At the risk of repeating myself ad nauseam, this is as good a time as any to remind ourselves how little we know about the present and how completely unexpected events can be in the future.

Our story so far: The technology sector has been booming for well over a decade. Software, mobile, e-tail, big data, LLM, and now AI have all been in growth mode.

Expectations have been that this is the story of the next generation. Powerful semiconductors and sophisticated software will drive the demand for freestanding, energy-hungry data centers.

That was upended by a scrappy China-based hedge fund that created an innovation to perform the functions of ChatGPT but with much less semiconductor horsepower needed. Free and Open Source, it created an order-of-magnitude decrease in costs.

At one point yesterday markets were off 3-4%, NVIDIA was down almost 20%, and nearly a trillion dollars in market cap disappeared.

As a short reminder, almost nobody had in their forecasts:

2020: Global pandemic that shut the world’s economy

2021: Inflation spikes, heads toward 9%

2022: Russia Invades Ukraine (February 24)

2023: Hamas surprise terror attack on Israel begins Gaza war (October 7)

2024: DeepSeek roils markets, challenges US advantages in AI

If these surprises or random events were rarities, then perhaps we could dismiss them. Was the assassination of Archduke Franz Ferdinand in 1914 a one-off? Pearl Harbor? JFK assassination? 9/11?

The reality is that events that are wholly unexpected and feel random occur with shocking regularity. The years that DON’T have a big surprise are the outliers, not the shock years.

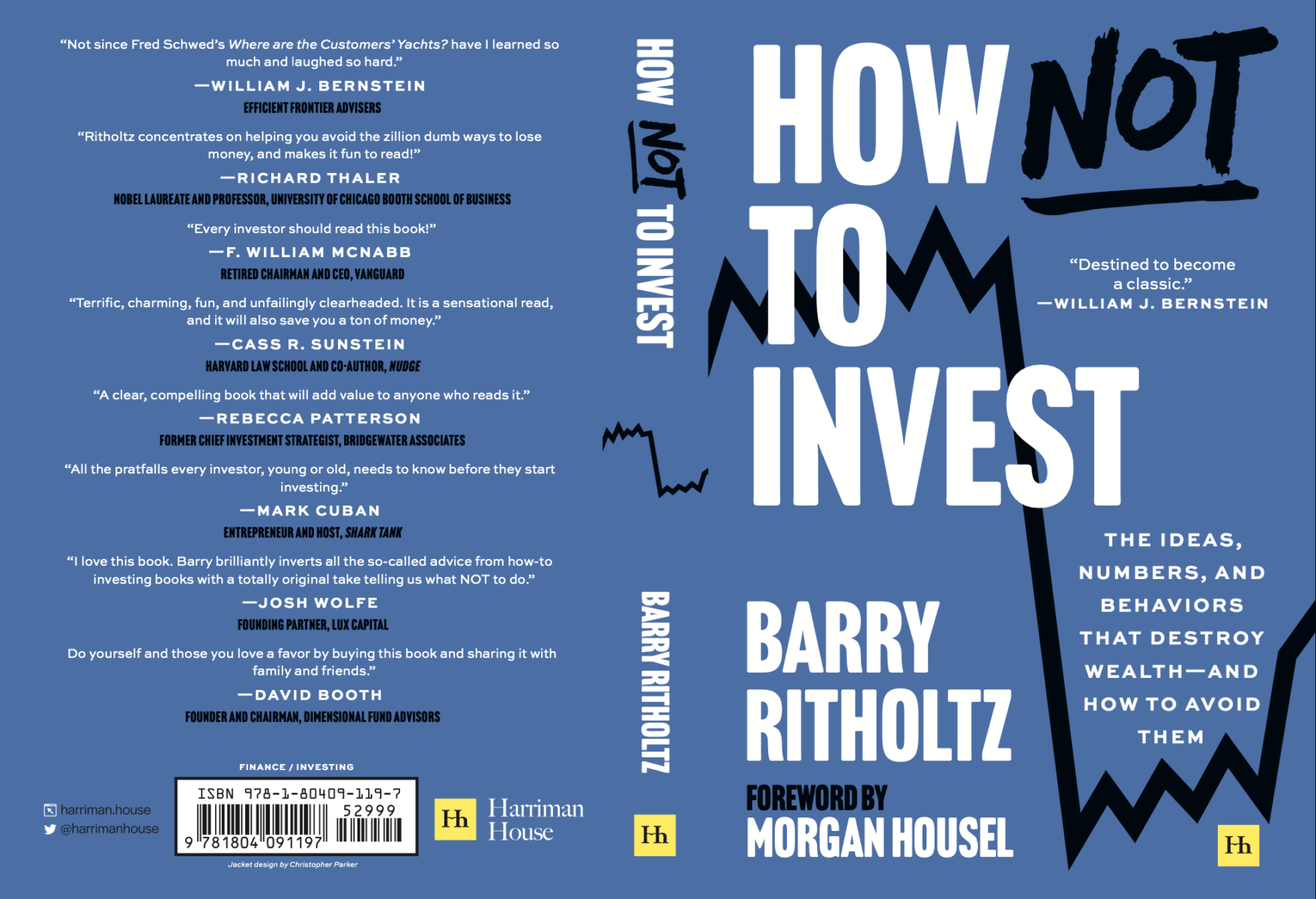

I sure as hell did not see DeepSeek coming. Very few others did, either. But we should never expect any company to own their sector forever. In “How Not to Invest,” I wrote, “It may be hard to imagine today, but your great-grandkids would probably laugh at the reverence once shown for Starbucks, Facebook, Nvidia, Amazon, Google, and even Apple.”

I was referring to Aswath Damodaran’s latest work, “The Corporate Life Cycle: Business, Investment, and Management Implications.,” where he compares all companies to people. They are born, go through growth spurts, mature, and eventually die. Even once-dominant firms like Intel, GE, or Cisco – all eventually lose a step and fade.

As the chart above shows, NVDA goes through regular drawdowns — 66% in 2022-23. My colleague Callie Cox discussed this a week ago — only she was referring to Apple, not Nvidia.

We were less than 4 weeks into the new year when a random event that no one had on their bingo card upended everybody’s market forecasts and sector picks.

It’s just a reminder that when it comes to the future, nobody knows anything…

Previously:

“Nobody Knows Anything,” Wall Street Strategist Edition (January 2, 2025)

Nobody Knows Anything, The Beatles edition (September 26, 2024)

Nobody Knows Anything (Full archive)

See also:

What Is China’s DeepSeek and Why Is It Freaking Out the AI World? (Bloomberg, January 27, 2025)

3 stock market thoughts amid the DeepSeek sell-off (Sam Ro, Jan 27, 2025)

DeepSeek’s $6 million AI model just blew a $1 trillion hole in the market. Here’s the only explainer you’ll need on this “Sputnik moment” (Sherwood, January 27, 2025)

The anatomy of a bubble bursting (Axios, January 27, 2025)

The Short Case for Nvidia Stock (Jeffrey Emanuel, January 25, 2025)

Apple investors’ mental torture (Optimistic Callie, January 21, 2025)

If you want to learn more about how the book was made, any related media appearances or background, get unique bonus material, or just ask a question, you can sign up here: HNTI -at-RitholtzWealth.com.