From a fascinating paper by Oli Coibion, Yuriy Gorodnichenko and Michael Weber, “The Upcoming Trump Tariffs: What Americans Expect and How They Are Responding“:

As the Trump inauguration looms, the prospect of new tariffs on our trading partners grows ever nearer. What do Americans expect that Trump will do with these tariffs and what effects do they anticipate these might have? In a recent survey, we asked Americans to tell us about what they thought would happen under Trump’s tariff policies and how this might affect their decisions. The results point toward widespread anticipation of tariffs being imposed on our trading partners, especially China, with significant expected passthrough into the prices of both imported and domestically produced goods and a general acknowledgment that American consumers will bear an important share of the cost of tariffs. In response to higher future tariffs, many Americans, and particularly Democrats, report that they would increase their purchases of foreign goods in anticipation of the upcoming tariffs and higher prices, while simultaneously trying to save more in the face of higher uncertainty about future policies. Managers report that their firms would become more likely to raise prices, change their mix of products and seek out alternative suppliers as the rise in tariffs approaches. While Republicans in our survey report positive, albeit tepid, support for these tariff policies, Democrats strongly oppose their enaction. But the divisions is not just across parties. Even within each party, there is a wide range of views about moving away from the postWWII era of trade liberalization.

A couple of graphs were particularly interesting (although the entire paper is a must read). Somebody‘s going to be surprised when the tariffs go into effect.

Overall, most Americans believe tariff costs will be borne by American consumers or producers.

Source: Coibion, Gorodnichenko, and Weber (2025).

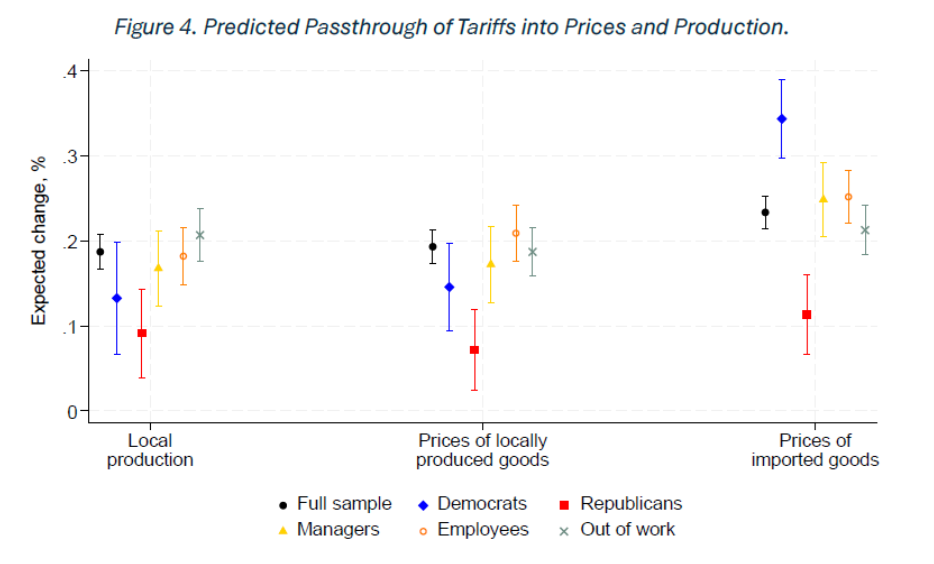

Interestingly, Republicans are outliers relative to overall, employers, and managers in terms of effects for a hypothetical 20% tariff. They’re also out of line with the experience of the Trump 1.0 tariffs.

Source: Coibion, Gorodnichenko, and Weber (2025).

At least there is some consistency, insofar as Republicans don’t believe tariff pass through is high for imported or locally produced goods, and the change in local production is commensurately small. Of course, this negates the “bring back the jobs” rallying cry for protection.

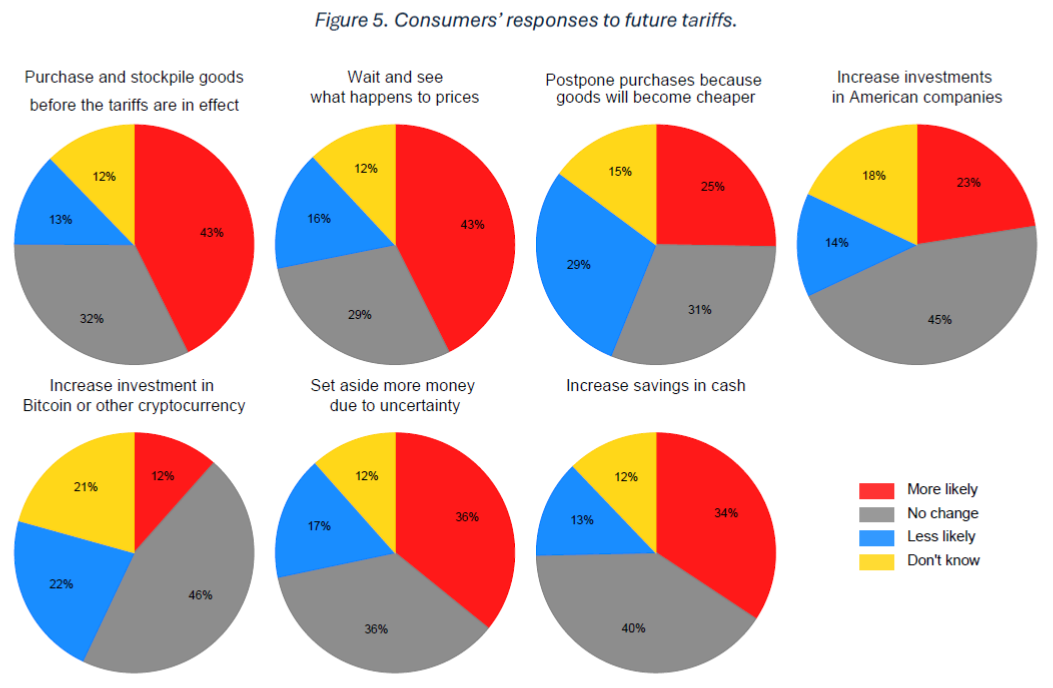

What about what people say they are likely to do? The biggest “more likely” response is for stockpiling, and “wait and see” for purchases.

Source: Coibion, Gorodnichenko, and Weber (2025).

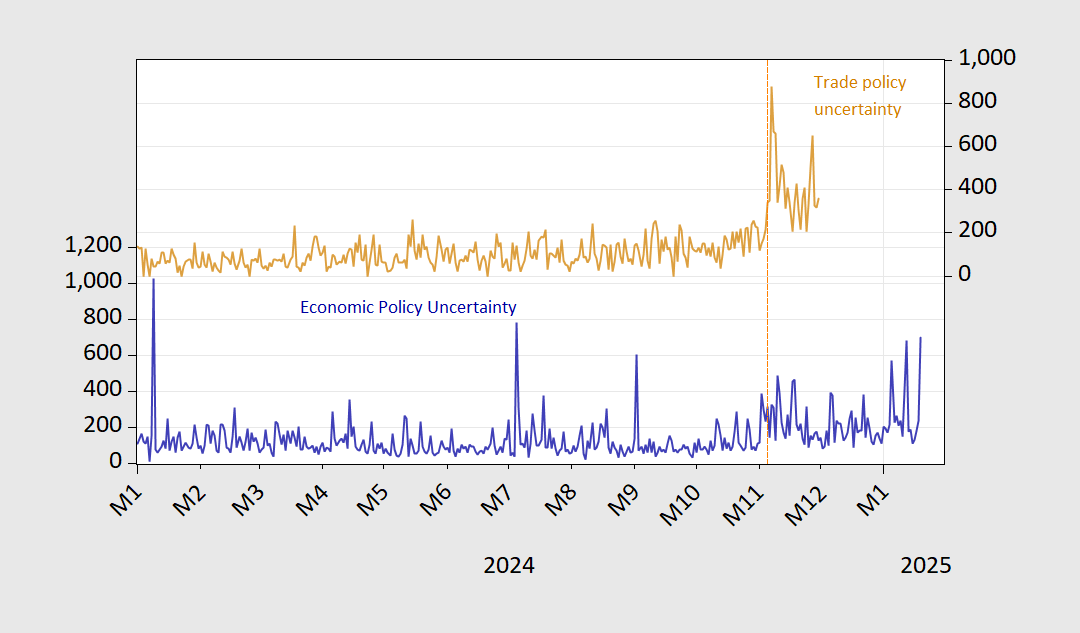

So, we’re likely seeing an uptick in sales and goods consumption now, as well as a deferral of consumption until way after tariff imposition. I.e., uncertainty is rising. A recap:

Figure 1: EPU (blue, left scale), Trde Policy Uncertainty (brown, right scale). Source: https://policyuncertainty.com, https://www.matteoiacoviello.com/tpu.htm.