Insurance carriers expecting to add staff in 2025 are largely looking for experienced professionals rather than filling entry level roles, according to the latest Insurance Labor Market Study from Jacobson Group and Aon.

Like prior installments of the semi-annual collaborative study of insurance carrier hiring expectations, the January 2025 survey doesn’t just ask insurers if they expect to grow staff during the coming year—55% of insurers expect to do so this year—but also asks the experience levels of employees they anticipate adding.

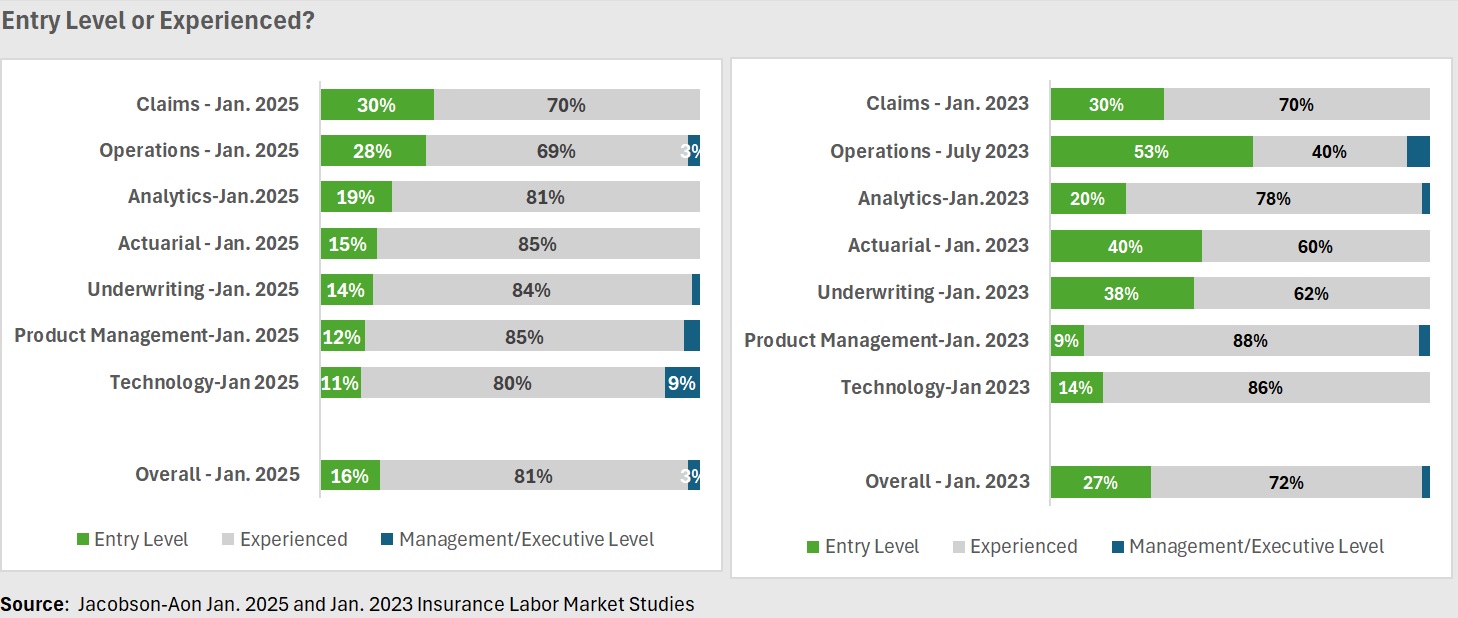

“At 16%, this is the lowest number that we’ve seen for the entry-level positions in aggregate,” said Jeff Rieder, partner and head of Strategy and Technology Group Performance Benchmarking at Aon, during a webinar to present the latest result last month. He shared a slide showing the percentages of responses for entry level, experienced and executive levels for 11 specific functions and across all functions in the aggregate. (Response percentages for seven of the 11 functions are reproduced in the graphics accompanying this article.)

Rieder noted that the 16% across all functions was five percentage points lower than the 21% figure recorded for entry level in a similar survey conducted in July last year. In fact, the 16% figure was also 11 percentage points lower than “entry level” responses tallied up in the Aon/Jacobson January 2024 and January 2023 surveys, when carriers surveyed said they expected 27% of new hires to be entry level personnel.

Related: Data Insight: More Insurers Expect to Boost Top Lines Than Headcount

Across all three of the latest January surveys, the claims function has consistently ranked as one of the top five for which carriers are likely to consider hiring entry level workers—with 30% of claims hires expected to be inexperienced. In contrast, carriers said none of their upcoming hires for the loss control function are expected to be inexperienced in 2025.

In addition, carriers are becoming less inclined to hire entry level workers in operations and actuarial functions, according to comparative survey results. In January 2023 and 2024, operations was the most likely function to welcome entry level candidates, with carriers indicating that those candidates would make up more than half of their operations hires. In January 2025, that’s down to 28%.

Similarly, in January 2023 and January 2024, carriers said they expected to hire novices for 35-40% of actuarial positions. This year, carriers are saying that only 15% of the actuarial roles they’ll be filling in the next 12 months will go to job seekers who are new to the actuarial profession.

During the webinar, Rieder responded to an audience member who asked whether a drop in the birth rate two decades ago may be fueling the decrease in entry level hiring, suggesting that there are not people to fill those roles. Rieder posited some other drivers, including a potential tie between higher levels of turnover in the insurance industry over the last few years and declines in entry level hires.

“I’ve heard many anecdotal stories where companies operated by perhaps a national carrier that closed a call center or other activities, that now they had the ability to hire from experienced talent locally that wasn’t there” before, he said. “And not necessarily locally because the virtual and remote hybrid environment allows for positions to be filled anywhere.”

Rieder said he was particularly surprised to see the large drop in the percentage of expected entry level hires for underwriting activities. The figure came in 14% in the January 2025, down from 21% in January 2024 and 38% in January 2023. “The concerns that I have tie into that birth rate discussion, but more broadly around companies as they think about succession planning and building a talent pool for the future.”

“This perhaps paints a bit of a bleak story for the ability for the industry to create those roles going into the future,” he said.

Jeff Blair, Jacobson Group’s senior vice president of executive search and business development, noted the challenges that insurance and other industries have faced in bringing new people into the industry. He pointed to efforts that Jacobson has sponsored to recruit from college campuses and to get them excited about insurance as the population of experienced professionals continues to age. “Are we hiring less entry because we need less or is it because we can’t find them?” he wondered out loud.

Rieder highlighted the loss control function as a particular cause for concern, noting that Aon and Jacobson added the question about hiring for this risk management-type function last year. He reported that a carrier he worked with recently had the highest level of turnover in loss control and had expressed challenges in filling those roles.

“In the study view, nobody responded that they were expecting to hire entry level employees” but pre-binding and post-binding survey inspection work still needs to be done to service new and existing customers, Rieder said. “It definitely creates a challenge to retain those employees. And then, if everybody’s going after experienced staff, that means that there’s going to be an increase in compensation as you’re pulling those employees away” from other carriers, he said.

More generally, across the property/casualty and life/health sectors, compensation levels have been trending lower, however, Rieder reported during a different point in the webinar. Providing high-level information that wasn’t addressed in the survey, and without detail by function, he noted that merit increases have fallen to median levels of 3.2-3.5%, compared to 4.2% in 2022 and 2023.

In recent past years, companies luring experienced professionals away from competitors also found themselves forced to make significant market adjustments to bring incumbent employees up to similar levels—with overall year-over-year compensation coming in at roughly 5% higher on average (merit and adjustment), he reported, noting that midyear market adjustments are becoming less likely now.

Incentive compensation, however, remains a high priority, however. “We’re seeing short-term incentive plans being offered typically to all levels of employees down to the frontline individual contributors,” Rieder said. In addition, a growing number of companies are introducing long-term incentive compensation plans to their executive populations, he said.

Flagging mutual companies, in particular, he said that 10-15 years ago, only 10-15% of mutual companies had those long-term incentive plans. “Now it’s more likely closer to 60%—and certainly once companies get over a billion in premium, it’s a dominant practice that all those companies would have a long-term incentive program,” he said.

“All these changes in incentive compensation are really to create competitive compensation programs so that companies can attract talent,” he said.

Topics

Carriers

Data Driven

Talent