to the type of investments in my portfolio, it doesn’t come close to providing enough dividend income to live on.

Low Passive Income Due to a Growth-Focused Portfolio

Ninety percent of my Equities – $826,191- is allocated to growth stocks. Microsoft offers the highest dividend yield in this category at about 0.78%, followed by Apple at 0.48%. This brings my average dividend yield across all my growth stock holdings to around 0.2%, resulting in just $1,653 in dividends annually.

The bulk of my ETF holdings – $476,000 – is in VTI, the Vanguard Total Stock Market Index, which has a dividend yield of roughly 1.33%. Consequently, my blended yield for the entire portfolio is around 0.6%, translating to about $7,800 in annual passive income.

With post-tax annual expenses at $40,000, I’d need a portfolio approximately 6.4 times larger—$8,320,000—to generate $50,000 in gross passive income to cover expenses after taxes.

It may seem excessive to need an $8,320,000 portfolio to achieve financial independence with annual expenses of $40,000. And it is. However, few people hold their entire net worth in liquid, income-generating assets. For many, their equity is not as readily accessible as it might appear.

Adjusting Your Net Worth Composition Isn’t Always Easy

Astute readers may suggest that the straightforward way to achieve financial independence on a $1,300,000 net worth is to adjust the investment composition: sell enough growth stocks and purchase enough dividend stocks or ETFs to generate $50,000 a year, which would require a 3.8% dividend yield.

To do this, I would have to rebalance the majority of my portfolio. If my retirement portfolio was in a taxable brokerage account, I would incur significant capital gains tax.

Thus, a rational investor is unlikely to sell stocks they are positive on unless absolutely necessary. Instead, they would continue working or find supplemental retirement income to support their lifestyle. Any surplus cash flow could be directed toward dividend-paying stocks or ETFs over time.

The Benefit Of A Roth IRA For Early Retirees

Fortunately for Roth IRA holders, investments can be traded within these accounts without triggering capital gains taxes. This allows for adjustments without an immediate tax bill, offering more flexibility for portfolio restructuring. Hence, for those who can build a large enough Roth IRA for retirement, the flexibility in repositioning your portfolio without tax consequences can be a great benefit.

For those who wish to retire before 59.5, you can always withdraw your original contributions tax- and penalty-free, regardless of your age or how long the account has been open. Since contributions are made with after-tax dollars, they’re not subject to penalties or taxes. After 59.5, you can then withdraw earnings tax- and penalty-free, provided your Roth IRA has been open for at least five years.

For those planning to retire early, the process requires meticulous planning. After years of following a particular investment strategy, you’ll need to adjust the composition of your portfolio to align with your new financial needs. On top of that, you’ll face the challenge of transitioning from accumulation to withdrawal, starting with tapping into your contributions. This shift is easier said than done and requires a clear strategy to avoid unnecessary taxes, penalties, or liquidity issues.

Housing Is A High Percentage Of Net Worth

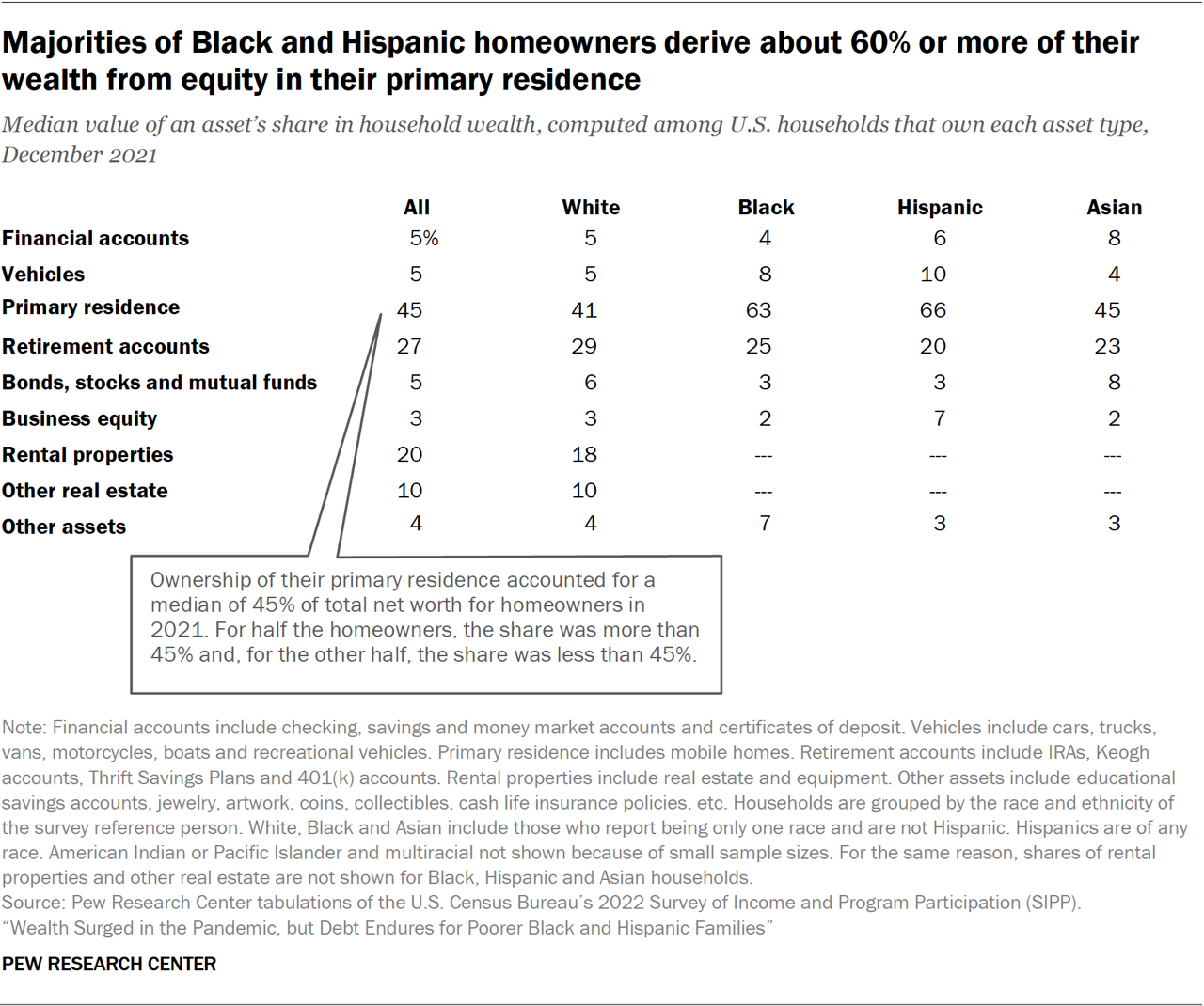

Another reason why a net worth of 25X annual expenses may not be sufficient to retire early is the high percentage of net worth tied up in housing. According to Pew Research, in 2021, the median net worth of U.S. households stood at $166,900, including all assets, with home equity accounting for a median of 45% of this net worth. The percentage is likely similar today.

However, when examining Pew’s article, they state, “In 2021, homeowners typically had $174,000 in equity in their homes,” alongside the national median net worth figure of $166,900. This discrepancy suggests home equity may represent an even larger share of net worth for many households. Many American homeowners got crushed during the global financial crisis due to real estate concentration risk.

Assuming 45% of one’s net worth is in their primary residence is accurate, that still leaves the typical household with only 55% of their net worth in other assets, such as vehicles, financial accounts, retirement funds, business equity, rental properties, and other real estate.

Taxable Brokerage Accounts: A Small Slice of Net Worth

Within this remaining 55%, Financial accounts—which I interpret as taxable brokerage accounts—make up a modest 5% for all races surveyed. These are the assets that can be tapped before 59.5 without penalty. Clearly, these accounts alone aren’t enough to sustain early retirement for most.

Interestingly, Pew’s data reveals that for White households, rental properties and other real estate represent 30% of total net worth, indicating that many White Americans generate rental income as landlords.

Perhaps Pew’s survey sample didn’t capture sufficient data from Black, Hispanic, and Asian households to reflect their ownership of rental properties and other real estate. Yet, real estate is a favored asset class for many Asians, including myself.

But is a combined 5% in financial accounts plus 30% in rental properties and other real estate sufficient to generate livable passive income for early retirement? Realistically, it’s highly unlikely.

So let’s be generous. Let’s assume the entire 55% of net worth is 100% allocated to productive income-generating assets like stocks and real estate. Further, there is no penalty to sell any of these assets. What would the more realistic net worth target based on annual expenses be?

45.5X Annual Expenses May Be A More Reasonable Net Worth Target For The Typical Household

Applying some basic math, with only 55% of the typical American household’s net worth outside of their primary residence, the typical household would need a net worth equal to 45.5X annual expenses to achieve early retirement.

I can already hear the complaints from readers saying that a 45.5X annual expenses target is both unrealistic and demoralizing. But if the data about the typical net worth composition of Americans is accurate, then this target is grounded in simple math.

To understand why, imagine if 100% of your net worth were tied up in your primary residence. Every room is occupied, and you can’t rent out any part of the house for income. How would you fund your retirement with such a net worth composition? Even if your home were worth 100X your annual expenses, it wouldn’t help you cover your living costs unless you took out a Home Equity Line of Credit (HELOC), did a cash-out refinance, or conducted a reverse mortgage.

In early retirement, you need to rely on passive income or liquidating assets to cover your expenses. In traditional retirement, Social Security benefits and pensions provide additional support, reducing the reliance on these strategies.

Letting Go of a Strict Definition of Financial Independence

A final approach to the 25X annual expenses debate on whether it is enough is to let go of a rigid definition of FIRE: your investments generate enough income to cover your living expenses. Instead, build a net worth of at least 25X your annual expenses and simply withdraw at a 4% (or potentially higher) rate, regardless of what anybody thinks.

Bill Bengen’s 4% rule, established in his 1994 study, assumes retirement at age 65. Bengen found that retirees beginning at this age could safely withdraw 4% of their retirement portfolio in the first year, then adjust annually for inflation, expecting the portfolio to last for at least 30 years—until age 95—without running out.

If you plan to retire at 65, you could confidently withdraw at a 4% rate or even a 5% rate, as Bill now suggests. Lowering the traditional retirement age to 55 for society might even be possible if workers only need to accumulate 20X their annual expenses (inverse of 5%).

However, if you want your wealth to endure for generations after you retire early, consider lowering your safe withdrawal rate to ensure the sustainability of your financial legacy. You can also generate supplemental retirement income.

Formula to Calculate Your True Annual Expense Multiple Needed to Retire Early

To determine the true multiple of your annual expenses needed to retire early, you’ll need to assess two key factors:

- The minimum annual expense multiple you believe is necessary for early retirement. 25X can be a baseline.

- The percentage of your net worth held in income-producing, liquid investments.

Here’s how it works:

Let’s assume you believe that a net worth of 25X your annual expenses, the inverse of 4%, is sufficient for early retirement. However, only 70% of your net worth is in income-producing, liquid investments. To adjust for this, you can use the following formula:

True Annual Expense Multiple = Baseline Annual Expense Multiple ÷ Percentage of Net Worth in Income-Producing, Liquid Investments

For this example:

True Annual Expense Multiple = 25 ÷ 0.7 = 35.7

If 70% of your net worth is in income-producing, liquid assets, you would need a net worth of 35.7 times your annual expenses to achieve the same financial security as someone with 100% of their net worth in such assets.

This is because the 30% of non-liquid, non-income-producing assets won’t contribute directly to generating income for expenses, so you need a higher overall net worth to compensate. Of course, as you change your net worth composition, you can re-calculate your true annual expense multiple for early retirement.

Focus on Building Net Worth First, Then Cash Flow

If you want to retire earlier, logically, you must find a way to achieve a net worth target equal to your true annual expense multiple sooner. This usually requires working longer, saving more, and taking on more risk. It may also mean forsaking homeownership to boost your liquid percentage.

Further, the government taxes income more heavily than investment gains, making it more advantageous to prioritize growing your net worth over generating cash flow in the early stages of your financial journey. While there’s ongoing debate about a potential wealth tax, it’s unlikely to become a reality anytime soon.

Only when you’re ready to stop working entirely, or your active income sources significantly dwindle, should generating passive income take center stage.

In our unusual case, my wife and I don’t have traditional jobs, yet we remain aggressive investors. Financial Samurai, our “X Factor,” provides supplemental income that we didn’t fully anticipate when we left our corporate roles in 2012 and 2015. This additional income has allowed us to take on more investment risk, such as focusing on growth stocks and allocating capital to venture funds for private market exposure.

As we’ve increased our investments in illiquid assets, the trade-off has been slower passive income growth. One day, Financial Samurai will come to an end, and when that time arrives, we’ll pivot to prioritize liquidity and income-generating investments.

Don’t Take The 25X Multiple For Financial Independence At Face Value

Just as focusing solely on revenue instead of profit can mislead in evaluating a business, so can assuming that 25X annual expenses is all one needs for financial independence. Many people have net worth tied up in homes, growth stocks, private companies, commodities, or collectibles that don’t generate income.

Based on my early retirement experience and that of countless others pursuing FIRE since 2009, a net worth equal to 25X expenses is often not enough. You’ll likely find yourself still working or seeking new income sources once you achieve this financial milestone. You may even crack the whip on your spouse to continue working as you kick back!

To feel genuinely free, consider aiming for 50X expenses or 20X your average gross income over the last three years. Better yet, do the simple math to find your unique multiple as I proposed in my formula above. While these net worth targets may seem ambitious, don’t underestimate the power of compound returns and disciplined saving.

If you don’t reach these multiples, that’s okay too. Many people continue to earn active income to fund their lifestyle goals. But now, I’m even more emboldened by my net worth targets due to national data from Pew Research and my logical formula.

Reader Questions And Suggestions

Readers, do you think a net worth equal to 25X your annual expenses is enough to retire early on? Have you ever met someone who did retire early on 25X expenses and doesn’t generate any active income?

Free financial checkup and $100 gift card: If you have over $250,000 in investable assets, take advantage and schedule a free consultation with an Empower financial professional here. Complete your two free video calls with the professional by November 30, 2024, and you’ll receive a free $100 Visa gift card. There’s no obligation to use their services after.

With a new president in office, it’s a great time to get a second opinion on your portfolio positioning. Consulting a financial professional in 2013 helped me grow my net worth by an additional $1 million. If I met with one today, I’m sure they’d recommend a more balanced portfolio. But I’m a risk-taker at heart.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more. Join 60,000+ others and subscribe to my free weekly newsletter here.