From the abstract to the paper:

Define a perfect recession predictor as one that correctly predicts every recession and does not falsely signal a recession when one does not occur. The benchmark spreads (10-year minus 2-year and 10-year minus 3-month term spreads, and the near-term forward spread) are far from perfect, and generate up to 59 mispredictions from 1962 to now. Using a supercomputer to search over 645 million series of forward and term spreads that are averaged over different horizons, we discover 83 perfect spreads. In contrast to the benchmark spreads, the perfects tend to be forward spreads starting 4 years out with a moving average of about a year. We use a New Keynesian model to rationalize these features of the perfects and highlight the underlying economic mechanisms. Finally, we expand on the concept of perfect spreads to construct recession-predicting indices and show their superior statistical performances compared to the benchmarks.

Perfect predictors in this instance means an AUROC=1. The obvious question brought forward by this result, at least for policymakers, is whether a recession is likely. I used the first listed perfect forward spread.

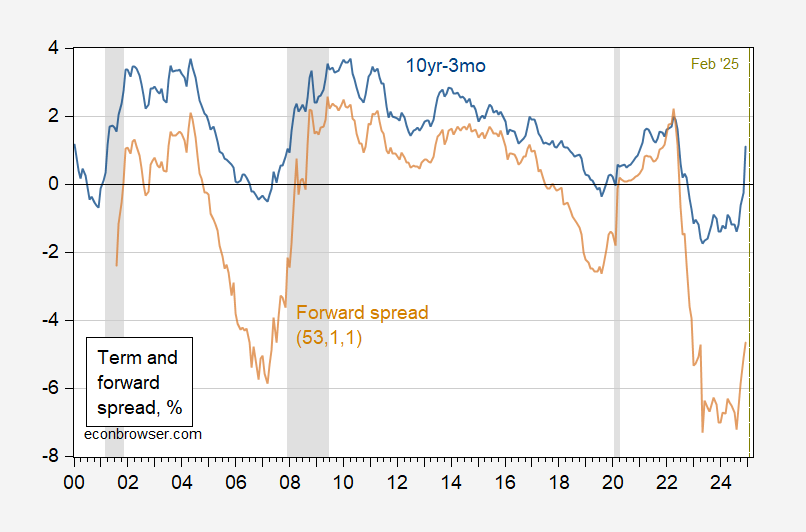

The top forward spread is l=53, m=1, n=1. I approximate this using 5 year government bond yield to maturity (60 months) instead of the 53 month zero coupon yield. Then compare this against the 10yr-3mo spread I usually use:

Figure 1: 10year-3month government term spread (blue), forward spread (brown), both in %. Source: Treasury via FRED, and author’ calculations. Source: Treasury via FRED, NBER.

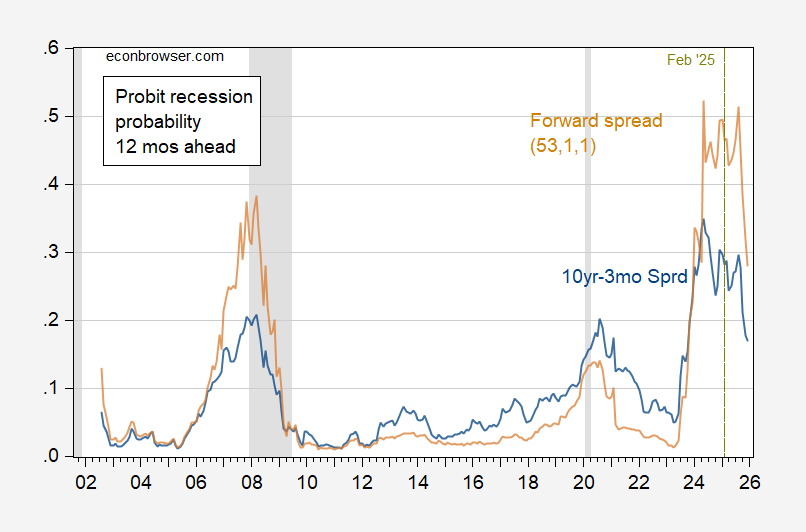

These data lead to this set of estimates of recession in 12 months…. (keeping in mind I estimate the probit models on a different and shorter sample — 2001M08-2025M01 — than do Diercks et al (2025):

Figure 1: Probit based regression prediction for 10year-3month government term spread (blue), forward spread (brown), both in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, and author’ calculations. Source: Treasury via FRED, NBER.

Needless to say, a recession is still plausible, even if our most recent economic statistics don’t indicate a recession. According to the forward spread there is a better than even chance of a recession as of February.

Diercks et al. searched over millions of combinations involving spreads and forward spreads, but did not consider other variables. A modified Chinn-Ferrara specification estimated over the same sample, but incorporating a debt-service ratio, yields only a 10% probability of recession for January 2025.